Mahindra Manulife Mutual Fund launched a new open-ended equity scheme named Mahindra Manulife Manufacturing Fund. This thematic fund aims for long-term capital appreciation by investing in companies across various manufacturing sectors. The New Fund Offer (NFO) is open for subscription from May 31, 2024, and closes on June 14, 2024. There is no entry load, but an exit load of 0.5% applies if you redeem or switch out your units within 3 months of allotment. The minimum investment amount is Rs 1,000.

The Mahindra Manulife Manufacturing Fund shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in manufacturing theme. However, there is no assurance that the objective of the Scheme will be achieved

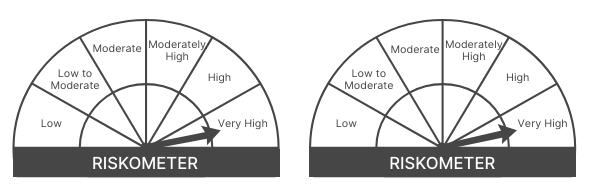

This NFO of Mahindra Manulife Manufacturing Fund is suitable for investors who are seeking long-term wealth creation and an open-ended equity scheme that aims for capital appreciation by investing predominantly in equity & equity related securities of manufacturing theme.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and Equity-related securities of companies engaged in manufacturing theme | Very High | 80 | 100 |

| Equity and Equity related instruments of companies other than the above | Very High | 0 | 20 |

| Debt and Money Market Securities (including TREPS (Tri-Party Repo) and Reverse Repo in Government Securities) | Low to Moderate | 0 | 20 |

| Units issued by REITs & InvITs | Very High | 0 | 10 |

The performance of the Mahindra Manulife Manufacturing Fund is benchmarked against S&P BSE India Manufacturing TRI (First Tier Benchmark).

Mr. Renjith Sivaram Radhakrishnan, 44, holds an MBA in Finance and a BTech in Mechanical Engineering. His recent tenure at Mahindra Manulife Investment Management Pvt. Ltd. (MMIMPL) began in June 2023 as a Fund Manager & Research Analyst. Previously, he served as an analyst at MMIMPL, ICICI Securities, Antique Stock Broking, and B&K Securities. He co-manages the Mahindra Manulife Business Cycle Fund, Mahindra Manulife Equity Savings Fund, and Mahindra Manulife Multi Asset Allocation Fund.

Mr. Manish Lodha, 48, is a B.Com (H) graduate and a qualified CS and CA. Since December 2020, he has been a Fund Manager at MMIMPL. His prior roles include Assistant Fund Manager at Canara HSBC OBC Life Insurance Co Ltd and Research Analyst at Kotak Mahindra Mutual Fund. He co-manages a range of funds, including Mahindra Manulife ELSS Tax Saver Fund, Multi Cap Fund, Mid Cap Fund, and others.

Mr. Pranav Nishith Patel, 40, holds a B.E. in IT and an M.Sc. He joined MMIMPL in April 2022 as an Equity Fund Analyst and previously held positions at MSCI Services Pvt. Ltd. and FICCI. He is the dedicated fund manager for overseas investments in several Mahindra Manulife funds, including the Short Duration Fund and Asia Pacific REITs FOF.

| Scheme Name | AUM (Crore) | Expense Ratio (%) |

| ICICI Prudential Manufacturing Fund | 3882.89 | 1.9 |

| Kotak Manufacture in India Fund | 1933.15 | 2.02 |

| ABSL Manufacturing Equity | 950.24 | 2.33 |

| quant Manufacturing Fund | 651.73 | 2.32 |

| Axis India Manufacturing | 4683.25 | 1.83 |

| Canara Robeco Manufacturing | 1241.89 | 2.1 |

Data as of May 30, 2024

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers