When securing your daughter’s future, think beyond buying gold and quality education. As we celebrate the International Day of the Girl Child on October 11, 2023, let’s explore the diverse investment options available for girl child in India. Grab a cup of tea, and join us on this journey together, tailored for your precious one.

Start investing for your little one on her behalf while she is still young so that there is a sizeable fund accumulated in her name upon reaching adulthood. These funds can be aligned with larger goals like education, weddings, etc. You can consider these options:

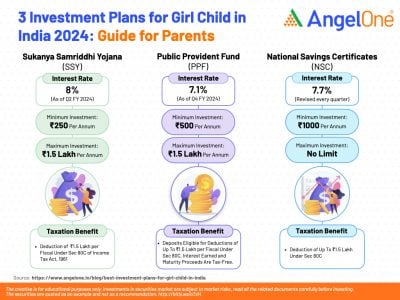

Specifically designed for girl children, this is one of the best investment plans for your daughters in India. The scheme not only gives compounded returns through the tenure of 15 years, but it also gives tax exemptions. SSY offers a relatively higher rate of interest, which is currently 8% per annum for Q3 FY 2023-24. This is subject to change quarterly, so keep an eye.

Read More About Sukanya Samriddhi Yojana (SSY)

This is a long-term investment option backed by the government. It gives attractive interest rates and tax benefits. PPF has a fixed 15-year tenure. You can start investing with ₹500 and go up to ₹1.5 lakh annually. These deposits are eligible for tax deductions under Section 80C. The interest earned and the maturity proceeds are also tax-free. Again, a win-win option.

Now is the time to teach your little one to start creating or at least monitoring her own investment portfolio. While still young, encourage her to start investing in secure investment options so that she always has something to fall back on in case of emergencies and market volatility in future. You can consider the following options:

The moment a daughter is born in a home, her parents desire to buy gold in her name. In addition to buying physical gold, you can also invest in paper gold, which can be gold ETFs, sovereign gold bonds, digital gold, etc. She can later use the proceeds to meet her future goals.

Fixed deposits offer assured returns and can be invested for your desired tenure, whether short, medium or long. It is wise to choose a cumulative FD over a payout option so the interest is reinvested through the tenure. This way, the proceeds on maturity will be sizeable. You can open an FD with India Post, banks, or even NBFCs.

These are also backed by the government, so their returns are guaranteed. Moreover, these also give tax benefits. Currently, the rate of interest is 7.7% per annum, which is revised every quarter. The maturity period is 5 years.

Read More About National Savings Certificate (NSC)

Once your daughter is old enough to manage her finances, introduce her to the stock market. Inculcate a learning habit in her right from an early age so she can start stock investment confidently. With her core portfolio ready, she can now venture into the high-risk arena of the stock market to earn potentially higher returns. You can align these investments with her education and other goals:

Starting with mutual fund investments can give her exposure to multiple asset classes like stocks, debt, and commodities at relatively lower risk, thanks to diversification. She can start investing via the Systematic Investment Plan (SIP) mode with small investments for consistent growth and switch to a lump sum whenever she has a sizable fund in hand.

Note that if you are not confident enough to let her invest on her own, you can invest in children’s mutual fund investment schemes for your girl.

For dual benefits, you can consider ULIPs that combine insurance and investment in one package. You can also benefit from income tax exemption of up to ₹1,50,000 under section 80C.

Once your girl child is confident enough to take on higher risk for potentially higher returns, she can start investing in individual stocks and ETFs. Ensure that she does a thorough analysis of her desired stocks and ETFs before investing. She can also seek professional advice in case she lacks the time to research.

Note, to start investing in stocks, your girl child needs to have a Demat account. If she is a minor, you can open one with Angel One for free in under a few minutes. You can operate it as a guardian till she turns major, and then she can complete certain formalities with the broker to continue using the same account.

If diversification is on your mind, look for investment plans for girl child beyond stocks, FDs, etc. Explore other options like:

You can either buy land or residential/commercial property in a prime location. Through this, you can enjoy regular income in the form of rent and capital appreciation when she wishes to sell in the future. Alternatively, you can also invest in REITs (Real Estate Investment Trust), which allows you to invest in income-generating real estate properties, often via publicly traded securities.

These are debt securities issued by governments or corporations to the public. Bonds are typically high-ticket-size investment options. Investors get periodic interest payments and the principal amount at maturity. These are relatively stable investment options compared to stocks, mutual funds, etc., but have inherent credit, interest, and default risks.

Your dreams for your daughter may be limitless. And as she grows, the dream kitty will only grow. So, it is best to set a stage to see her achieving them carefree, without financial turbulence. Angel One wishes you and your child the best on this International Day of Girl Child. May her soar without any money-related challenges stopping her.

This article has been written for educational purposes only. The securities quoted are only examples and not recommendations.

We're Live on WhatsApp! Join our channel for market insights & updates