In Nifty Outlook of 16 June, 2022 expiry, we analyzed Nifty on Monthly, Weekly, Daily & Hourly time- frames.

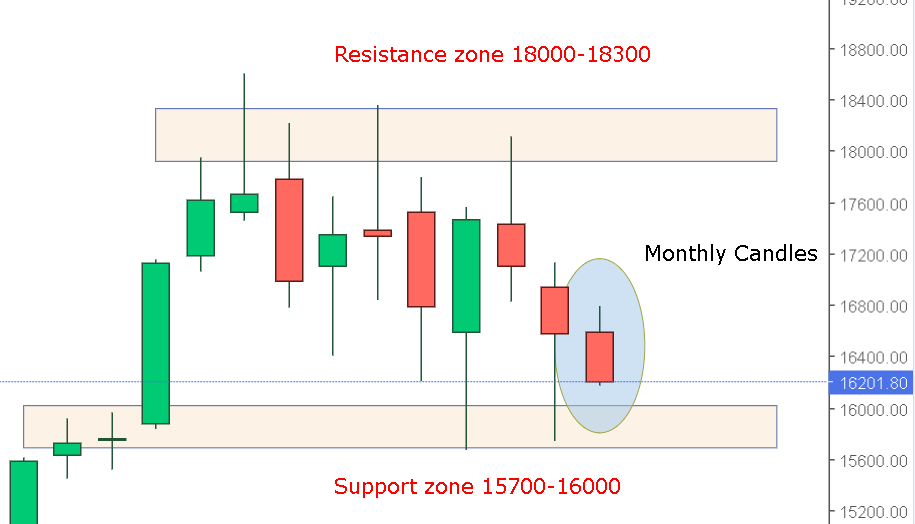

Nifty in Consolidation phase with Support of 15700.Monthly time-frame indicates bearishness in market, but price is near support zone, which can be tested.

Falling Range with LH-LL formation, Last weekly candle of past week, is red Marubozu candle gives confirmation of continuation of down-trend.

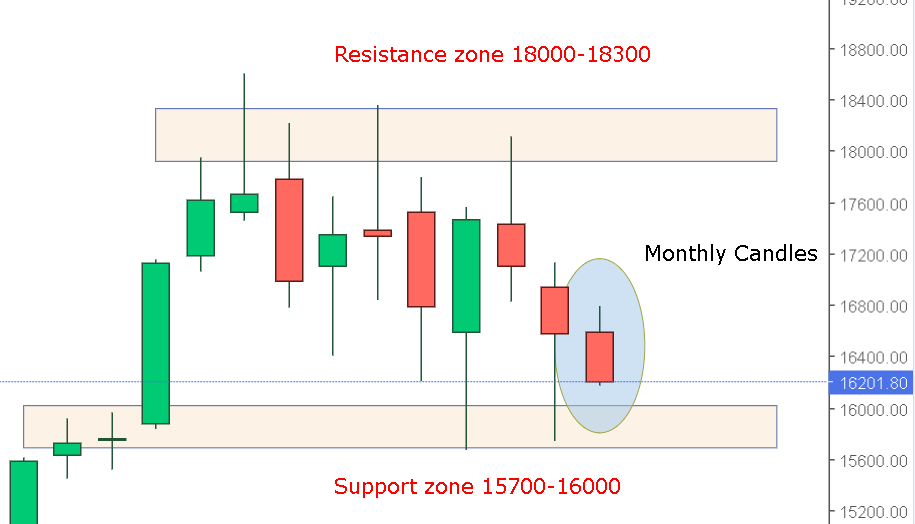

Bears took charge & clearly broke 16400 level and opened path for further down-move.

On Friday Bulls lost their 16400 territory & Bears showed their power by which they were able to drag nifty from 16800 levels to 16200 levels (600Points).

On Monday – We witnessed huge Gap-down and further selling taking Nifty down by 426 points, however a lower wick indicates somewhat buying from the support zone of 15700.

On Tuesday – Bulls tried to take market up, but failed to take it further closing with shooting star pattern.

On Wednesday – a small red candle showing indecisiveness in market.

So it can be said market is in the hands of bears but at 15700 levels Bulls are regaining power to defend it.

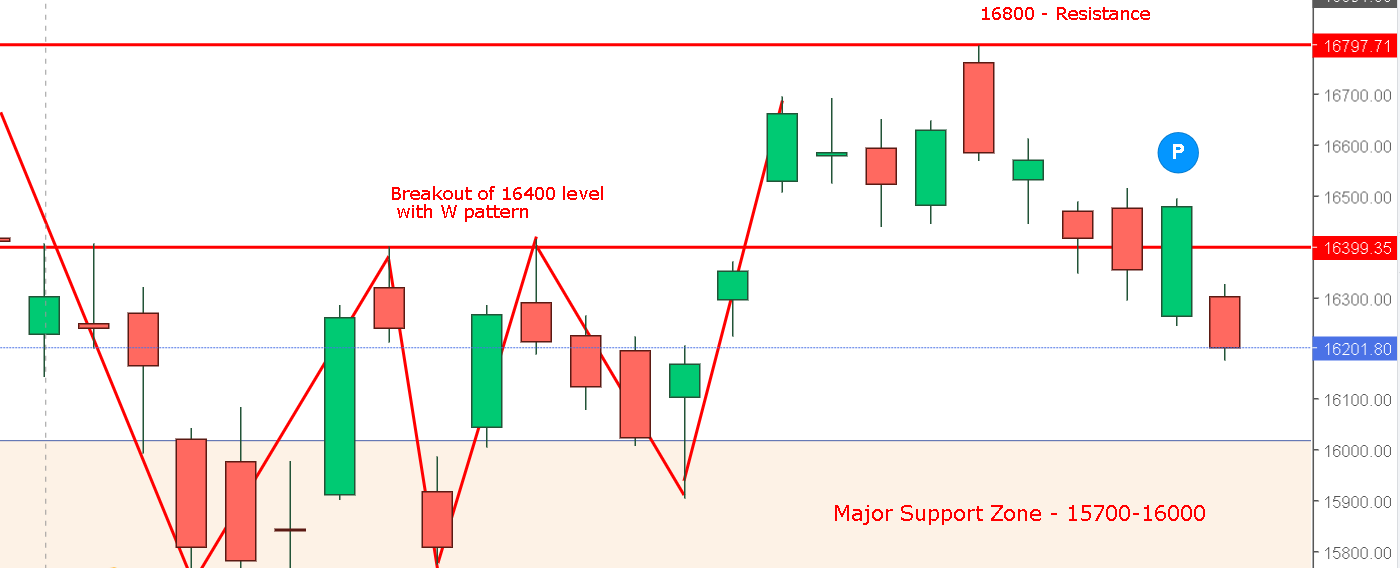

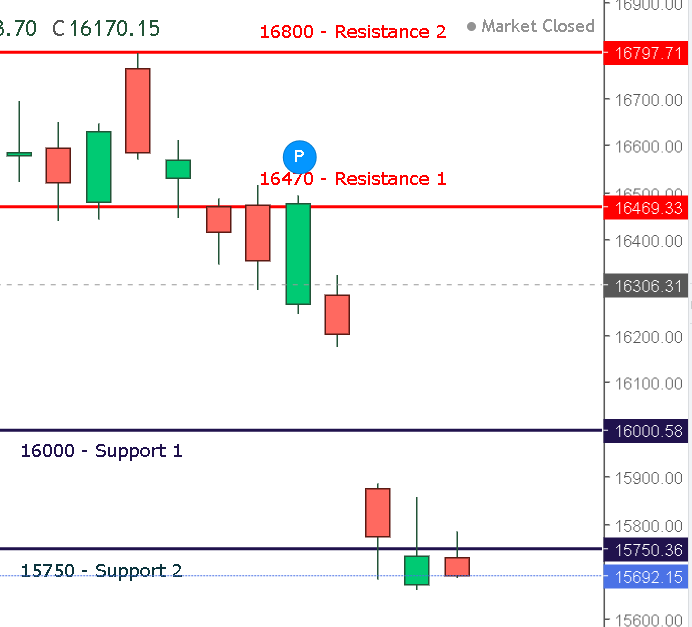

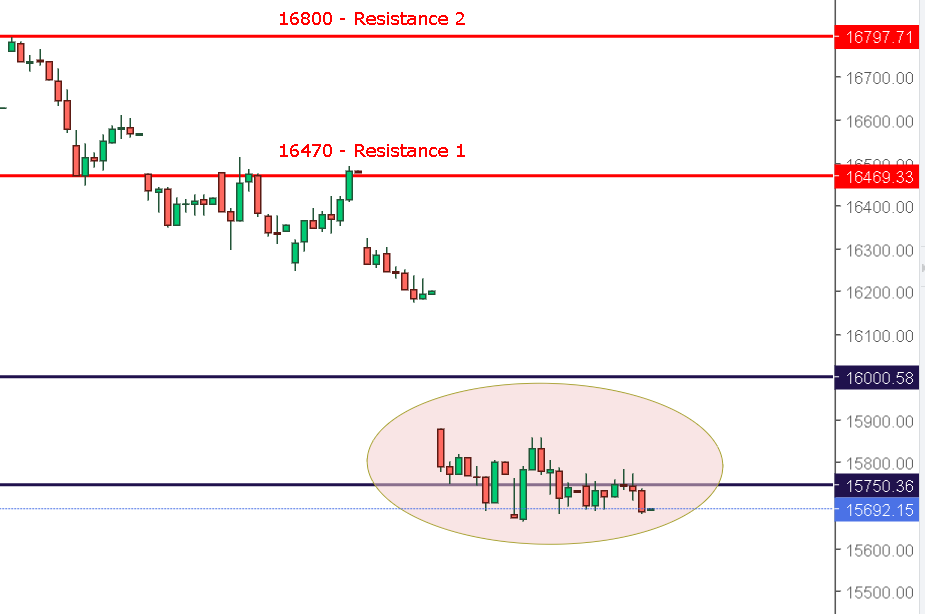

Now lets analyse chart on a Hourly time-frame:

The bears dragged market from the high of 16800 to 15700 levels (1100 pts).

Now at these levels, there is a tough fight between Bulls & Bears.

Bulls not ready to give 15700 support zome.

Bears are continuously giving pressure, and not going above 15900.

So in this expiry two important levels are must to watch :

Resistance – 15900

Support – 15700

However, bears seems more powerful as they dragged market from the high of 16800 to the lows of 15700 (1100 Points), but Bulls are also not yet ready to easily give-up.

So If, Resistance 15900-16000 is broken, then only we can assume that bulls will be able to defend their territory. Until then outlook is slight bearish.

If, major support level of 15700 level is broken with good volume and big candle, so that will be considered as the defeat of Bulls, then Bears will take market further down to the important level of 15500.

Let’s witness this fight together.

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Published on: Jun 15, 2022, 5:51 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates