Edelweiss Mutual Fund launched the Edelweiss Nifty Alpha Low Volatility 30 Index Fund, an open-ended index fund that aims to track the Nifty Alpha Low Volatility 30 Index. The scheme invests primarily (95-100%) in equity and equity-related securities like the index. There is no assurance of achieving the investment objective and no guaranteed returns. The New Fund Offer (NFO) is open for subscription from April 26 to May 10, 2024, with a minimum investment of Rs. 100 and there is no entry or exit load.

The investment objective of the Edelweiss Nifty Alpha Low Volatility 30 Index Fund is to provide returns before expenses that closely correspond to the total returns of the Nifty Alpha Low Volatility 30 Index, subject to tracking errors. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns.

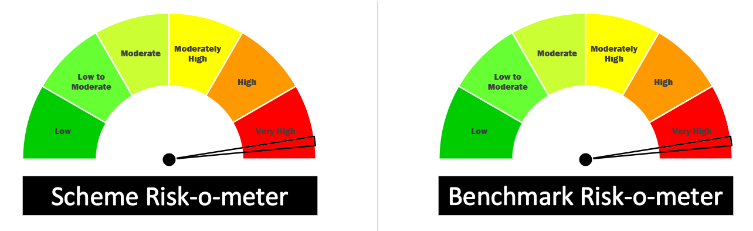

This NFO of Edelweiss Nifty Alpha Low Volatility 30 Index Fund is suitable for investors who are seeking long-term capital appreciation and passive Investment in equity and equity-related securities replicating the composition of Nifty Alpha Low Volatility 30 Index, subject to tracking errors. Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and equity related securities Constituting the Nifty Alpha Low Volatility 30 Index | Very High | 95% | 100% |

| Debt and money market instruments | Low to Medium | 0% | 5% |

The performance of the Nifty Alpha Low Volatility 30 Index Fund is benchmarked against the Nifty Alpha Low Volatility 30 Index (TRI).

Bhavesh Jain, aged 38, holds an MMS in Finance from Mumbai University. He has over 14 years of expertise in the equity market. Currently, he is the co-head for hybrid and solution funds at an AMC, where he has worked for more than 11 years. In this role, he has managed various schemes with great skill. Before this, he worked at Edelweiss Securities Limited as an SGX Nifty Arbitrage Trader.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | YTD Ret (%) |

| Nippon India Nifty Alpha Low Volatility 30 Index Fund Reg Gr | 273.93 | 0.72 | 52.09 | 12.86 |

| UTI S&P BSE Low Volatility Index Fund Reg Gr | 350.47 | 0.91 | 39.98 | 7.93 |

| Motilal Oswal S&P BSE Low Volatility Index Fund Reg | 73.96 | 1.03 | 39.55 | 7.7 |

| Bandhan Nifty100 Low Volatility 30 Index Fund Reg Gr | 494.55 | 1.02 | 32.87 | 3 |

| Index Fund – Category Average | – | – | 27.46 | 5.94 |

All of the above funds are recently launched. Data as of – 26-04-2024

The Nifty Alpha Low-Volatility 30 Index is designed to reflect the performance of a portfolio of stocks selected based on a top combination of Alpha and Low Volatility. It intends to counter the cyclicality of a single-factor index strategy and provides investors with a choice to take exposure to multiple factors through a single index product. The Index consists of 30 stocks selected from Nifty 100 and Nifty Midcap 50.

The weight of the stocks derived from Alpha and Low Volatility factor scores with individual stock weight capped at 5%.

The index can be used for a variety of purposes such as benchmarking, creation of index funds, ETFs, and structured products

Elevate your savings strategy with our easy-to-use SIP Return Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers