Tata Mutual Fund is launching a new closed-end fixed maturity plan (FMP) called Tata Fixed Maturity Plan Series 61 Scheme C (91 days). This scheme aims to generate income and potentially capital appreciation by investing in fixed-income instruments maturing within 91 days. There is no guarantee of achieving the investment objective or returns. The investment window for this scheme is open from June 10th, 2024 to June 12th, 2024, with a minimum investment of Rs. 5,000. Neither entry load nor exit load is applicable.

The investment objective of the Tata Fixed Maturity Plan Series 61 Scheme C (91 days) is to generate income and capital appreciation by investing in fixed-income instruments with maturity in line with the scheme’s maturity. The maturity of all investments shall be equal to or less than the maturity of the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns.

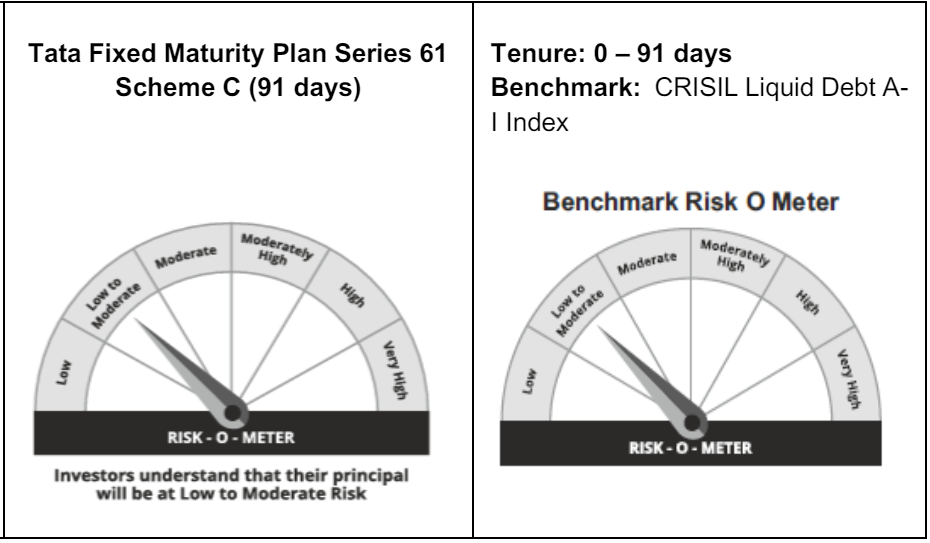

This NFO of Tata Fixed Maturity Plan Series 61 Scheme C (91 days) is suitable for investors who are seeking income or capital appreciation over the tenure of the scheme by investing in Debt, Money market instruments & Government Securities.

Potential Risk Class: it’s a close ended scheme, relativelylow interest rate risk and relatively moderate credit risk (B – I).

| Investments | Indicative Allocation | Risk Profile |

| Debt and Money Market Instruments including Government Securities | Minimum 0% – Maximum 100% | Low – Medium |

Tata Fixed Maturity Plan Series 61 Scheme C (91 days) will benchmark against CRISIL Liquid Debt A-I Index.

Akhil Mittal, aged 44, holds a B. Com degree and an MBA. He is currently serving as a Senior Fund Manager at Tata Asset Management Pvt. Ltd., a position he has held since June 2014. Prior to this, from March 2011 to June 2014, he worked at Canara Robecco Asset Management Ltd. as a Senior Fund Manager. In his current role, he reports to the Head of Fixed Income, leveraging his extensive experience in fund management and fixed-income securities.

| Funds | 1Y Returns | 3Y Returns | 5Y Returns | Since Inception |

| Nippon India Interval Fund-Monthly Interval Fund-Series-I- Direct Plan – Growth | 6.30% | 5.40% | 4.80% | 6.50% |

Elevate your savings strategy with our easy-to-use Angel One SIP Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers