There are two primary ways in which any business can increase its total revenues – either increase the number of customers or increase the revenue obtained from each customer i.e. revenue per user or RPU. RPU means how much money or value you are able to generate over a period of time from every additional user that you onboard.

Now raising the expenditure on sales and marketing for increasing the number of new customers increases your total customer acquisition cost but with no guarantee of customer retention. In contrast, the higher the RPU, the higher the profitability – because the cost to acquire one extra customer being the same, increased revenue from the customer means increased margins.

There are other benefits of having an RPU-based approach towards growth as well such as –

Now, as you might have realised, increasing the RPU has several challenges of its own – it requires you to have excellent knowledge of not only product-market fit but also of the problems and opportunities in your customer base.

Higher monetisation of existing users is something that stockbrokers and sub-brokers strive for – successful companies focus not only on adding more users but also analysing whether these users are active and how to increase the sources of revenue from each user.

If you are an authorised person looking to protect your business from a cash crunch by raising the RPU of your business then we have something in store for you!

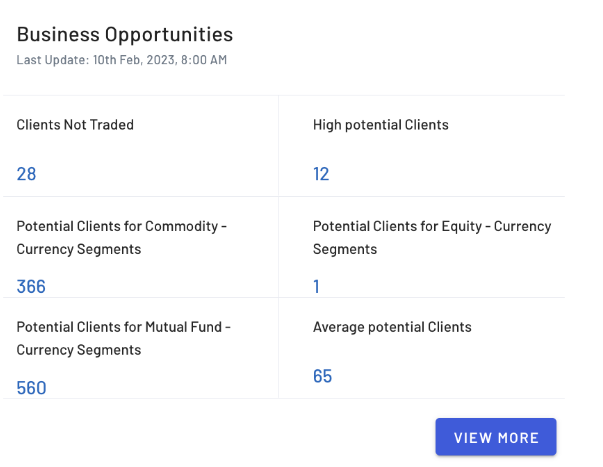

NXT 2.0, which is the online platform of Angel One for our sub-broker partners, has the section titled “Business Opportunities” which empowers authorised persons with the following data points among others –

Fig.: Overview of potential clients for various services

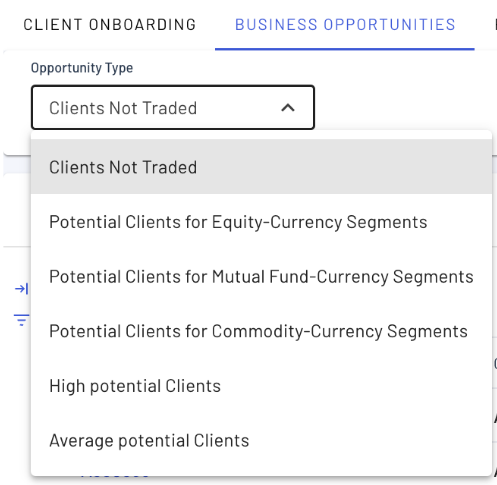

Fig.: Dropdown menu on the segment-wise potential clients list

Once sub-brokers have this information with them, they will know which segments they need to focus on in order to diversify and expand the total amount invested by each customer, thereby increasing their sales commissions through increased RPU.

They will also know what are the problems that their businesses are facing and will therefore be in a better position to solve them e.g. if the number of active clients is low, then the sub-broker can ask his/her sales team to follow up on existing clients instead of wasting time in adding more inactive traders/investors to their client list.

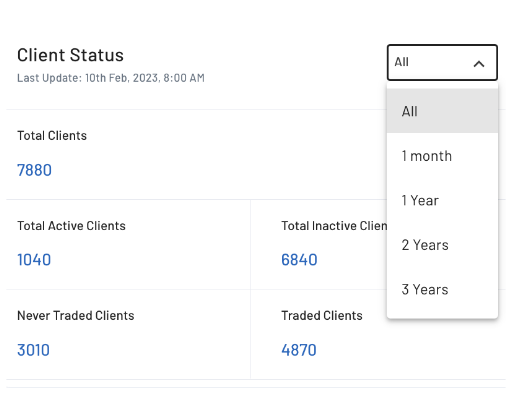

There exists another feature on NXT 2.0 with which sub-brokers can better understand and cater to the needs of their clients – the Client Status. It gives us the number of the following categories of clients –

Finally, it also allows date-wise segmentation for different client statuses.

Fig.: Client status page

As seen above, better understanding the status of your clients will allow you to not only identify the most pressing problems in the business but also know which area in the process of client monetisation may give the highest return on effort. With NXT 2.0, you can now increase your RPU as well instead of just desperately trying to increase your client base. The result – you will be far ahead of your competitors in terms of client monetisation, client satisfaction and business intelligence.

In modern businesses, data-driven decision-making is the key to choosing the right trajectory for your business. NXT 2.0 is the ultimate tool in the market for authorised person’s business in terms of getting the right kind of technological support to grow their business.

If you are a sub-broker and interested in the aforementioned features, become a partner with Angel One and take your sub-broker business to the next level!

Published on: Apr 3, 2023, 1:59 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates