We, at Angel One, are committed to making innovations on a regular basis while keeping the user’s requirements in mind. As a part of this process, we have recently come up with a set of new features which will surely upgrade your experience of trading on our app!

The Options Watchlist can be reached from the “Options” tab right next to the normal watchlist.

The earlier Option Watchlist shows the list of most active options on a set of indices. However, to serve the needs of the traders better, this is about to change entirely. The new Option Watchlist will have a more navigable list of options, which can be filtered based on:

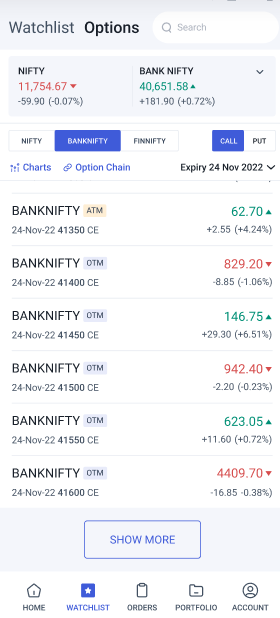

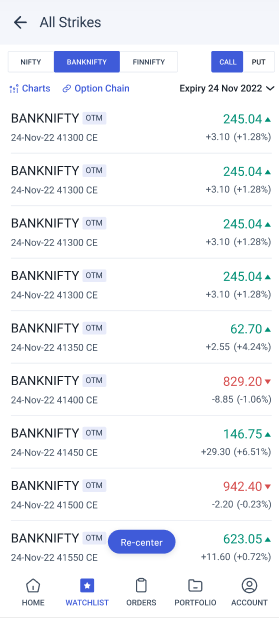

Users can now choose two indices that will be put up on two cards on the Options Watchlist at the top. The indices that can be added here are currently Nifty 50, Nifty Bank and Nifty Financial Services, though more indices (except the Sensex) may be added to this list in the coming weeks. Clicking on these above cards will open their option chains with the latest expiry.

Fig. 1: Initial Option Watchlist (left) and the entire list (right). Notice the indices, option type and expiry date on the top. Also notice the ITM, ATM and OTM tags next to each option.

The process of filtering is simple. To choose the right expiry date look right above the list of derivatives on the Option Watchlist screen and you will see the expiry date whose option chain you are viewing. You can just click on the down arrow next to the expiry date and choose the one you wish to look at.

To view the complete list of strike prices, click on “Show More” at the bottom.

You can also directly choose the index (NIFTY, BANKNIFTY and FINNIFTY) as well as the option type (Call or Put) from right above the expiry date. Next to each option on the list, you will be able to see whether the option is in-the-money (ITM), at-the-money (ATM) or out-of-the-money (OTM) given as a tag.

Right next to the choice of index, you can see the tabs for call and put options. Click on the type of options that you want to see on the list.

You can shuttle easily between the orderpad, the charts of the underlying assets and the option chain using the buttons in the middle. This brings us to the next set of features which are related to improving the orderpad on Angel One.

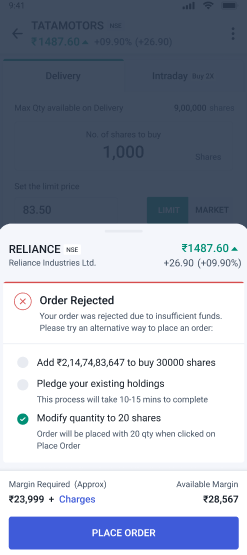

One of the problems that frequent traders face while placing major orders is order rejection due to a lack of funds in the account. However, this situation can easily be resolved with the multiple solutions presented by Angel One.

The following are the choices you see on a window that appears when you are about to place an order that will potentially be rejected:

You can carry out the first and third options in the bat of an eye – the number of clicks needed to complete the journey is reduced to a minimum. The second one requires a few minutes more to process.

Fig. 2: List of choices for you on how to handle order rejection – add funds, pledge securities or modify order quantity.

Thus we have not only shortened the user journey in avoiding order rejection, we have also made the users aware of the entire spectrum of options available to them to handle the same.

Opening an account with us is now easier and quicker with the optimized KYC journey. Under the new version, you can seamlessly add nominees and update DDPI details on your Angel One account.

Interested in the features mentioned above? Open demat account with Angel One, if you have not already. For more updates on the Angel One app, join the Angel One Community today!

Published on: May 29, 2023, 10:43 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates