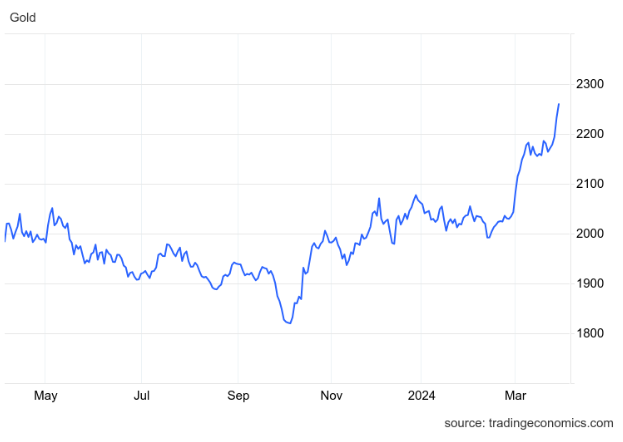

In a stunning surge, gold prices soared to a record high at the start of the second quarter, driven by a combination of factors including expectations of Federal Reserve rate cuts and escalating geopolitical tensions. The precious metal reached as high as $2,259.69 an ounce on Monday, marking a 1.3% increase from Thursday’s closing price and continuing a trend of setting new peaks in recent sessions.

The Federal Reserve’s indication of potential rate cuts has significantly impacted the market sentiment towards gold. The core personal consumption expenditures index, the Fed’s preferred measure of underlying inflation, showed a cooling trend in February. This data, released on a day when many markets were closed, has further fueled expectations for a reduction in borrowing costs. Despite this, the US central bank has maintained a cautious stance.

Gold’s rally, up by approximately 14% since mid-February, has been bolstered by several positive drivers. The prospect of monetary easing by major central banks, along with heightened tensions in regions like the Middle East and Ukraine, has contributed to the surge. Additionally, strong buying from central banks, particularly in China, coupled with increased consumer demand in the country, has played a crucial role.

Fed Chair Jerome Powell, commenting on the inflation figures, stated that they were in line with expectations, indicating no immediate need for rate cuts. However, investors are eagerly awaiting further insights into the US economy and central bank policy, with the monthly payrolls report expected to show an increase of at least 200,000 jobs for the fourth consecutive month.

Market indicators suggest a growing likelihood of a Fed rate cut in June, with swaps markets pricing in a 61% chance, up from 57% on Thursday. Lower interest rates are generally favorable for gold, as the metal does not provide interest payments.

China has exhibited significant demand for gold in recent quarters. The nation’s central bank has consistently increased its bullion reserves for the past 16 months. Moreover, gold-buying has gained popularity among younger Chinese consumers, further boosting demand.

Leading banks have expressed optimism about gold’s future prospects. JPMorgan Chase & Co. identified gold as its top pick in commodities markets, predicting a price potential of $2,500 an ounce this year. Similarly, Goldman Sachs Group Inc. sees a potential for prices to reach $2,300 an ounce, citing the benefits of a lower interest-rate environment.

Conclusion

The record-breaking rally in gold prices underscores the complex interplay of factors influencing the precious metal market. As geopolitical tensions and economic uncertainties persist, gold continues to be a favored asset for investors seeking safe-haven assets.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 1, 2024, 2:00 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates