In recent years, India has witnessed a significant surge in its infrastructure development initiatives, driven by the government’s commitment to fostering economic growth and creating employment opportunities. In today’s Interim Budget of 2024, we heard some announcements related to infrastructure development.

To build on the enormous impact of the capital expenditure that has tripled over the last four years in terms of economic growth and job creation, the outlay for the upcoming year has been increased by 11.1% to Rs 11,11,111 crore. This corresponds to 3.4% of the GDP.

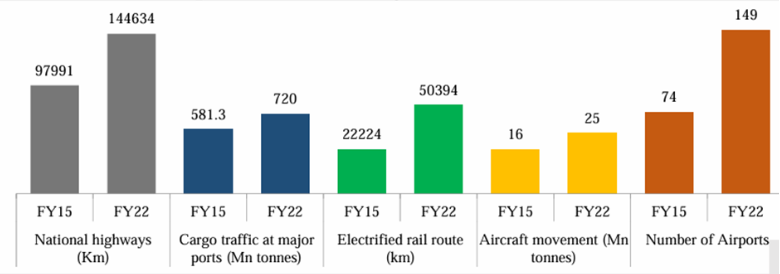

Following chart shows the improvement in the infrastructure from FY15 to FY22.

The following are the industries where the government seek to invest for the economic growth of India.

Bilateral Investment Treaties (BITs) and Foreign Investment

The promotion of foreign investment through BITs has become a cornerstone of India’s economic strategy. Negotiating and strengthening these treaties will not only attract foreign capital but also bolster the overall infrastructure landscape. Investors keen on tapping into this trend should keep an eye on stocks in sectors likely to witness increased foreign participation, such as construction, logistics, and transportation.

Likely to be beneficiary stocks: Larsen & Toubro, IRB Infrastructure Developers, Container Corporation of India.

UDAN Scheme and Airport Development

The ambitious expansion of existing airports and the comprehensive development of new ones under the UDAN scheme signal a booming aviation sector. Companies involved in airport infrastructure, logistics, and allied services are poised for growth. Investors may consider stocks of airport operators, ground handling services, and aviation-related logistics firms.

Likely to be beneficiary stocks: Jet Airways, Interglobe Aviation

Urban Transformation through Metro Rail and NaMo Bharat

The promotion of urban transformation through Metro Rail and NaMo Bharat signifies a commitment to sustainable urban development. Stocks related to metro rail construction, urban planning, and real estate development in metro corridors are likely to witness increased demand.

Likely to be beneficiary stocks: Rail Vikas Nigam Ltd, Titagarh Wagon Industries, and Jupiter Wagons.

Medical Colleges and Healthcare Infrastructure

The plan to set up more medical colleges utilizing existing hospital infrastructure presents an opportunity in the healthcare sector. Investors can explore stocks in companies engaged in medical education, healthcare infrastructure development, and pharmaceuticals.

Likely to be beneficiary stocks: AsterDM Healthcare Ltd

Dairy Development and Livestock Mission

The comprehensive program for supporting dairy farmers, building on existing successful schemes, opens avenues for investments in the dairy and animal husbandry sector. Stocks related to dairy processing, livestock development, and veterinary services may experience positive momentum.

Likely to be beneficiary stocks: Voltas, Blue Star, Kirloskar Industries, etc.

Infrastructure Development and Railways

The substantial increase in capital expenditure for infrastructure development, particularly in railways, is a key driver for economic growth. Stocks of companies involved in railway corridor projects, logistics, and infrastructure development are poised for potential gains.

Three major economic railway corridor programmes will be implemented. These are:

Likely to be beneficiary stocks: KEC International, Larsen & Toubro (L&T), Bharat Heavy Electricals Limited (BHEL)

Electric Vehicle Ecosystem

The government’s focus on expanding and strengthening the e-vehicle ecosystem provides a promising investment opportunity. Investors may consider stocks in electric vehicle manufacturing, charging infrastructure, and related technology companies.

Likely to be beneficiary stocks: NTPC and Tata Power.

Domestic Tourism and Island Development

The emphasis on domestic tourism and projects for port connectivity on islands, including Lakshadweep, suggests opportunities in the tourism and hospitality sectors. Stocks of companies involved in tourism infrastructure, port development, and hospitality services may benefit.

Likely to be beneficiary stocks: Indian Hotels Company (IHCL), ITC, Adani Ports & SEZ, JSW Infrastructure, Adani Ports.

From the Interim budget of 2024 we are looking forward to the infrastructure development in these industries and so indicated by the honourable Finance Minister.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates