Motilal Oswal Nifty India Defence Index Fund, launched by Motilal Oswal Mutual Fund, is an open-ended index fund that tracks the Nifty India Defence Total Return Index. The fund aims to mirror the performance of the Indian defence sector by investing in the companies that comprise the index. Investors can participate with a minimum investment of Rs 500. The New Fund Offer opens on June 13th, 2024 and closes on June 24th, 2024. There is no entry load, but an exit load of 1% applies if redeemed within 15 days of allotment.

The investment objective of the Motilal Oswal Nifty India Defence Index Fund is to provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty India Defence Total Return Index, subject to tracking error. However, there can be no assurance or guarantee that the investment objectives of the scheme will be achieved.

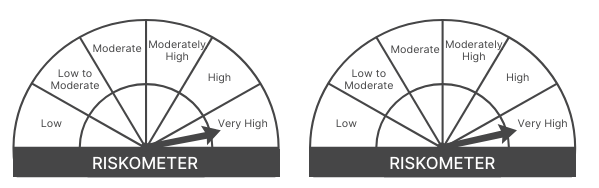

This NFO of Motilal Oswal Nifty India Defence Index Fund is suitable for investors who are seeking return that corresponds to the returns of the Nifty India Defence Total Return Index, subject to tracking error and long term capital growth.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Constituents of Nifty India Defence Index | Very High | 95 | 100 |

| Units of Liquid schemes and Money Market instruments | Low | 0 | 5 |

The performance of the Motilal Oswal Nifty India Defence Index Fund will be benchmarked to the performance of Nifty India Defence Total Return Index.

Mr. Swapnil Mayekar

Mr. Swapnil Mayekar, aged 39, holds a Master of Commerce in Finance Management. He has been managing funds since inception at Motilal Oswal Asset Management Company Ltd. since March 2010. Swapnil brings over 13 years of experience in fund management and product development, having previously served as a Research Associate at Business Standard from August 2005 to February 2010.

Experience: Swapnil has over 13 years of experience in fund management and product development.

Rakesh Shetty

Rakesh Shetty, aged 42, has a Bachelor of Commerce degree. He manages the debt component at Motilal Oswal Asset Management Company Limited, with more than 14 years of experience in trading in equity, debt segments, Exchange Trade Funds management, corporate treasury, and banking. Prior to joining Motilal Oswal, he was involved in equity and debt ETFs, customized indices, and product development at a company engaged in capital market business.

Experience: Rakesh has over 14 years of experience in trading in equity, and debt segments, ETFs management, corporate treasury, and banking.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | Since Launch Ret (%) |

| ICICI Prudential Nifty Next 50 Index | 5283.53 | 0.66 | 63.65 | 13.91 |

| LIC MF Nifty Next 50 Index Fund | 84.078 | 0.9 | 62.79 | 12.76 |

| UTI Nifty 50 Index Fund | 16924.52 | 0.41 | 26.36 | 12.05 |

| Bandhan Nifty 50 Index Fund | 1265.70 | 0.6 | 26.06 | 12.05 |

| HDFC Index Nifty 50 | 14219.56 | 0.36 | 26.35 | 15.12 |

| HDFC Index S&P BSE Sensex | 6820.42 | 0.36 | 23.19 | 15.06 |

| Category Average | – | – | 27.52 | 16.53 |

As of June 12, 2024, There is not any peer scheme catering to the defence theme.

Elevate your savings strategy with our easy-to-use Angel One SIP Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers