One of the significant changes in the Union Budget 2018 was the introduction of tax on long term capital gains (LTCG) at the rate of 10% above the profit level of Rs.1 lakh per year. For example, if your long term capital gains for the year 2018-19 are Rs.145,000/- then your LTCG up to Rs.100,000 will be exempt. On the additional LTCG of Rs.45,000/- tax at 10% (Rs.4500) will have to be paid. That means your long term capital gains on equities, which will be tax-free till March 31st 2018, will be taxable after that. Here are 5 things you need to know about the LTCG tax that was imposed in the Union Budget 2018…

5 things you need to know about the tax on LTCG on equities…

While the tax looks like a fairly straightforward flat tax on profits exceeding a threshold of Rs.1 lakh per annum, there are some nuances that you need to understand here…

It may be recollected that when the securities transaction tax (STT) was introduced in 2004, it was introduced in lieu of the tax exemption granted to LTCG. However, this 10% tax on LTCG above Rs.1 lakh will be payable by you in addition to the STT that you will be anyway paying on your equity market transactions.

How will the tax on LTCG impact you?

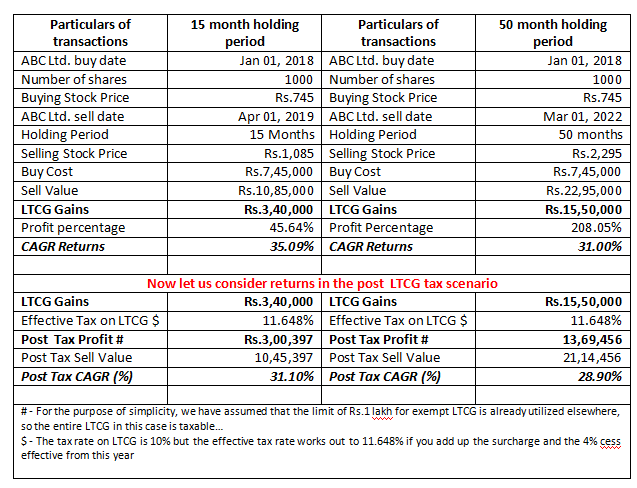

Obviously, the attractiveness of equities as an asset class will reduce. Let us understand how big the difference will be after you consider the impact of tax on LTCG under two different holding period assumptions. But, how big will the impact of this LTCG tax actually be?

If you are really worried about the impact of the LTCG tax, you can afford to relax! We have considered two scenarios where an investor makes LTCG after a holding period of 15 months and 50 months. In the first case, the CAGR return is lower by 4% after tax whereas in the latter case, the CAGR returns falls by just about 2% post tax. So as your holding period gets longer, the actual impact of this LTCG tax on your CAGR returns will be quite negligible. So, to answer your big query, it will not make any substantial difference to your long term financial plan.

Here are 3 things for you to remember about LTCG Tax on equities…

Read More About Tax on Mutual Funds

We're Live on WhatsApp! Join our channel for market insights & updates

Enjoy ₹0 Account Opening Charges

Join our 2 Cr+ happy customers