FINNIFTY or the Nifty Financial Services Index is an index of the National Stock Exchange that includes the stock prices of top public companies in the Indian financial sector. In other words, it expands beyond the banking sector and brings a greater chunk of the financial sector as a whole under its ambit.

Although banks still constitute well over 65% of the index, there are other major financial institutions in its list of stocks. This includes insurance companies, housing finance, NBFCs and other companies that offer financial services.

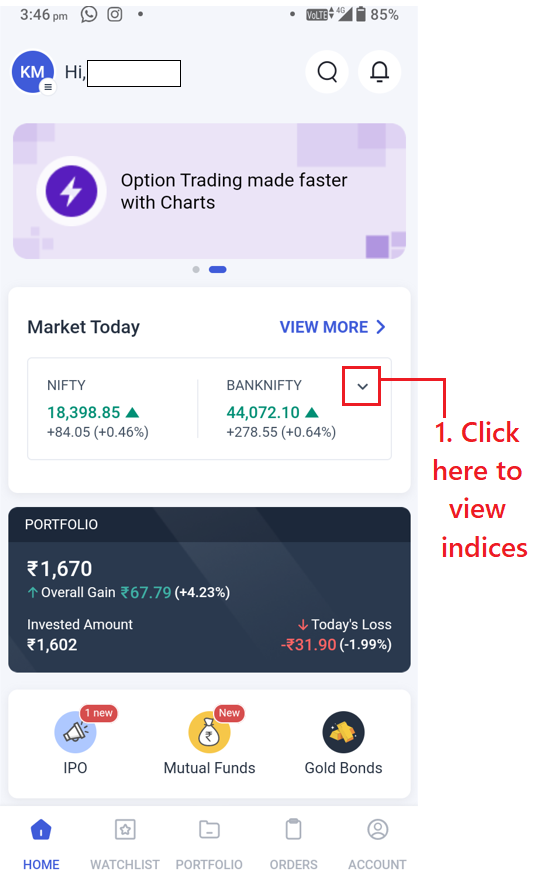

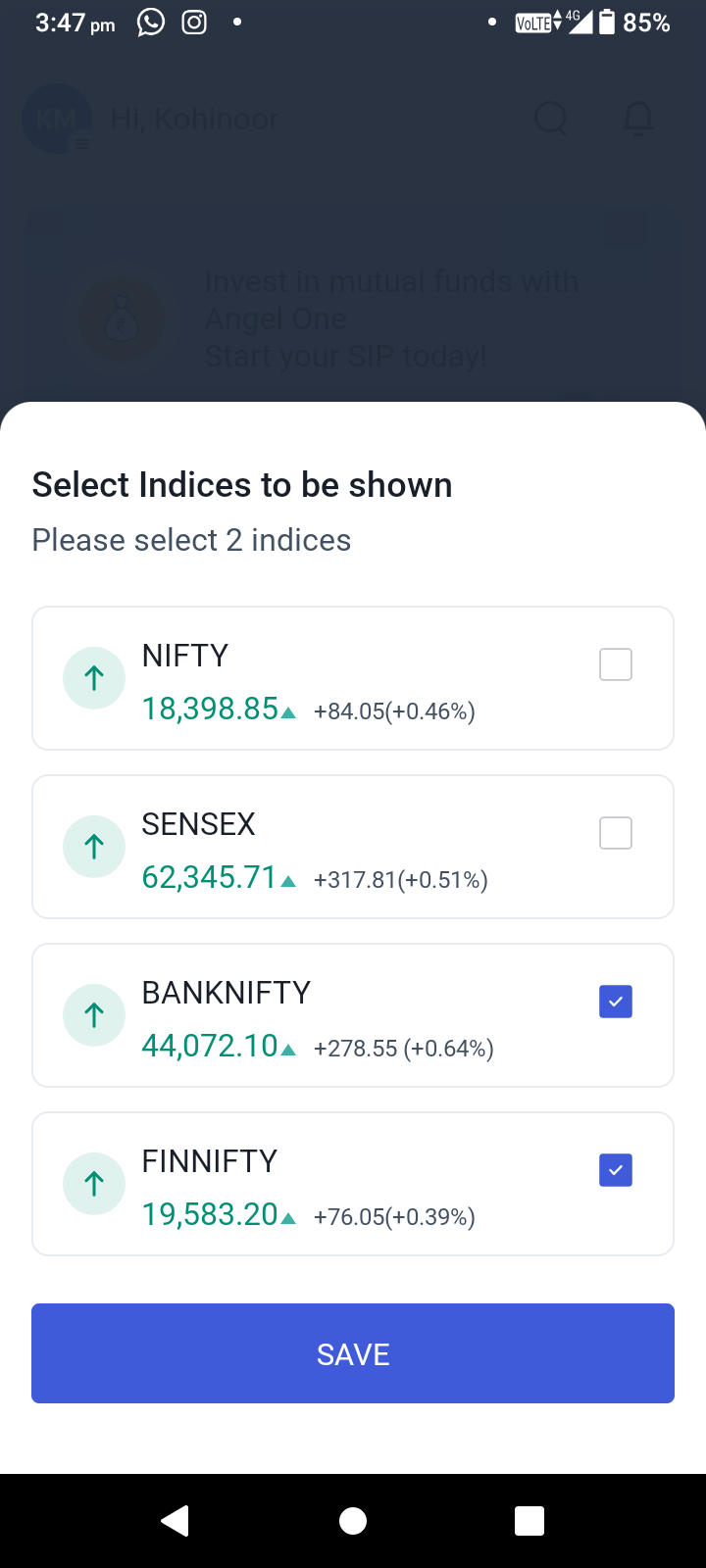

In order to track FINNIFTY on your Angel One app, take the following steps –

Fig. 1: How to add FINNIFTY to the Home page

You can also view the same set of indices on top of the Watchlist section. Here too, you can follow the aforementioned steps in order to view FINNIFTY on the card.

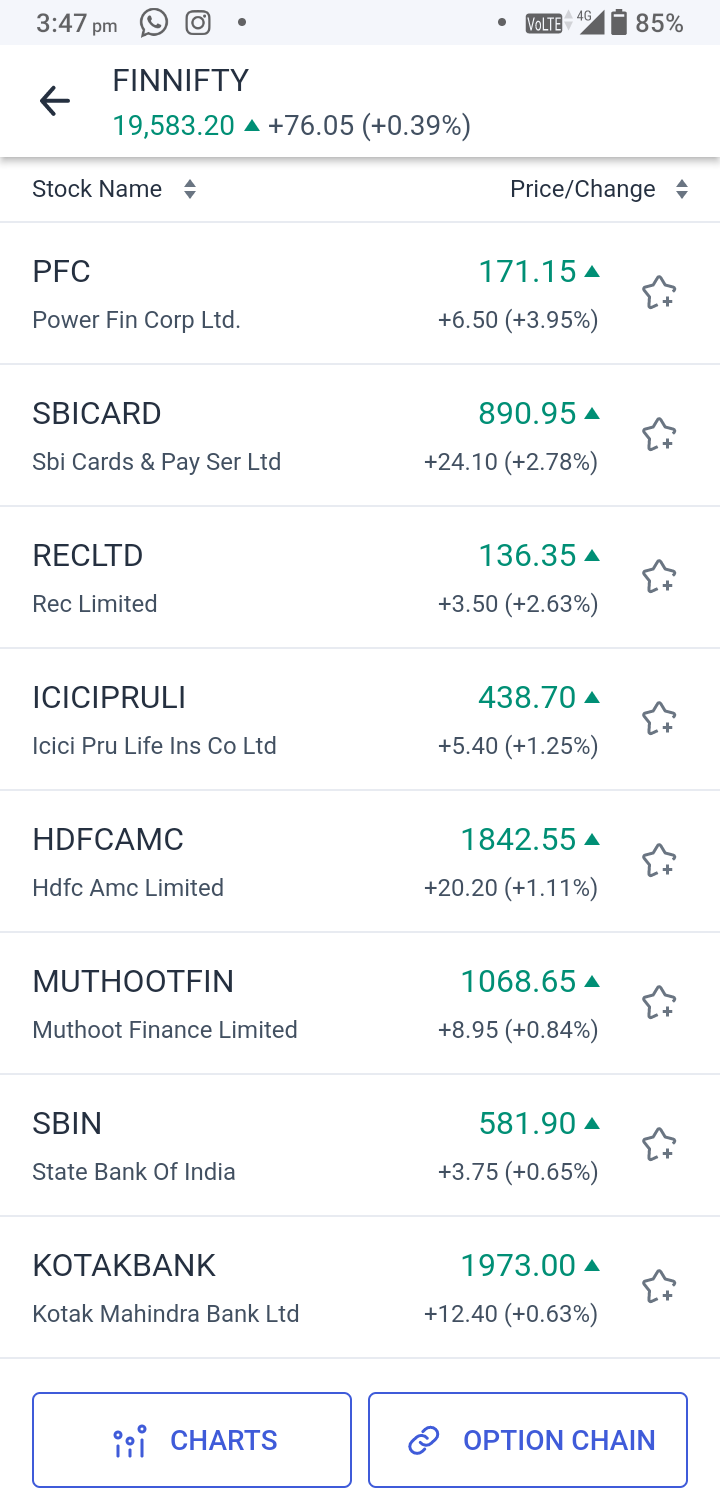

Apart from checking the overall performance of FINNIFTY from Home and Watchlist, you can get into further details by examining the FINNIFTY stocks, charts and options chains.

Stocks

On the Home page, click on FINNIFTY in order to view the entire list of stocks that are included in the FINNIFTY index. For each stock, you can view the current market price (CMP) as well as the absolute and percentage change in the CMP since the previous day’s closing. If you want, you may add individual stocks from this list to your watchlist by clicking the star icon next to the stock price.

For further details on the index, you can click on the following tabs at the bottom – “CHARTS” and “OPTION CHAIN”.

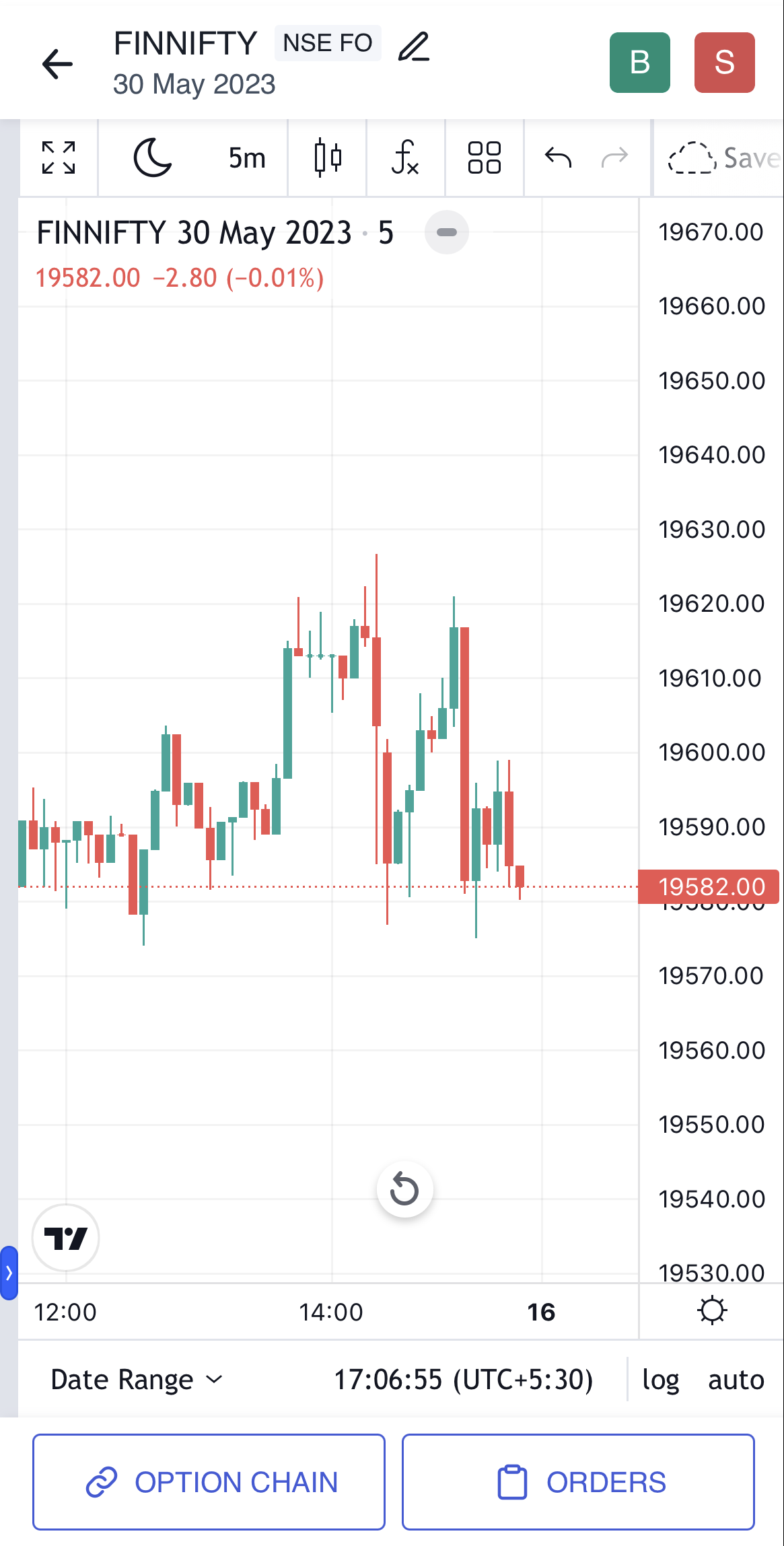

Charts

Clicking this will show you the graph of FINNIFTY. If you want, you may change the time frame of the chart, chart type (e.g. candles to line chart), add indicators, save the graph etc.

At the bottom of the chart, you can find the “ORDERS” button which will take you to the Positions section of the ORDERS page. You can also view the option chain of the index by clicking on the “OPTION CHAIN” button.

Option Chain

This section shows all the available options for a particular date and their details e.g. Open Interest, Volume, Implied Volatility etc. Just scroll sideways and you will be able to see each value for both call and put options. You can also change the date for which you are viewing the options from the top.

By placing the Charts, Option Chain and Orders buttons next to each other, it is now easier for you to switch between these pages to quickly check important numbers and facts during decision-making.

Fig. 2: Stocks in FINNIFTY (left), FINNIFTY Chart (middle) and FINNIFTY Option Chain (right). Notice the buttons for Charts, Option Chain and Orders at the bottom for easily switching between pages.

Once you have viewed the FINNIFTY performance and its stocks, chart and option chain, you may want to choose to trade derivatives on the index.

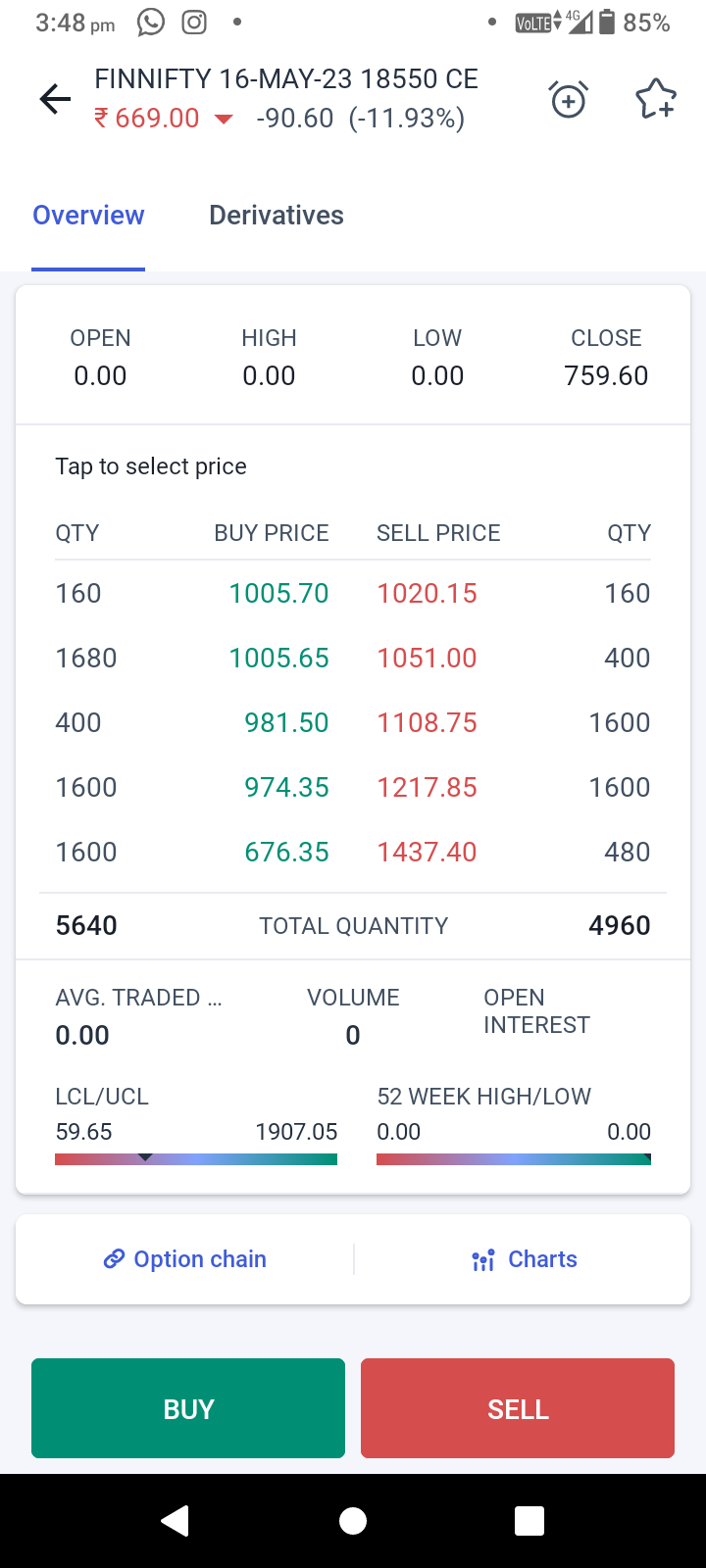

For trading futures, visit the Watchlist and type FINNIFTY into the search bar at the top. You will see suggestions on FINNIFTY futures as well as options. Click on one of the futures and you will be able to view not only the charts and option chain but also the “Stock Details” of the index, which in this case would refer to the basic details of price and volume indicators.

You can also trade in FINNIFTY Options through the Watchlist – simply type out FINNIFTY along with the price or the date for which you wish to view the options.

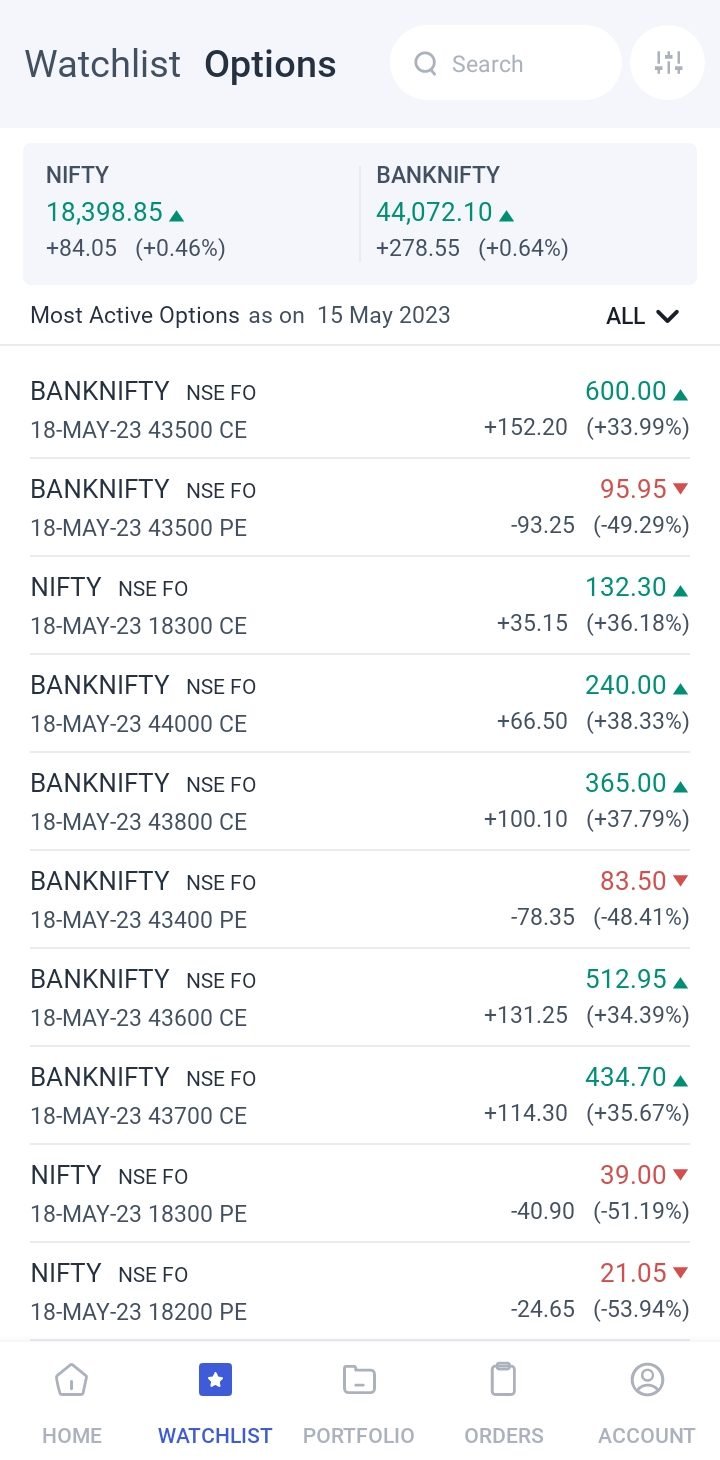

There is another place in the watchlist via which you can trade FINNIFTY options. Just go to the Watchlist section and choose “Options” (right next to “Watchlist” on the top). This will show you a list of the most active options as of today. From this list, if you find a FINNIFTY option that you want to trade, just click on it – you will find the buttons to buy or sell the option or to explore the charts, option chain or stock details further. You can place orders for FINNIFTY options through both the normal watchlist as well as options watchlist search bar.

Fig.3: Searching for FINNIFTY options (left), list of most active options (middle) and details of a particular option (right)

Once you have decided to buy or sell the derivative you simply have to click on the “Buy” or “Sell” button and trade the derivative just like any other stock or index-based derivative.

Finally, you can also follow FINNIFTY calls provided by Angel One’s stock advisory as notifications on your device as well as on the app itself.

Diversification is one of the keys to a more secure portfolio. FINNIFTY offers you this diversification both in trading and investing and thereby reduces non-systematic risks (i.e. risk from individual stock volatilities).

However, the reduced risk does not necessarily mean lower returns. The performance of the index in the last 5 years (at 77.07%) is better than that of the Nifty 50 (69.55%) and the Nifty Bank (65.42%).

If you are interested in trading stocks, futures and options, open a demat account with Angel One, India’s trusted online stockbroker. Also, do not forget to follow the Angel One blog for more updates.

Disclaimer: This article has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations.

Published on: May 15, 2023, 7:53 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates