We all dream of catching those multibagger stocks, right? You know, the ones that can multiply your investment many times over. But finding such gems involves quite a bit of legwork, like doing fundamental analysis, checking out the company’s management, and diving into technical analysis. Wouldn’t it be awesome if there was a simpler way to spot these winners early on?

Well, you are in luck! Today, we are going to show you how to use ChatGPT and TradingView to make this whole process a lot easier. By the end of this article, you will know how to create a Pine Script that helps you identify potential multibagger stocks early, giving you clear buy and sell signals. Let’s get started!

First, we need some simple rules for our strategy. We will focus on the momentum factor, which is all about catching stocks that are on the rise. Here is our game plan:

This way, we are betting on stocks that are already showing strength and riding them until they show signs of significant weakness.

Now, let’s get ChatGPT to help us create the Pine Script code. We will ask it to write a script that:

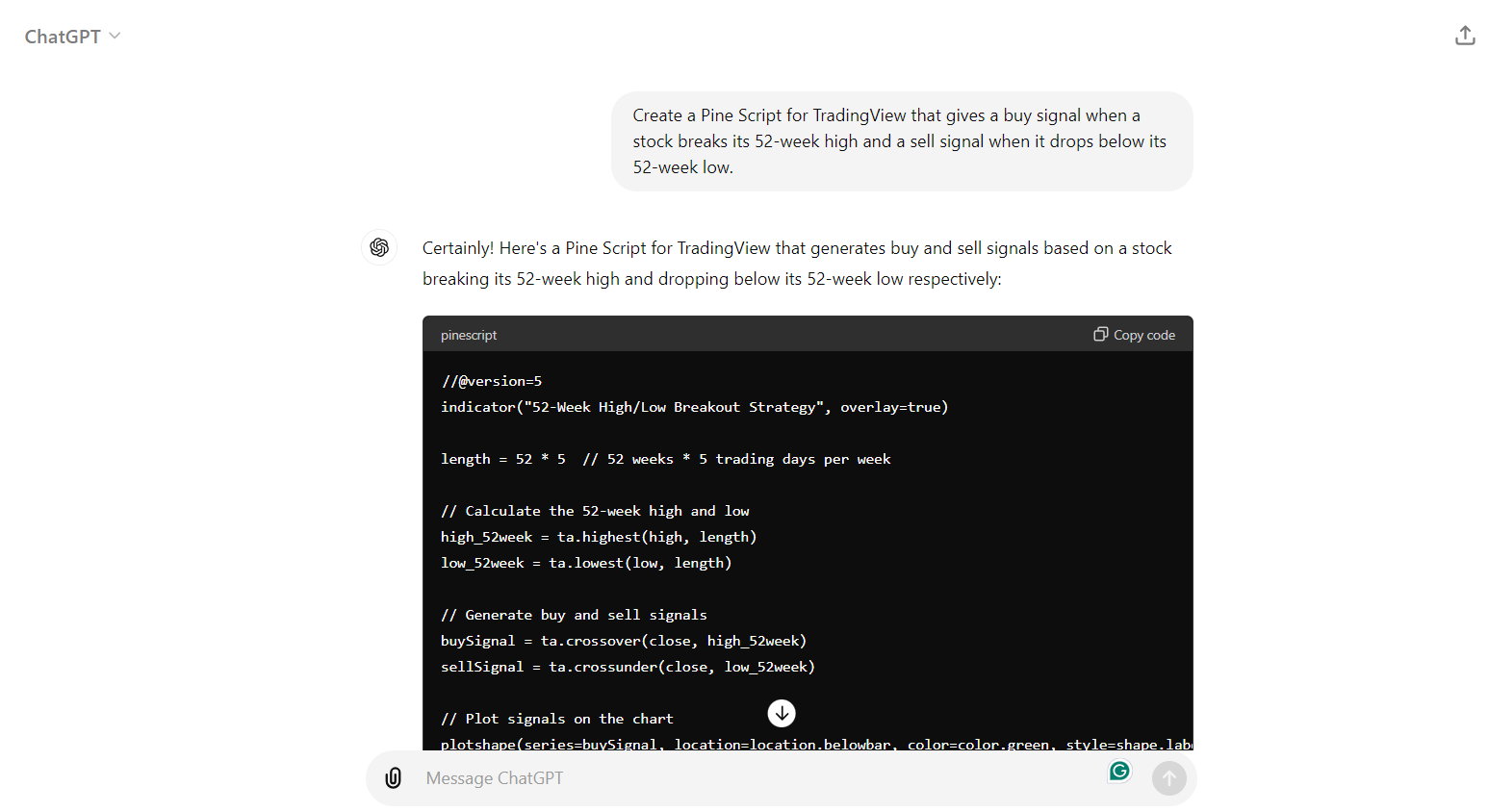

Here’s how you can prompt ChatGPT:

“Create a Pine Script for TradingView that gives a buy signal when a stock breaks its 52-week high and a sell signal when it drops below its 52-week low.”

ChatGPT will then generate the code for you. Just copy this code.

For example,

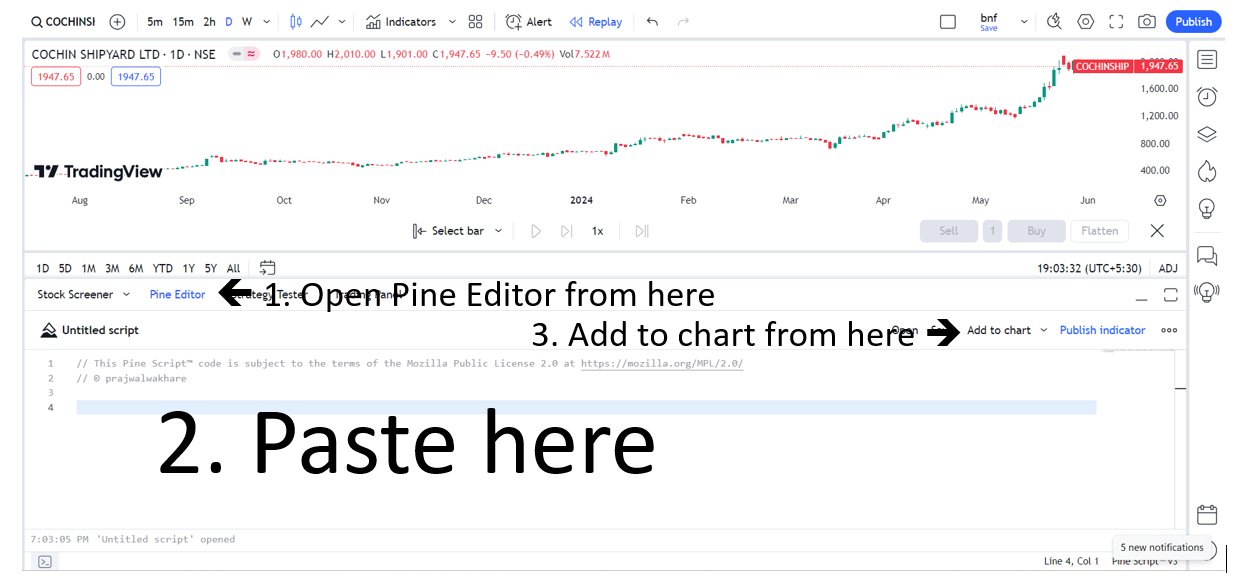

Next, head over to TradingView. If you are not already using it, TradingView is a fantastic platform for charting and analyzing stocks. Here’s what you need to do:

Now, the script will calculate the 52-week high and low prices. You will get a buy signal if the stock’s price closes above the 52-week high. If it closes below the 52-week low, you will get a sell signal.

Let’s look at a couple of examples to see how this works:

You can try this with any stock — Mid-cap, Large-cap, you name it. For example, when Zomato breached its 52-week high of around 77.60 rupees, the script gave a buy signal, and the stock has been trending up since then.

Want to tweak the strategy a bit? Maybe you don’t want to wait for the stock to hit its 52-week low before selling. You can adjust the script to exit if the stock falls below its last 20-week low instead. This way, you can lock in profits sooner.

Just change the sell parameter in the Pine Script from 52 weeks to 20 weeks, and you will see the sell signals adjust accordingly. This is already made in the chart of Zomato example shown above.

Combining technical analysis (for entry and exit points) with fundamental analysis (to pick solid stocks) can help you build a portfolio of potential multibaggers. Websites like Screener.in are great for analyzing stocks based on fundamentals. Once you have a list of good candidates, apply your TradingView strategy to manage your trades.

That is it! By following these steps, you can simplify the process of finding and trading multibagger stocks. Give it a try, and you might just catch the next big winner!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Enjoy ₹0 Account Opening Charges

Join our 2 Cr+ happy customers