Retirement planning is a crucial aspect of financial stability, ensuring a comfortable life after you stop working. Simply put, it is a process of setting financial and lifestyle goals for your retirement years and developing a strategy to achieve those goals.

While there are various avenues for retirement savings, SIP in mutual funds and the Public Provident Fund (PPF) stand out as reliable options as they are known to be efficient vehicles for long-term wealth accumulation. In this article, we will guide you through the journey of building a retirement corpus of ₹1 crore.

You can make investments in mutual funds through a Systematic Investment Plan, or SIP. Instead of making a sizable, one-time payment, you can invest a certain amount over time at regular periods.

SIPs are a practical option that helps you invest without having to worry about timing the market. You can set up an account and benefit from rupee-cost averaging over time. SIPs are also renowned for their flexibility since they allow you to begin with a small initial investment and gradually increase it when your financial circumstances improve.

Let us look at several examples to understand how SIP can help Rakesh accumulate a corpus of ₹1 crore for his retirement in various scenarios.

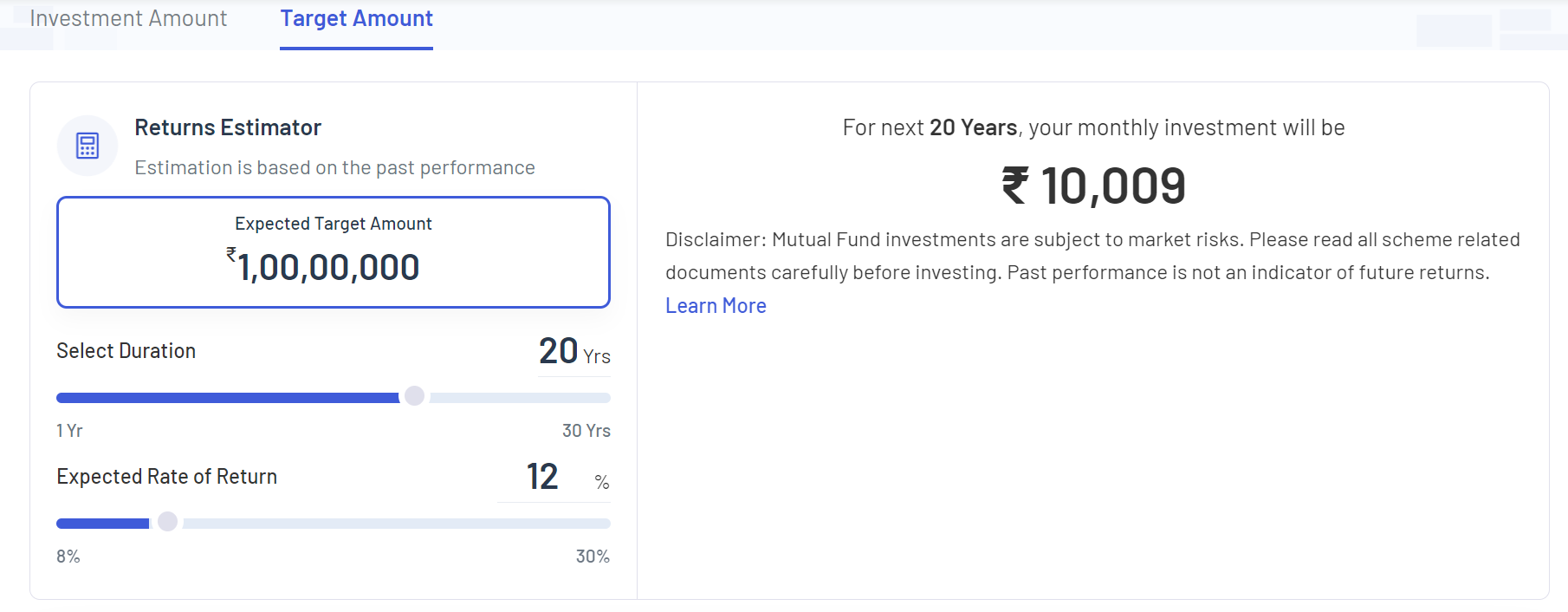

Use the Target Amount feature of Angel One SIP calculator to get an estimated SIP amount Rakesh will have to invest to accumulate the corpus by the time he turns 40. The monthly SIP amount would be ₹10,009.

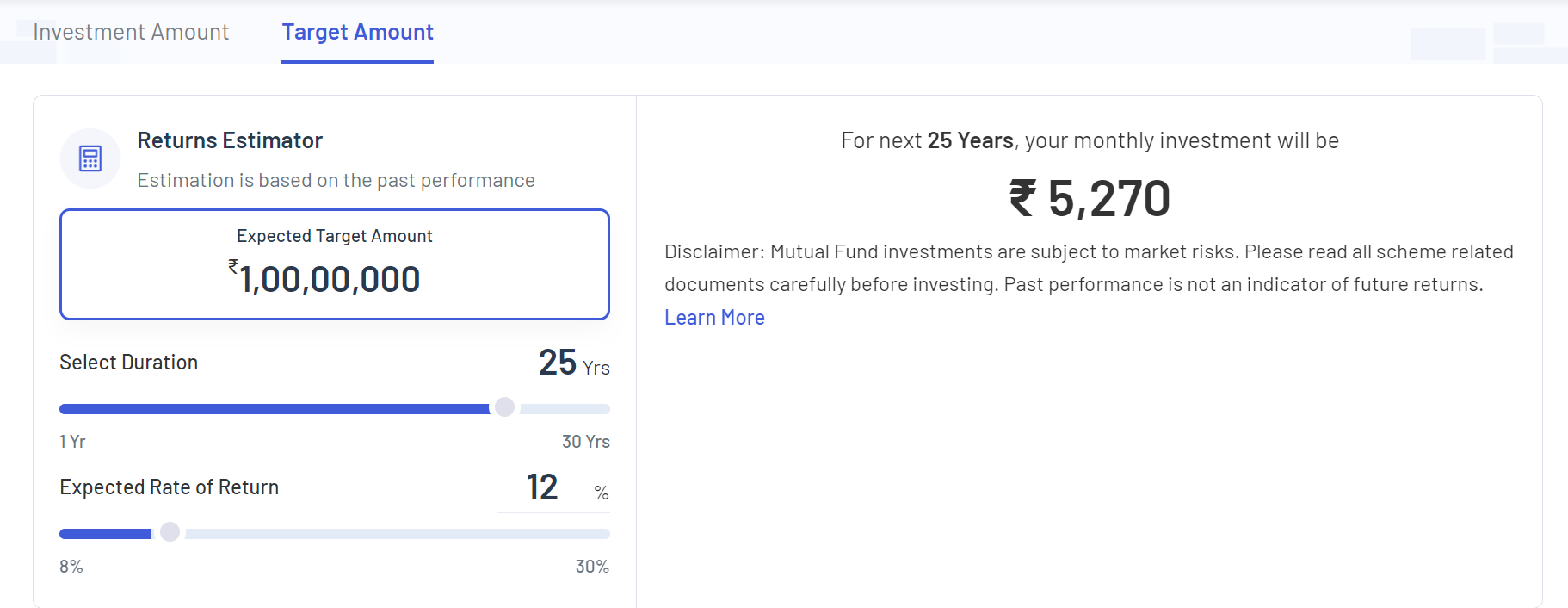

In case Rakesh wants to retire at the age of 50, he has 25 years until retirement. Suppose he has identified an investment that earns returns at 12% p.a.; he will have to invest ₹5,270 monthly to accumulate the corpus by the time of retirement.

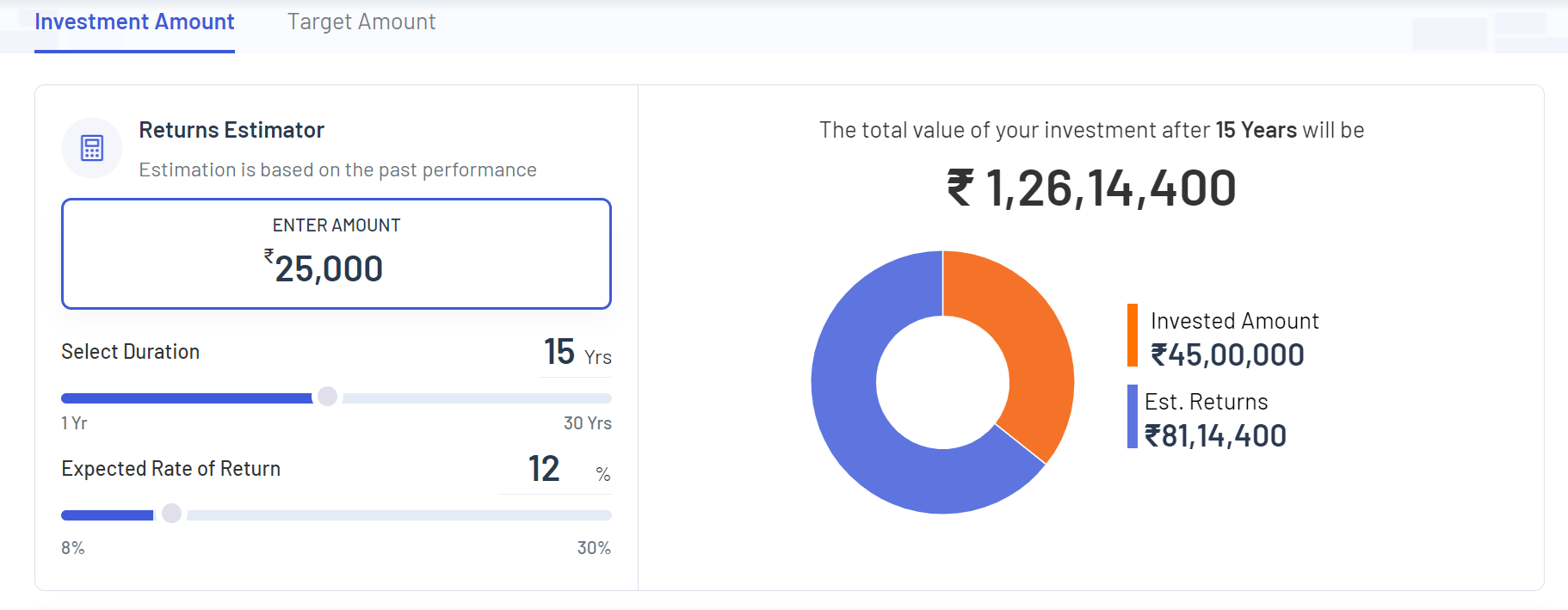

In case, Rakesh is planning to invest ₹25,000 per month for 15 years to earn a return of 12% p.a. with an expectation of retiring at 40. The investment amount feature of the Angel One SIP calculator estimates that the total investment value after 15 years will be ₹1,26,14,400.

The table below showcases how much you need to invest each month to accumulate a retirement corpus in various scenarios. Use the Angel One SIP calculator to estimate the monthly SIP required to accumulate a corpus of ₹1 crore or any other amount you desire.

| Corpus Target | CAGR | Investment Period | Monthly SIP | Corpus Generated |

| ₹1 Crore | 12% | 10 years | ₹45,000 | ₹1,04,55,258 |

| ₹1 Crore | 12% | 15 years | ₹20,000 | ₹1,00,91,520 |

| ₹1 Crore | 12% | 20 years | ₹11,000 | ₹1,09,90,627 |

| ₹1 Crore | 12% | 25 years | ₹5,500 | ₹1,04,36,993 |

The following table showcases the current taxation treatment of gains earned from SIPs in mutual funds:

| Nature of Profits / Income | Equity Funds Taxation | Non-Equity Funds Taxation |

| Minimum holding period for long term capital gains | 1 year | 3 years |

| Minimum holding period for short term capital gains | Less than 1 year | Less than 3 years |

| Short term capital gains | 15% + 4% cess = 15.60% | As per the tax rate of the investor (30% + 4% cess = 31.20% for investors in the highest tax slab) |

| Long term capital gains | 10% + 4% cess = 10.40% (if the long term gain exceeds ₹1 lakh) | 20% with indexation |

| Dividend distribution tax | 10% + 12% surcharge + 4% cess = 11.648% | 25%+ 12% surcharge +4% cess = 29.120% |

However, SIPs in Equity Linked Savings Schemes or ELSS mutual funds are eligible for benefits from Section 80C of the Income Tax Act. The maximum investment amount eligible for tax deduction under Section 80C is ₹1.5 lakh. You can plan your investment by considering the tax amount in order to reach a retirement corpus of ₹1 crore.

A Public Provident Fund (PPF) is a popular long-term savings and investment scheme offered by the Indian government. It was introduced in 1968 with the aim of encouraging savings and providing a safe and tax-efficient investment option for Indian residents. You can open a PPF account at designated branches of authorised banks and post offices across India.

The minimum annual deposit in a PPF account is ₹500, and the maximum is ₹1.5 lakh. Any investment you make over and above ₹1.5 lakh will not be eligible for interest calculation and tax deductions.

Deposits can be made in a lump sum or in instalments, but the total annual deposit cannot exceed the maximum limit. PPF accounts come with a maturity period of 15 years. However, the account can be extended in blocks of 5 years after maturity.

The interest rate of PPF is subject to change every quarter at the government’s discretion. Currently, the interest rate is 7.1%.

Your contributions to a PPF account qualify for deductions under Section 80C of the Income Tax Act, making it a tax-efficient investment. The interest earned on a PPF account is also tax-free. In addition, PPF withdrawals and the maturity amount are also tax-exempt.

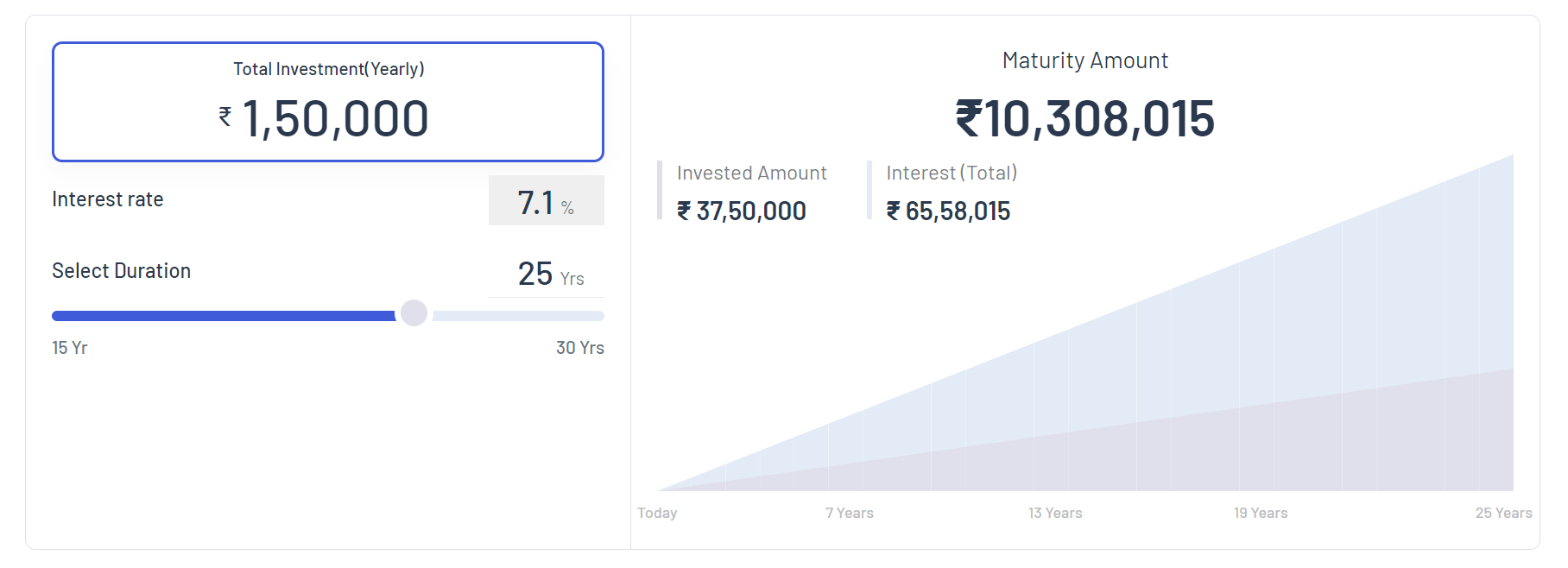

Let us understand the calculation of retirement corpus with the help of an example:

Rohit, a 30-year-old IT engineer, wants to retire at the age of 55. Hence, he has 25 years left until retirement. In case he invests ₹1.5 lakh annually, at the current rate of interest, he will be able to accumulate a corpus of ₹1.03 crore in 25 years. The PPF amount can be easily calculated by using the Angel One PPF calculator.

It is important to start investing early and stay committed to your goals because retirement planning helps you build a financial safety net for the future. You can start your retirement journey by easily opening a demat account online with Angel One today.

Disclaimer: This article has been written for educational purposes only. The securities quoted are only examples and not recommendations.

We're Live on WhatsApp! Join our channel for market insights & updates