Remember the clink of a coin dropping in a piggy bank? It takes us back to the time when every coin deposit in the piggy bank took us closer to that toy we wanted to buy or that movie ticket. Revisiting this faded memory we understand that cracking open a piggy bank mounted to a larger corpus. All those seemingly insignificant deposits of mere rupees transformed into a huge sum!

This was one of the times when we learned the importance of saving consistently and the reward it reaps. This holds true for investing too but instead of setting money aside idly, you put it to work. Investing money can help you get returns on your deposits and build a corpus that is more than the money invested. One way to invest through periodical deposits is a Systematic Investment Plan (SIP).

What are SIPs?

Systematic Investment Plans are a method of investing where you make periodical contributions instead of a one-time lump sum. These contributions can be made monthly, quarterly, or semi-annually. Typically, an SIP is opted for monthly contributions.

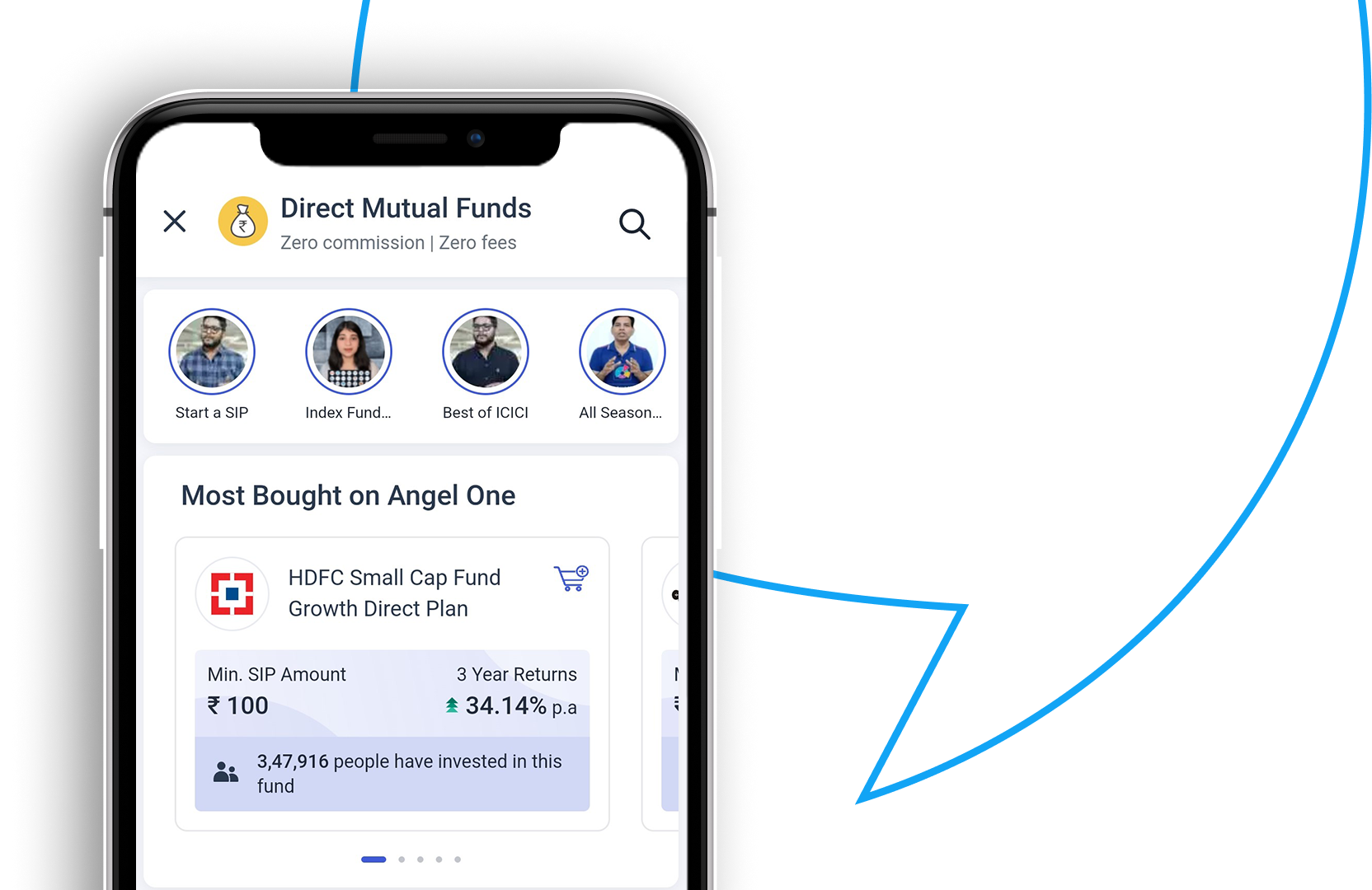

Although SIPs are known as an approach used to invest in mutual funds, they can also be used to invest in equity (Stock SIP). With SIPs, the smaller contributions have the potential to grow to a larger corpus that helps you achieve a long-term goal or even retire early! Check out how much your contribution can amount to with the help of Angel One’s SIP Calculator.

Building consistency through SIPs

Disciplined and regular SIP investments can offer steady and reliable growth toward your financial goals. This includes investing through all the cycles of the market. Your small contributions coupled with compounding can make a big impact on your savings. Let us understand briefly how investing consistently with SIP can make a big difference:

Rupee Cost Averaging Benefit

By investing a fixed amount regularly, you buy units regardless of whether the market is low or high. This helps average out the cost per unit over time, reducing the impact of market fluctuations. Tampering with investments because of short-term market conditions can affect your portfolio.

Disciplined Investing

SIP enforces a disciplined investing habit. You contribute a set amount at a particular frequency and stick to it regardless of market conditions. This consistency helps you build wealth gradually without being swayed by emotions. To make sure your SIP contributions are made timely, you can automate the process using the facility of One Time Mandate (OTM).

Compounding Benefit

SIP allows you to benefit from compounding. This means that your returns are reinvested, generating higher returns on your initial investment and accumulated earnings over time. This creates a snowball effect, boosting your wealth in the long term.

Getting started with SIPs

Start Small

Investing can be done like walking – you don’t start sprinting on the first day. Similarly, when starting SIPs, start small. Some of the SIPs can be started with a monthly contribution of a mere ₹500. Although this sum may seem too small to make an impact, with the help of compounding, it can grow into a huge corpus over a longer period of time.

Boosting your SIP

Starting small can help you get to your goals steadily, one step at a time. However, to reach your goals faster, you can also boost your SIP after a certain period or even regularly. Boosting SIP simply means increasing your periodical contribution amount. This can be done keeping in mind that only the excess funds are boosted without causing a strain on your budget.

Diversification

Instead of opting for a higher corpus in one avenue, you have the option of investing in multiple avenues through SIPs. This can help reduce the risk that is sector-specific or security-specific. The facility of multi-SIP can help you invest in multiple mutual funds in a single transaction.

Understanding the power of consistency in SIP

Example

Let us assume that you are planning to purchase a car after 7 years and need to start investing in it.

The estimated cost of this car after 7 years is assumed to be ₹15 Lakh.

Therefore, by opting for a SIP of a mere ₹12,000 (at an expected rate of 12%), you can accumulate a corpus that exceeds the required amount.

Use Angel One’s SIP calculator to confirm.

Calculation:

Monthly Investment: 𝑃 = ₹12,000 per month

Since you are investing Rs. 12,000 every month, the annual contribution will be:

Pannual = 12,000×12 = ₹144,000 per year

The formula for the Future Value of Each Annual Investment:

Future Value = Pannual × (1+r)t

- Pannual is the annual investment (Rs. 144,000)

- r is the annual interest rate (12% or 0.12)

- t is the number of years that the investment will compound from the point of each annual contribution

The Rs. 144,000 investment is made at the end of each year and then compounds annually. The first year’s investment will compound for 6 years (since at the end of the first year, 6 years remain), the second year’s for 5 years, and so on until the seventh year’s investment, which does not compound (compounds for 0 years).

Like:

1. First year’s investment after 6 years:

144,000 × (1+0.12) 6

2. Second year’s investment after 5 years:

144,000 × (1+0.12) 5

3. Third year’s investment after 4 years:

144,000 × (1+0.12) 4

4. Fourth year’s investment after 3 years:

144,000 × (1+0.12) 3

5. Fifth year’s investment after 2 years:

144,000 × (1+0.12) 2

6. Sixth year’s investment after 1 year:

144,000 × (1+0.12) 1

7. Seventh year’s investment (no compounding):

144,000 × (1+0.12) 0

Summing All Contributions:

To find the total future value, you sum up all these individual future values from the first to the seventh year.

Total Future Value=∑6t=0 (144,000 × (1+0.12) t ) = ₹ 15,83,748

Thus by investing ₹12,000 monthly, you can accumulate a corpus of ₹ 15,83,748.

Note: The above figures are completely hypothetical and may vary in real-life situations.

Conclusion

Consistency yields great returns in investing through the principle of compounding. Every SIP is like a small step you take towards climbing the wealth ladder. The sooner you start climbing, the earlier you will reach. Time waits for no one. Open your Demat account with Angel One and start climbing (we mean investing) today!

FAQs

How do I start investing with a SIP?

You can start a SIP by choosing to invest a fixed amount regularly (e.g., monthly, quarterly) into a mutual fund or stocks. This approach allows for gradual wealth accumulation without needing a large sum upfront.

What benefits do SIPs offer?

SIPs promote disciplined investing, utilising rupee cost averaging and leveraging compounding returns. They help build a substantial corpus over time.

Can SIPs start with small amounts?

Yes, SIPs can start with minimal amounts, even as low as ₹500 per month, making it easier to gradually build an investment portfolio.

How can I increase my SIP returns?

By boosting your SIP contributions periodically—annually or as your budget allows—you can accelerate your wealth accumulation and enhance the benefits of compounding.