We are excited to let you know that Angel One is coming up with a revamped Super app with significant improvements in terms of efficiency and user-oriented framework – it has been designed to give users the most advanced and seamless trading experience currently available in the country and beyond.

In this article, we shall focus on the improvements made in the orderpad of the Angel One app whereby placing, tracking and managing various types of orders simultaneously have been made far easier.

“Simplicity is the ultimate sophistication” – Leonardo Da Vinci

The order journey actually starts right from the watchlist where the trader starts looking for the right assets and instruments to utilise. It continues not just until the profit/loss is booked but even into future orders where the strategies of past orders can be reviewed and reapplied.

The following are the major improvements made in the order journey –

Let us also understand what is the new process for buying an asset on the app.

If you choose to buy an asset, click on the “Buy” option – it will take you to the page where you will have two options – Delivery and Intraday.

[However, before you reach this page, you will first receive a quick guide on the options available to you in terms of –

Delivery

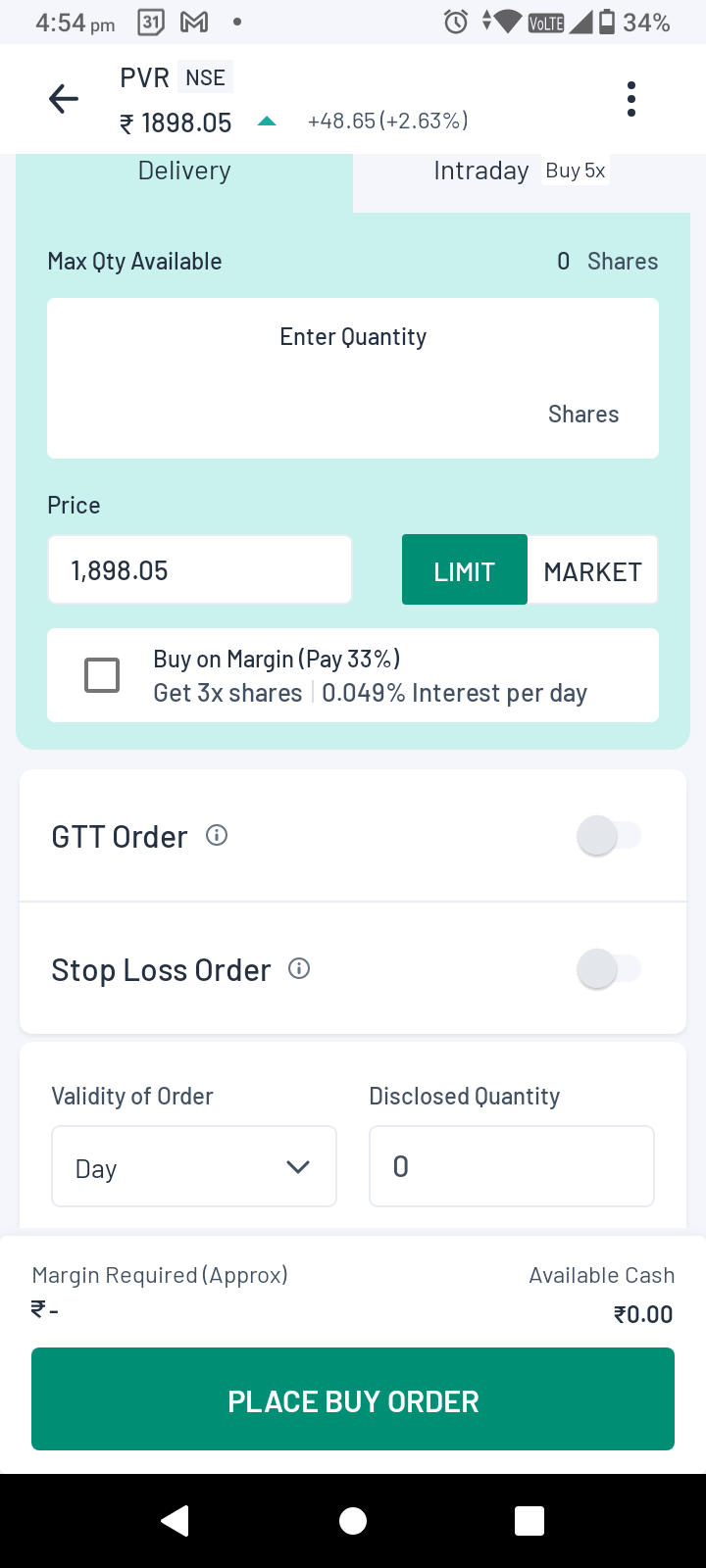

For delivery, enter the quantity of assets (e.g. shares) you want to buy at the given market price (and also type the actual margin that you wish to pay for the transaction). You can also choose to place a limit order or a market order at this stage.

As mentioned before, you can buy shares on margin i.e. pay only a fraction (say 33%) of the actual cost in order to gain profits from the asset resale. If you want to know about what trading on margin is, click here.

Smart order – By clicking the “Smart order” button, you can also place a GTT order or a Stop Loss order – if you do not know what the terms mean you can easily click on the ‘i’ logo to their right and see the explanation.

You can decide whether the order validity will be in terms of day or IOC. IOC i.e. Immediate or Cancel Order means the order will be executed as soon as it is released into the market, failing which the order will be removed.

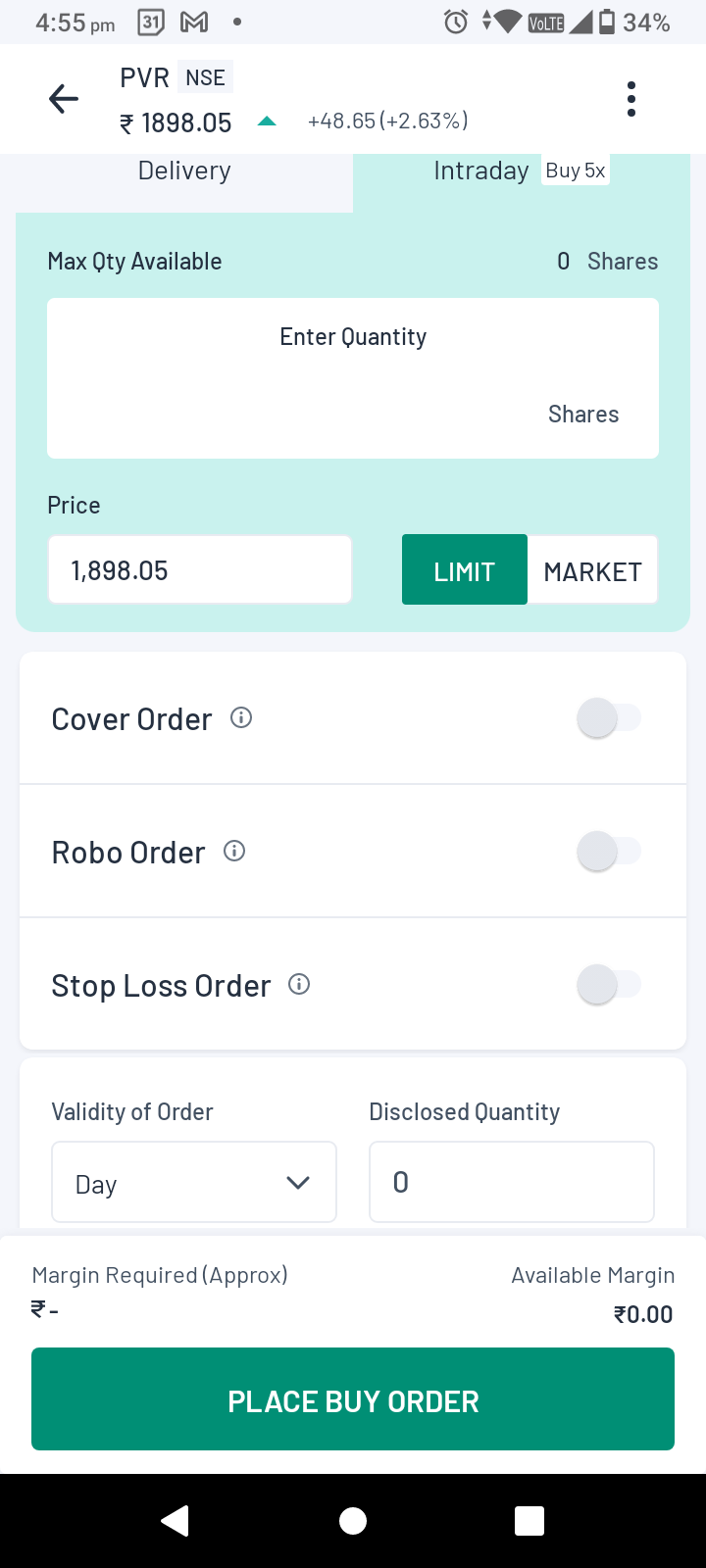

Fig. 1 & 2: Order portal at Angel One

Intraday

For intraday, you can also choose to avail other smart orders such as cover order, Robo order or a stop loss order. If you do not understand the terms then click on the ‘i’ logo to their right and the explanation will appear.

Here too, you can decide whether the order validity will be in terms of day or IOC.

Finally, at the bottom of either page, you can see how much margin is required to place the order and the available margin that you have.

Once you have decided on the order and have the required amount available in your account, click on “Place buy order” to execute the buying process.

Additional points

On the top right hand corner, you can open a dropdown box in order to change your exchange or switch to a sell order.

On the top left, you will see the current market price of the asset and the daily change in the same.

Process of selling assets

If you click the “Sell” option, here too you will find the two options of delivery and intraday.

Like buy orders, here too you can place GTT and Stop loss for delivery and Cover order, Robo order and Stop Loss order for intraday.

All other features are also very similar such as limit and market order, selling on margin, setting the validity period of orders etc.

Post-order process

Once the order is placed, you can go to the Orders section from which you can track and manage your open orders, positions, GTTs and Stock SIPs.

It is our mission to build a sophisticated, user-friendly system that not only makes trading efficient but also an easy, enjoyable and refined experience. If the above innovations excite you, open demat account with Angel One today and start a new investment journey!

Published on: Dec 1, 2022, 7:22 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates