Invesco Mutual Fund has recently filed draft papers with the Securities and Exchange Board of India (SEBI) for its new open-ended equity scheme, the Invesco India Manufacturing Fund. This scheme will follow the manufacturing theme, aiming to provide investors with capital appreciation over the long term by investing predominantly in equity and equity-related instruments of companies within the manufacturing sector.

The Invesco India Manufacturing Fund is suitable for investors seeking long-term capital appreciation. The scheme focuses on companies that follow the manufacturing theme, offering a diversified portfolio of equity and equity-related instruments.

The benchmark for the Invesco India Manufacturing Fund is the Nifty India Manufacturing TRI. The scheme falls under the thematic fund category, specifically targeting the manufacturing sector.

The primary objective of the scheme is to generate capital appreciation by investing in a diversified portfolio of equity and equity-related instruments of companies within the manufacturing theme. However, there is no assurance that the investment objective will be achieved.

The scheme offers two plans:

Each plan offers the following options:

Minimum/Additional Application Amount: Rs 1,000 per application and in multiples of Re.1 thereafter.

Minimum Target Amount: Rs 10 crore

Minimum Redemption Amount: Rs 1,000 or 0.001 unit or account balance, whichever is lower.

Entry Load: Nil

Exit Load – For each purchase through Lumpsum, switch-in, SIP, and STP:

For each purchase through IDCW Transfer Plan:

| Instruments | Indicative Allocations | Risk Profile | |

| Minimum | Maximum | High/Medium/Low | |

| Equity & equity related instruments of companies following manufacturing theme | 80 | 100 | High |

| Other equity & equity related instruments | 0 | 20 | High |

| Debt & Money Market Instruments | 0 | 20 | Low to Medium |

| Units issued by REITs and InvITs | 0 | 10 | Medium to High |

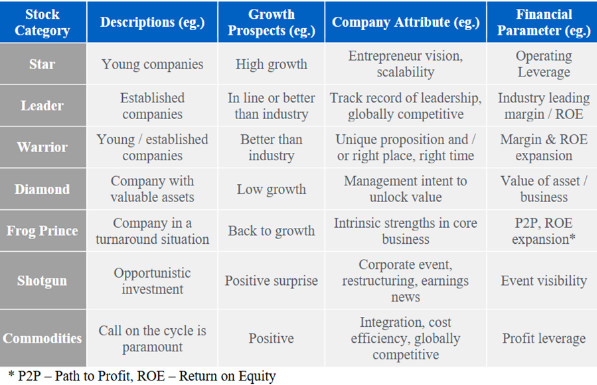

The proprietary stock categorization system helps identify the best investment opportunities within the universe. Each category describes the fundamental attributes expected of the company.

The following types of businesses are part of the manufacturing theme:

The Invesco India Manufacturing Fund will be managed by:

By investing in the Invesco India Manufacturing Fund, investors can potentially benefit from the growth and development of the manufacturing sector in India, aligning their investments with the country’s economic goals and industrial expansion.

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers