A basket order allows you to place multiple orders at the same time in a single click. To do this, you simply collect multiple assets in a single basket and then place the order on them when the time is right.

You can also view the overall margin for placing multiple orders in a single view as the Basket also acts as a Margin Calculator.

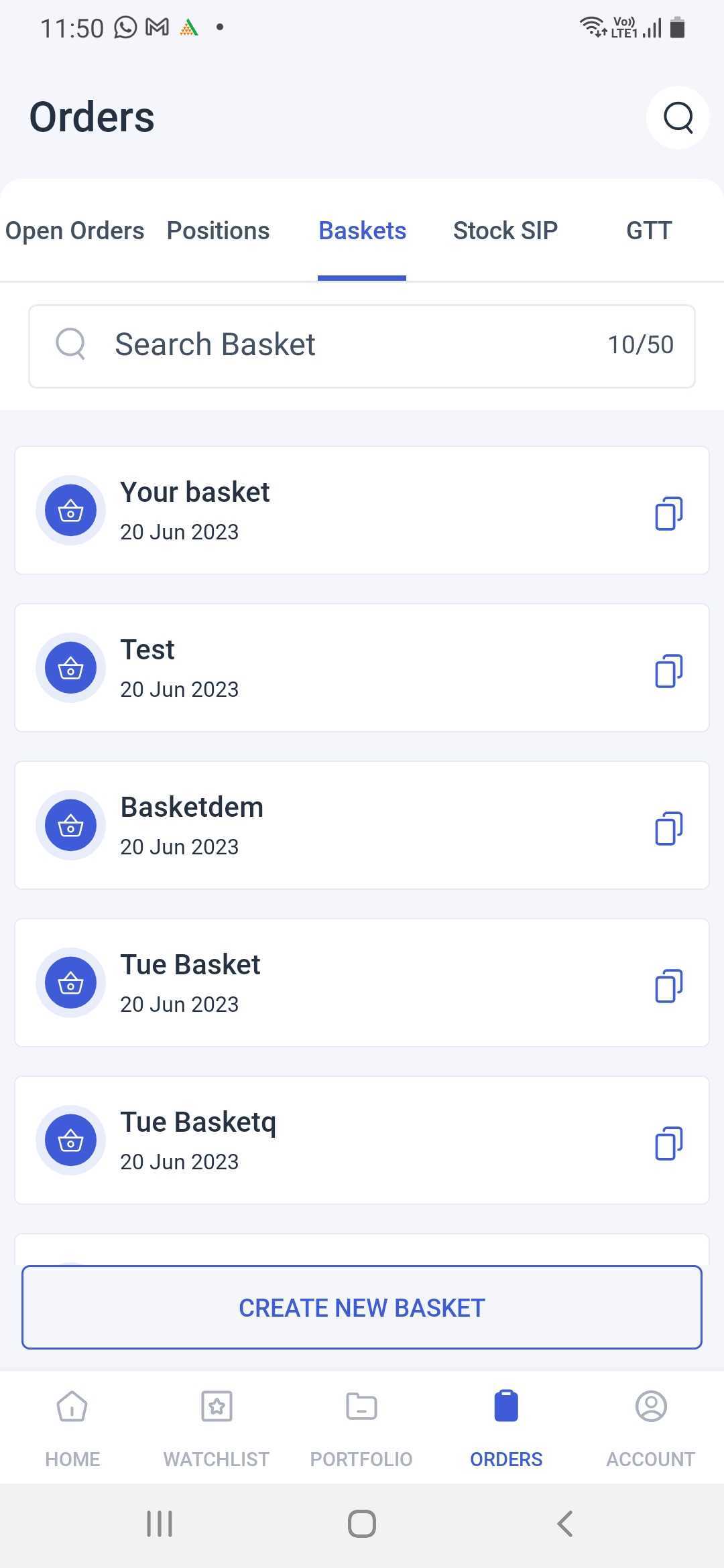

Fig.1: List of baskets (with the clone icon next to it).

Basket orders do not require any extra charges apart from the usual brokerage. However, they bring to you some unique advantages that you will not find elsewhere:

You can execute multiple orders at the same time based on a particular event, or a category of assets etc. For example, you can place different option orders for a particular index and expiry date together by placing them in the same basket. At the crucial moment of execution, you do not have to recall all the asset pages you need to visit and then accurately fill in all the details each time.

2. Reduced margin required

While creating a Basket with hedged positions, you will get the benefit of hedging in terms of reduced margin. Simply put, you can now place multiple trades with less margin amount required upfront.

Example of margin benefit

Suppose you enter into a contract for buying a Nifty June Future and selling a Nifty July Future. Assume that a margin of Rs. 1 lakh is required for each of these trades. So, if you place these 2 orders separately then the required margin would be around Rs. 2 lakh.

But if you combine these two orders into a Basket and place the Basket order then the required margin could be only Rs. 50,000. You will get a margin benefit of Rs. 1.5 Lakh.

3. Efficient Split Orders

Split orders basically entail the automatic division of a major order into multiple smaller orders in order to meet the upper limit on the number of lots set by the exchange.

In case your order in a basket turns into a split order, you will be able to see the status of each individual split order that is a part of the single, larger order inside the Basket.

In case you do not want the split order anymore, you can easily cancel, delete or modify the split order with a single click instead of having to execute the same task multiple times for each split order.

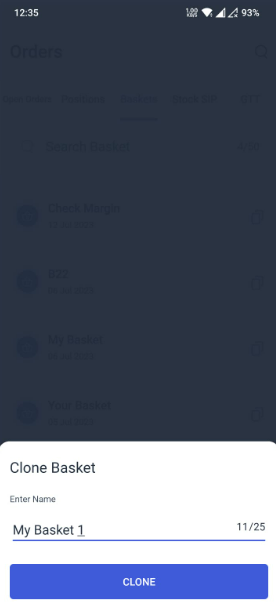

4. Cloning

You now clone any of your baskets by clicking on the clone icon to its right and giving it a name. This will allow you to scale up your orders with incredible ease, without having to manually replicate the names or quantities of each scrip.

Fig.2: Naming the cloned basket

5. Add any asset class

Stocks, indices, F&O, currency or commodity – any of these assets can be added to your basket.

6. Better navigability

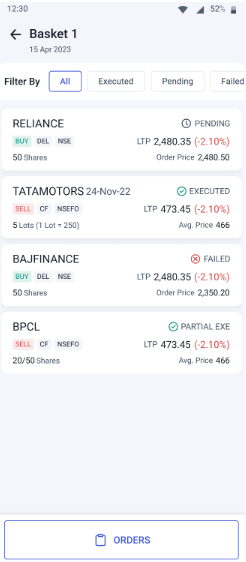

Once the basket order is placed, you will be immediately shown their status. At this point, you can also easily filter the list of orders in a basket based on their order status i.e. executed, pending or failed.

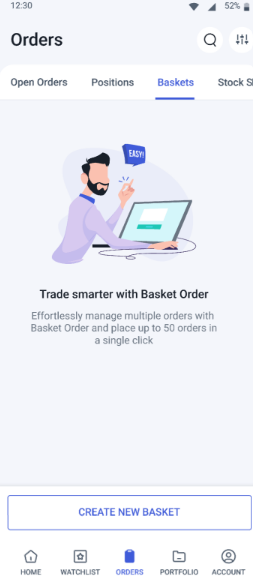

Step 1: Click on Create New Basket. You can do so either from the Home page or from the ‘Baskets’ section in the ORDERS page.

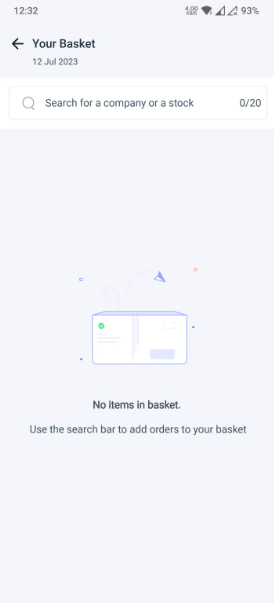

Step 2: Add new scrips to your basket from the search bar on the top.

Fig.3: Create new basket (left), add new scrips to the basket (middle and right).

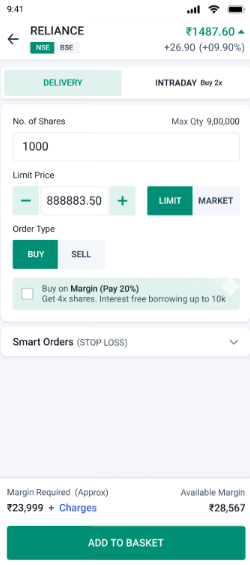

Step 3: Choose a scrip, fill in all the details of the order you want to place on that scrip in the orderpad and click on ‘ADD TO BASKET’.

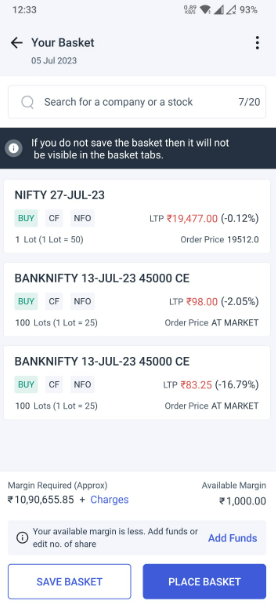

Step 4: In the same way as above, add more scrips to your basket. The Margin Required for the basket and the Available Margin in your account will be visible to you.

Step 5: When the time comes, click on ‘PLACE BASKET’ and then confirm the order to place your entire basket order in full.

Fig.4: Fill in the order details of a particular scrip (left), overall basket view, including the margins (middle) and status of your basket order (right).

3. A basket can be created and securities can be added to it at any time. However, you can place a basket order only during normal market hours.

4. You can rename or delete a basket any time you want.

The basket order is an outstanding tool that will help Angel One users save on time, effort and money. For more such updates, join the Angel One community today!

Published on: Jul 12, 2023, 6:12 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates