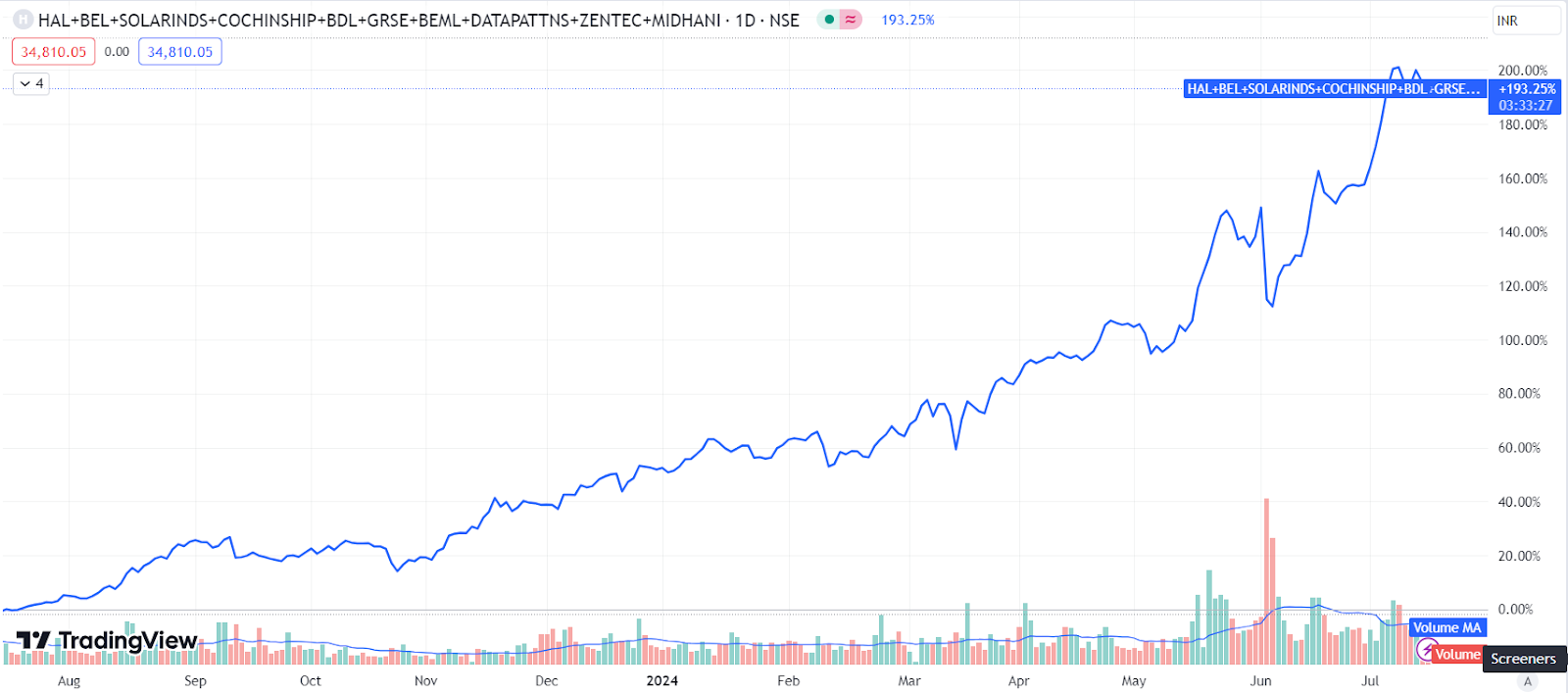

The aerospace and defence sector has been on a meteoric rise in recent years, particularly in India. The sector has given exceptional returns, especially in the last three years. According to data sourced from Simply Wall Street, the Indian aerospace and defence industry has given a return of 177% in the past year. Investors holding onto this sector have built immense wealth, with about 760% returns registered over the past three years.

Past 1 year performance of a basket of the top 10 companies in the aerospace and defence industry

(source: tradngview)

As of July 15, 2024, as per the data from simply wall street, the Indian aerospace and defence industry is trading at a PE (price-to-earnings) ratio of 57.2x. Over the past three years, the market capitalisation of this industry has grown by an astounding 769%, while revenues have grown by just 54%. The three-year average PE ratio for the Indian sector is around 24.7. Earnings growth over the past three years stands at 131%, but the market cap growth rate has outpaced the earnings growth rate by nearly six times.

The US aerospace and defence industry, one of the top players globally, is currently trading at a PE ratio of 33.1x. Over the past three years, the market capitalisation of this industry has grown by 54%, while revenues have grown by 34%. The three-year average PE ratio for the US sector is around 27. This shows a more balanced growth compared to India, where the market cap growth is more closely aligned with revenue growth.

The Chinese aerospace and defence industry is trading at a PE ratio of 58.8x as of July 15, 2024. Over the past three years, the market capitalisation of this industry has declined by 19%, while revenues have grown by 29%. The three-year average PE ratio for the Chinese sector is around 75.1. The decline in market capitalisation can be majorly attributed to the slowdown in the Chinese economy as a whole.

The Indian aerospace and defence sector’s current PE ratio of 57.2x and the three-year market cap growth of 769% raise concerns about sustainability. The revenue growth of 54% and earnings growth of 131% are strong, but the market cap growth rate far outstrips these figures. According to Screener data, there are 22 companies in this industry, with a median PE of about 98. This means investors are paying 98 rupees for every 1 rupee of profit, which seems unsustainable in the long run.

For investors in this sector, a key metric to monitor is the delivery of the orders these companies are executing. The current high valuations might cool down if these companies fail to deliver on their promises, leading to a correction in market prices. It’s crucial to keep an eye on the operational performance and order execution capabilities of these companies to assess the long-term viability of investments in this sector.

While the Indian aerospace and defence sector has shown remarkable growth in recent years, the current valuations seem overheated. Investors should be cautious and closely monitor the delivery of orders and operational performance of companies in this sector to ensure sustainable returns.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 15, 2024, 6:41 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates