In FY24, FPIs that is Foreign Portfolio Investors injected a total of Rs 3.39 lakh crore into the Indian Market. Over the past twelve months, FPIs were net buyers in nine months, with the remaining three months showing a net seller position. This trend is consistent in the equity segment, mirroring the overall capital flow pattern.

Surprisingly, FPIs demonstrated significant trust in the debt category throughout FY24, remaining net buyers without any selling activity in any month. They infused approximately Rs 1.21 lakh crore into the Indian debt market, contributing 36% to the total capital inflows in the Indian market.

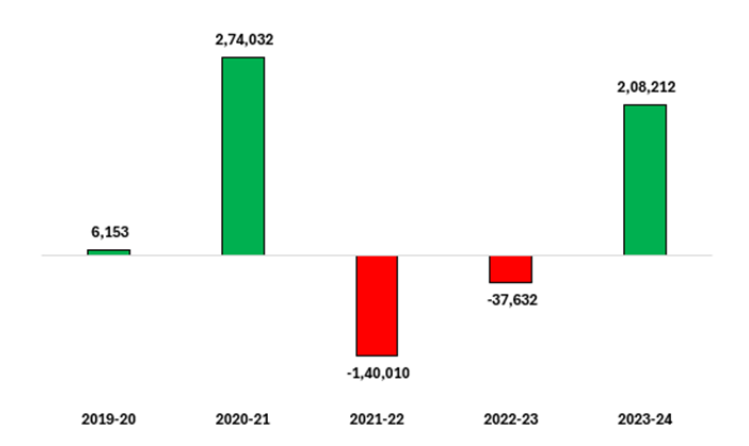

Upon analyzing the data above, it is evident that FPIs transitioned from being net sellers in FY22 and FY23 to becoming net buyers in FY24. They infused a total of Rs 2.08 lakh crore in FY24, in contrast to selling approximately Rs 1.40 lakh crore in FY22 and around Rs 0.37 lakh crore in FY23.

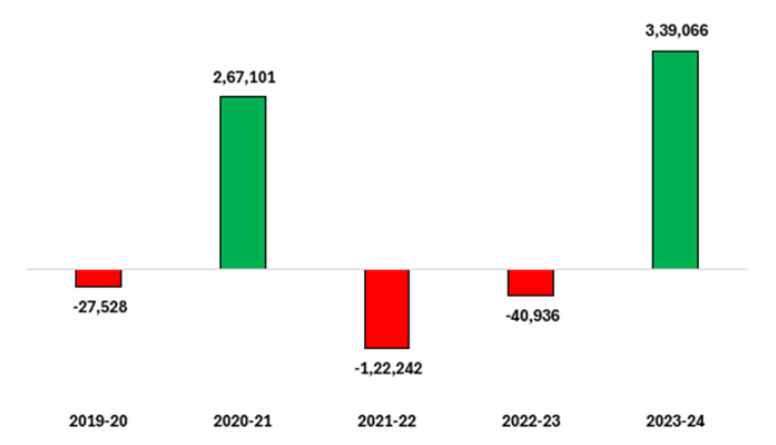

Moreover, the cumulative investment injected by the FPIs amounts to approximately Rs 3.39 lakh crore, marking a shift to net buying after consecutive years of selling. In FY23, FPIs sold Rs 0.40 lakh crore, and in FY22, they sold Rs 1.22 lakh crore, as illustrated in the image below. Over the past five years, FPIs have been net sellers for three years and only transitioned to net buyers for two years.

| Financial Year | Equity Rs Cr | Debt Rs Cr | Debt-VRR Rs Cr | Hybrid Rs Cr | Total Rs Cr |

| 2019-20 | 6,153 | -48,710 | 7,331 | 7,698 | -27,528 |

| 2020-21 | 2,74,032 | -50,443 | 33,265 | 10,247 | 2,67,101 |

| 2021-22 | -1,40,010 | 1,628 | 12,642 | 3,498 | -1,22,242 |

| 2022-23 | -37,632 | -8,937 | 5,814 | -181 | -40,936 |

| 2023-24 | 2,08,212 | 1,21,059 | -2,972 | 12,767 | 3,39,066 |

| Total | 4,76,177 | 2,11,002 | 56,080 | 37,555 | 7,80,815 |

In the last five financial years, FPIs invested Rs 7.80 lakh crore across categories, with Rs 4.76 lakh crore invested in the equity markets, constituting approximately 61% of their total investment in the Indian market. Additionally, Rs 2.11 lakh crore, or 27%, was allocated to the debt market in the same period.

| Calendar Year | Equity | Debt | Debt-VRR | Hybrid | Total |

| January | -25,744 | 19,837 | -710 | 24 | -6,593 |

| February | 1,539 | 22,419 | 862 | 6,997 | 31,817 |

| March | 35,098 | 13,602 | 2,478 | 818 | 51,996 |

| Total | 10,893 | 55,858 | 2,630 | 7,839 | 77,220 |

Analyzing the data above, it’s apparent that FPIs remained bullish and emerged as net buyers across various categories, including Equity, Debt, and others in the past two months. They invested Rs 0.77 lakh crore in the first three months of CY24.

In the past three months, the debt market has garnered more attention from FPIs compared to the equity market. FPIs invested Rs. 0.55 lakh crore in the debt market, representing around 72% of total investments in the debt markets, whereas they contributed only 14% to the Indian equity markets.

In conclusion, the data indicates a significant shift in FPI behavior toward net buying in the Indian market, particularly in FY24. Despite sporadic net seller positions in the past two financial years, FPIs showcased bullishness across equity and debt categories. Notably, FPIs’ investments in FY24 totaled Rs. 4.76 lakh crore, with a substantial portion directed towards the debt market, representing 36% of total investments. In the first three months of CY24, FPIs continued their bullish trend, with a considerable focus on the debt market, accounting for 72% of their total investments.

Published on: Apr 1, 2024, 3:09 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates