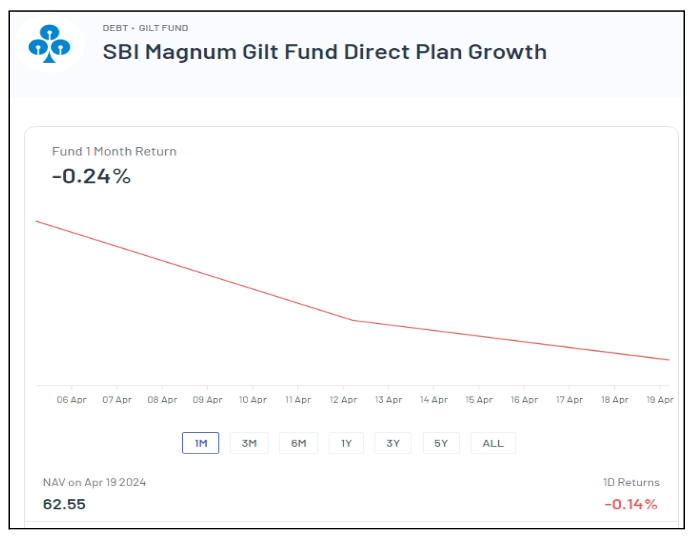

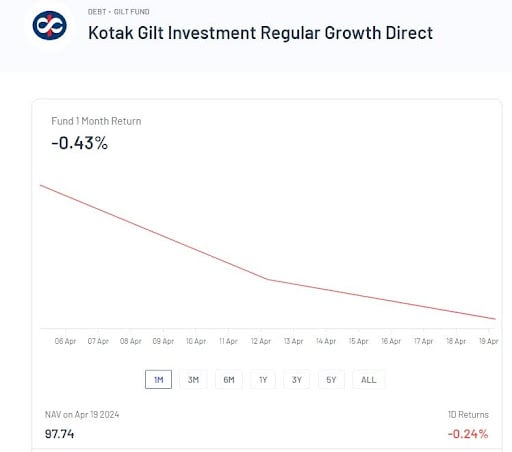

When we think about Gilt Funds, the first thing that typically comes to mind is their low risk. However, recently, the Net Asset Values (NAVs) of some Gilt Funds have taken a noticeable hit. This drop, along with Kotak Gilt Fund’s recent decision to stop accepting new subscriptions, is a wake-up call. There’s more to this story than meets the eye.

As we know, the market often moves ahead of the general sentiment, with significant players having insights that the average retail investor might not. These big players can drive market trends. The recent dive in Gilt prices suggests that something is amiss—quite the opposite of what some “experts” have been saying. They have been promoting the idea of lower interest rates and a peak in long-term rate cycles. I, on the other hand, have been advocating a temporary cut in rates, with a potential for procyclical adjustments in 2025.

One key metric to watch is the 10-year bond yield. Keeping an eye on this is crucial. If it goes above 7.60%, it’s probably not the best time to invest in sovereign debt. Conversely, if it falls below 7.06%, it might be wise to hold off on adding Gilt funds to your portfolio.

An interesting question arises: Why is Kotak Gilt Fund turning away new investments? Kotak is known for its deep understanding of interest rates and funding costs, often better than other market players. This leads me to believe that investors are pushing for—and might soon receive—higher yields. If you consider the Indian 10-year bond’s convexity against the backdrop of Gilt fund NAVs, the message becomes clearer. Last Friday, April 19, 2024, the 10-year yield hit 7.233%, and the price of the benchmark bond plummeted. It seems the market has some insight that the “experts” are missing.

As people who aim to stay profitable and support our families, we need to decide where to get our information from and whom to trust. The bond market’s recent behavior seems to be a loud warning about 2025. This year alone, there are dozens of national elections, which could lead to heightened optimism and uncertainty.

With all these factors in mind, it’s critical to stay informed and be cautious when navigating the current landscape of Gilt Funds.

Elevate your savings strategy with our easy-to-use SIP Return Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 22, 2024, 5:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates