Shriram Mutual Fund launched the Shriram Nifty 1D Rate Liquid ETF on July 1st, 2024. This open-ended Exchange Traded Fund aims to track the NIFTY 1D Rate Index, which invests in Tri-Party Repo on Government securities or treasury bills (TREPS). The investment objective is to provide returns that mirror the index, before expenses, but there is no guarantee of achieving this. There is a minimum subscription amount of Rs 1,000. The New Fund Offer will be open for subscription until July 3rd, 2024 and there are no entry or exit loads.

The investment objective of the Shriram Nifty 1D Rate Liquid ETF is to invest in Tri-Party Repo on Government securities or treasury bills (TREPS). The Scheme aims to provide investment returns that, before expenses, correspond to the returns of the NIFTY 1D Rate Index, subject to tracking error. There is no assurance or guarantee that the scheme’s investment objective would be achieved.

This NFO of Shriram Nifty 1D Rate Liquid ETF is suitable for investors who are seeking a stable, liquid alternative to traditional savings accounts and safety and liquidity for short-term funds

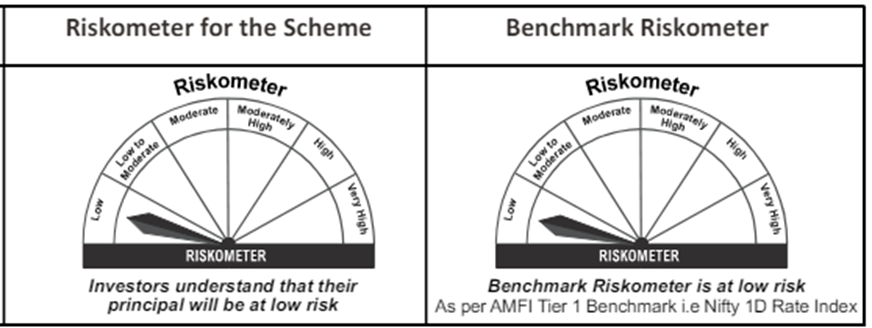

Risk-o-meter:

Potential Risk Class: it’s a close-ended scheme with, relativelylow interest rate risk and relatively low credit risk (A – I).

Funds Allocation

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Tri-Party Repo on Government Securities or T-bills, Reverse repo & Cash and Cash equivalents | 95 | 100 |

| Other money market instruments with a residual maturity of up to 30 days | 0 | 5 |

The performance of the Shriram Nifty 1D Rate Liquid ETF will be benchmarked to the performance of the price of Tier 1 Benchmark i.e. Nifty 1D Rate Index.

Fund Managers

Mr. Deepak Ramaraju comes with a diverse experience of over 22 years. He is a chemical engineer with an academic background. Before joining Shriram Asset Management Company Ltd., Mr. Deepak was advising Sanlam Group of South Africa on their India-focused fund and was part of their global equity research team. He has been associated with equity markets for the past 18 years and before that, Mr. Deepak was a researcher and co-inventor at GE India Technology Center, Bangalore with 10 patents as co-inventor to his credit.

Ms. Gargi Bhattacharyya Banerjee has an experience of over 23 years in her professional career. She joined as Research Manager at Shriram Asset Management Company Limited in November 2012. Before joining Shriram Asset Management Company Limited, she held key positions with Zacks Research Private Limited and Shriram Insight Share Brokers Limited.

Peer Mutual Fund Schemes

| Scheme Name | AUM (Crore) | TER (%) | 1 Year Rtn. % | 3 Years Rtn. % | 5 Years Rtn. % | Since Launch Rtn. (%) |

| DSP NIFTY 1D Rate Liquid ETF IDCW Daily Reinvest | 1,044.77 | 0.35 | 7.08 | 5.29 | 4.47 | 4.24 |

| ICICI Pru S&P BSE Liquid Rate ETF | 3,212.75 | 0.25 | 7.17 | 5.45 | 4.43 | 4.32 |

| Nippon India ETF Nifty 1D Rate Liquid BeES DAILY IDCW | 11,902.65 | 0.69 | 5.7 | 4.7 | 3.69 | 2.4 |

| ABSL CRISIL Overnight Fund AI Index ETF IDCW Daily Reinv with Weekly Pay | 42.61 | 0.43 | 6.97 | – | – | 6.97 |

| Bajaj Finserv Nifty 1D Rate Liquid ETF | 10.01 | 0 | – | – | – | – |

| DSP S&P BSE Liquid Rate ETF | 573.3 | 0.35 | – | – | – | 1.62 |

| HDFC Nifty 1D Rate Liquid ETF | 13.84 | 0.5 | – | – | – | 5.72 |

| Kotak Nifty 1D Rate Liquid ETF | 46.13 | 0.2 | 7.15 | – | – | 7.04 |

Data as of June 28, 2024

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers