In Nifty Outlook of 09 June, 2022 expiry, we analyzed Nifty on Monthly, Weekly, Daily & Hourly time- frames.

Monthly – Nifty in Consolidation phase with Support of 15700.

Weekly – Falling Range with LH-LL formation, took support of 15700 & then Shooting star candle with High of 16800.

Daily – Breakout of resistance level of 16400 with W pattern, with Red Marubozu candle with high of 16800.

Hourly – Impulsive down-move from the high of 16800.

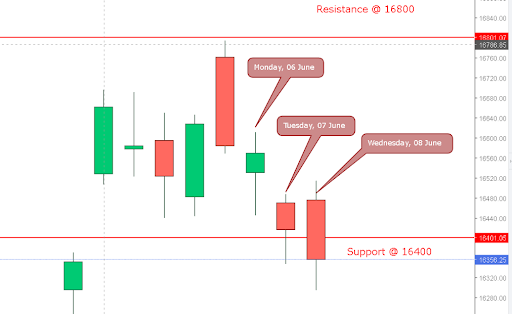

On Monday – we witnessed support from 16440, but ultimately closed with indecisiveness.

On Tuesday – a Gap-down, closed in red, but again got support from the level of 16400 as wick of the candle indicates.

On Wednesday – a big red candle with wicks on both side.

So it can be seen that there is weakness in market started from the levels of 16800.

But wicks on lower side indicate that Bulls are in fighting mode, not ready to surrender easily.

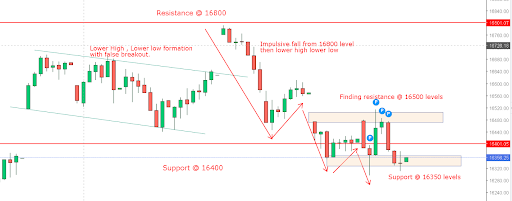

Now let’s analyse chart on a Hourly time-frame:

There is a tough fight between Bulls & Bears.

Bulls not ready to give 16350-16400 territory.

Bears are continuously giving pressure from the level of 16500.

So in this expiry two important levels are must to watch:

Resistance – 16500

Support – 16350.

However, bears seems more powerful as they dragged market from the high of 16800 to the lows of 16300 (500 Points), but Bulls are also not yet ready to easily give-up.

So If, Resistance 16500 is broken, then only we can assume that bulls will be able to defend their territory. Until then outlook is slight bearish.

If, 16350 level is broken with good volume and big candle, so that will be considered as the defeat of Bulls, then Bears will take market further down to the important level of 16000.

Let’s witness this fight together.

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Published on: Jun 8, 2022, 6:37 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates