Axis Nifty 500 Index Fund is a new open-ended index fund offered by Axis Mutual Fund that launched on June 26, 2024. It aims to track the total returns of the Nifty 500 TRI, subject to tracking errors. There is no entry load but an exit load of 0.25% if redeemed or switched out within 15 days from the date of allotment. The minimum subscription amount is Rs 100. The offer closes on July 9, 2024.

The investment objective of the Axis Nifty 500 Index Fund is to provide returns before expenses that closely correspond to the total returns of the Nifty 500 TRI, subject to tracking errors. There is no assurance that the investment objective of the Scheme will be achieved.

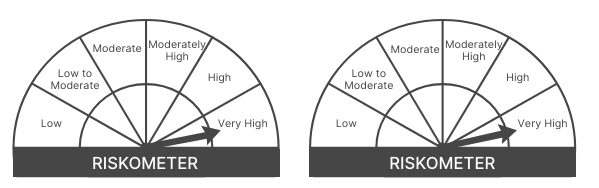

This NFO of Axis Nifty 500 Index Fund is suitable for investors who are a long-term wealth creation solution and an index fund that seeks to track returns by investing in a basket of Nifty 500 TRI stocks and aims to achieve returns of the stated index, subject to tracking error.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Securities covered by Nifty 500 Index | Very High | 95 | 100 |

| Debt & Money Market instruments | Low | 0 | 5 |

The performance of the Bandhan Nifty Total Market Index Fund will be benchmarked to the performance of Nifty 500 TRI.

Karthik Kumar holds an M.B.A. from the Krannert School of Management at Purdue University, a C.F.A. from the USA, and a B.E. in Mechanical Engineering from Sardar Patel College of Engineering, Mumbai University. His educational background combines technical and financial expertise, allowing him to approach investment management with a strong analytical and practical foundation. Karthik has accumulated 10 years of experience in the finance industry.

Sachin Relekar earned his Master of Management Studies from Mumbai University, providing him with a robust foundation in management principles and practices. With over two decades in the field, Sachin has developed extensive knowledge and skills in fund management. He brings 22 years of experience in the finance sector.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | Since Launch Ret (%) |

| UTI Nifty 500 Value 50 Index Fund | 308.39 | 1.03 | 90.97 | 85.22 |

| Motilal Oswal Nifty 500 Index Fund | 1130.1 | 0.88 | 39.02 | 20.71 |

| HDFC BSE 500 Index Fund | 130.49 | 0.97 | 38.22 | 40.62 |

Data as of June 25, 2024

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers