As we conclude FY24, the bullish momentum in the Indian equity market has rewarded investors handsomely. Notably, both Indian and foreign investors have reaped significant profits. Today, marking the first trading day of FY25, the Indian markets continued the upward trend of FY24, reaching new all-time highs. The Nifty 50 Index surged to a historic high of 22529.95, surpassing the previous record of 22525.65 set on March 7, 2024. However, the index couldn’t maintain these levels and retraced to around 22,448 levels. A similar trend was observed in the Sensex, which also hit all-time highs today.

In this article, we will delve into the performance of Nifty’s sectoral indices over the past 12 months, encompassing FY24. This analysis aims to provide insights into which sectors have shown strong performance, indicating potential areas for investors to allocate their capital for further growth. Given that it is an election year, the market may witness significant rallies in the coming days, making it crucial for investors to identify promising sectors for potential gains.

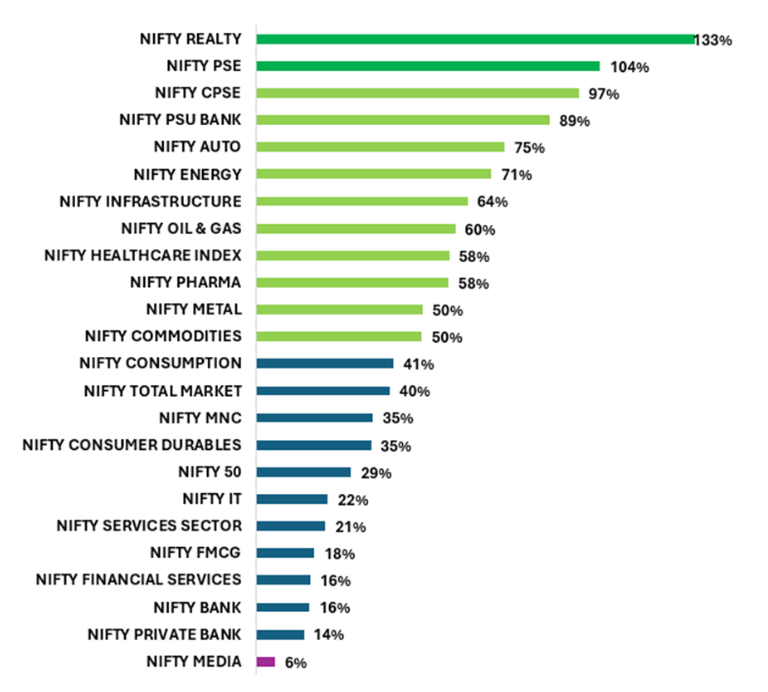

As per the chart above, two sectors, namely Nifty Realty and Nifty PSE, have outshone others by delivering impressive rallies of over 100% in FY24. Nifty Realty has returned approximately 133%, while the PSE Index has shown a remarkable return of around 104% during the same period.

Additionally, among these sectors, ten have yielded returns between 50% to 100%. These include Nifty CPSE, PSU Bank, Auto, Energy, Infrastructure, Oil and Gas, Healthcare, Pharma, Metals, and Commodities indices.

However, the Media sector has disappointed investors, offering only a meager return of around 6% during the same period.

| Index | Current Levels | 31-Dec-23 | 3 Months Returns |

| NIFTY PSU BANK | 7,087.25 | 5,713.45 | 24.05% |

| NIFTY OIL & GAS | 11,514.90 | 9,496.15 | 21.26% |

| NIFTY CPSE | 5,836.25 | 4,860.45 | 20.08% |

| NIFTY PSE | 9,270.50 | 7,854.95 | 18.02% |

| NIFTY REALTY | 935.80 | 793.05 | 18.00% |

| NIFTY ENERGY | 39,447.20 | 33,468.10 | 17.87% |

| NIFTY AUTO | 21,525.80 | 18,618.20 | 15.62% |

| NIFTY INFRASTRUCTURE | 8,419.90 | 7,303.40 | 15.29% |

| NIFTY HEALTHCARE INDEX | 12,153.50 | 10,637.80 | 14.25% |

| NIFTY PHARMA | 19,153.20 | 16,831.80 | 13.79% |

Looking at the trend over the last three months, the above-mentioned sectors have performed admirably, delivering returns of over 10% during this period. Particularly noteworthy are Nifty PSU Bank, Nifty Oil & Gas, and the CPSE Sector, which have topped the list with returns exceeding 20% in the past three months. Additionally, the Nifty Realty Index, which demonstrated strong performance in FY24, has generated a return of around 18% during the same period. This suggests that these sectors could continue to outperform in the upcoming period, prompting investors to keep them on their radar. Identifying strong fundamental stocks within these sectors may enable investors to capitalize on any surges in the sector and profit from upside momentum.

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 2, 2024, 10:02 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates