With Dhanteras around the corner, the age-old tradition of buying gold is on everyone’s mind. But here’s a twist: instead of gold jewelry, more and more Indian investors are opting for Gold ETFs. And the numbers show why!

In 2024, Gold ETFs have seen a surge in demand, driven by two key factors:

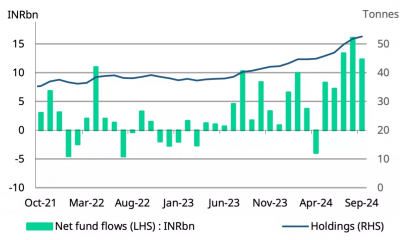

The numbers are telling: according to the Association of Mutual Funds in India (AMFI), Gold ETFs recorded a net inflow of INR 12 billion in September 2024—significantly higher than the average inflow of INR 5.3 billion during the first half of the year. The cumulative assets under management (AUM) in Gold ETFs reached a record INR 398 billion, up 67% from a year ago.

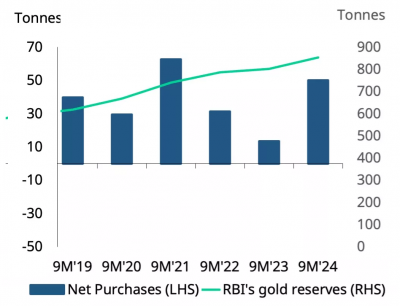

Another indicator of gold’s rising importance is the Reserve Bank of India’s (RBI) strategic increase in its gold reserves. Over the past year, the RBI added 54.7 tons of gold, pushing its total holdings to a record 858 tons. This move not only diversifies India’s forex reserves but also highlights the growing demand for gold as a hedge against uncertainty.

If you’re thinking of jumping on the Gold ETF bandwagon this Dhanteras, it’s essential to keep an eye on:

Gold’s timeless allure combined with strategic financial instruments like Gold ETFs makes Dhanteras an opportune time to diversify your investment portfolio. However, stay informed and consider the long-term trends before making your move!

Happy Dhanteras and happy investing!

Source: World Gold Council

Date: 21st October, 2024

Disclaimer: This blog has been written exclusively for educational purposes.

http://bit.ly/3usSGoH

We're Live on WhatsApp! Join our channel for market insights & updates

Enjoy ₹0 Account Opening Charges

Join our 2 Cr+ happy customers