Kotak Nifty AAA Bond Jun 2025 HTM Index Fund (NFO) is an open-ended index fund launched by Kotak Mahindra Mutual Fund on March 15, 2024. The scheme aims to generate returns that match (before fees and expenses) the performance of the Nifty AAA Bond Jun 2025 HTM Index. This index tracks the performance of AAA-rated bonds that are maturing near the target date of the index. The minimum investment amount is Rs 100 and there is no upper limit on additional investments. The new fund offer (NFO) will close on March 26, 2024.

The investment objective of the Kotak Nifty AAA Bond Jun 2025 HTM Index Fund is to generate returns that are commensurate (before fees and expenses) with the performance of Nifty AAA Bond Jun 2025 HTM Index, which seeks to track the performance of AAA rated bond issued by Public Sector Undertakings (PSUs), Housing Finance Companies (HFCs), Non-Banking Financial Companies (NBFCs) and Banks maturing near target date of the index, subject to tracking errors. However, there can be no assurance that the investment objective of the Scheme

This NFO of Kotak Mahindra Mutual Fund is suitable for investors who are seeking income over target maturity period.

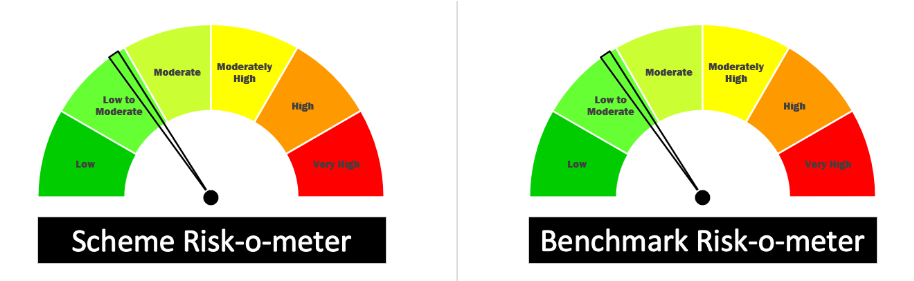

Risk-o-meter:

Potential Risk Class: it’s a close ended scheme, relativelymoderate interest rate risk and relatively low credit risk (A – II).

| Investments | Indicative Allocation | Risk Profile |

| Replication of Securities covered by Nifty AAA

Bond Jun 2025 HTM Index |

Minimum 95% – Maximum 100% | Low – Moderate |

| Cash & Debt/Money Market Instruments | Minimum 0% – Maximum 5% | Low |

The performance of Kotak Nifty AAA Bond Jun 2025 HTM Index Fund is benchmarked against the Nifty AAA Bond Jun 2025 HTM Index.

Mr. Abhishek Bisen, aged 45, holds a BA in Management and an MBA in Finance from IIM-C. He has been with the company since October 2006, primarily managing debt schemes. Before joining Kotak AMC, he worked at Securities Trading Corporation of India Ltd, focusing on sales, trading of fixed income products, and portfolio advisory. He also has 2 years of experience in merchant banking with a leading firm

| Scheme Name | NAV (Rs per Unit) | AUM (Rs. Cr) | Returns in %, As on March 15, 2024 | |

| 1M | 1Y | |||

| SBI CRISIL IBX SDL Index – September 2027 Fund Regular – Growth | 11.07 | 1,076.97 | 0.74 | 7.68 |

| Bandhan CRISIL IBX 90:10 SDL Plus Gilt- April 2032 Index Fund Regular – Growth | 11.08 | 348.77 | 1.05 | 9.28 |

| Bandhan CRISIL IBX Gilt June 2027 Index Fund Regular – Growth | 11.61 | 8,316.98 | 0.69 | 7.53 |

| Tata Nifty G-Sec Dec 2026 Index Fund Regular – Growth | 10.81 | 111.31 | 0.68 | 7.43 |

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers