Investing in mutual funds is a top choice for both retail investors and HNIs in India, and they exhibit significant differences in fund allocation strategies. An in-depth analysis of these investment patterns provides insights into their financial priorities and risk profiles.

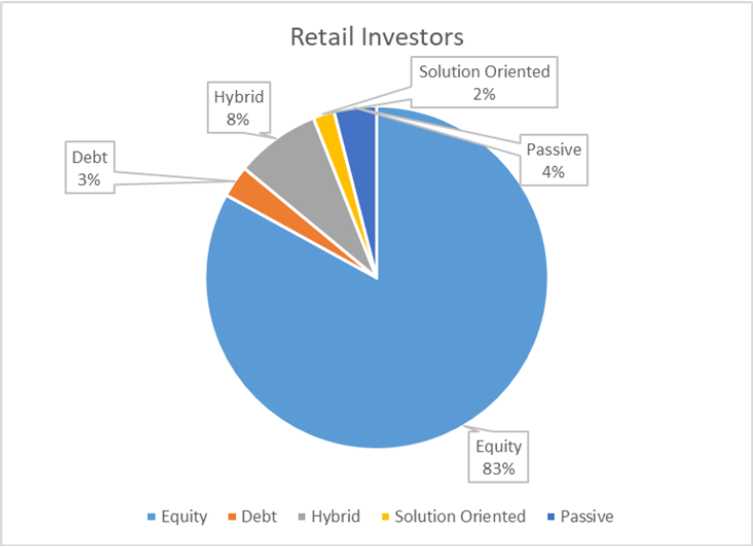

Retail investors primarily favour equity mutual funds, with a substantial 83% of their portfolio dedicated to this category. A strong preference for capital growth is indicated by this high allocation, despite the inherent market volatility associated with equities. The longer-term investment horizon where investors expect higher returns in exchange for higher risk is suggested by the fact that equities are preferred over other investment options.

On the flip side, only a tiny percentage of 3% of retail investors’ portfolios is committed to debt funds, which are usually regarded as safer and provide regular income through interest. This meager allocation may mirror a widespread market view that these instruments offer lower returns in a fast-growing economy such as India. Hybrid and solution-oriented funds take up 8% and 2% respectively, indicating a burgeoning but still small interest in diversified investment approaches. Passive funds represent 4%, hinting at a nascent attraction to these inexpensive investment strategies.

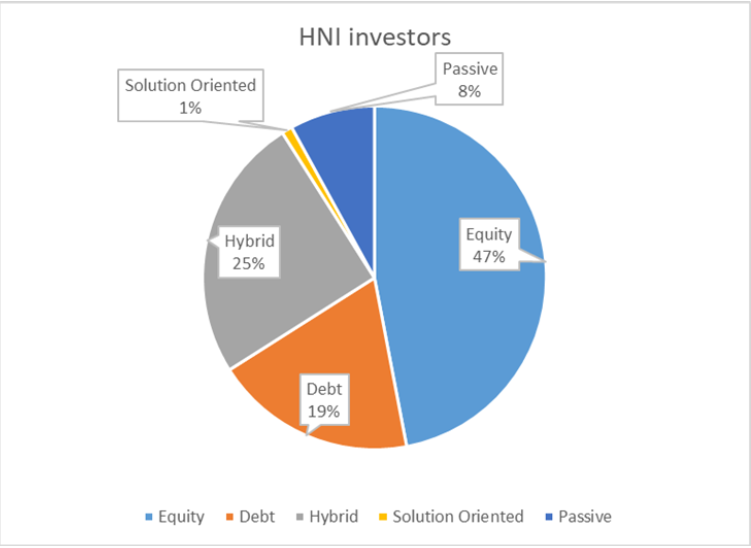

Strategies of Investors in HNI The investment pattern for HNIs is still 47% in equity funds, which shows a more diversified approach as compared to retail investors. HNIs invest a substantial 25% of their portfolio in hybrid funds blending both equity and debt characteristics. This suggests that HNIs are cautious and seek to balance high equity returns with debt stability.

Furthermore, debt funds account for 19% of HNI portfolios as well, indicating a preference for stable and predictable income, perhaps reflecting risk aversion to safeguard their significant assets. Additionally, passive funds represent 8% of their total investments signalling an inclination toward lower cost indexed market tracking investment vehicles.

The following table shows the money allocation across 5 broad categories of funds by Retail and HNI segment:

| Fund Category | Wealth allocation | |

| Retail Investors | HNI investors | |

| Equity | 83% | 47% |

| Debt | 3% | 19% |

| Hybrid | 8% | 25% |

| Solution Oriented | 2% | 1% |

| Passive | 4% | 8% |

Source: AMFI, data as of December 31, 2023

Source: AMFI, data as of December 31, 2023

Source: AMFI, data as of December 31, 2023

Retail and HNI investors differ in their investment strategies, reflecting their dissimilar financial goals and risk tolerance. Retail investors in India prefer growth, hence they are keener on equities whereas HNIs have a broader view that encompasses both growth, stability, and wealth preservation. This is because HNIs seek to maintain as well as increase their wealth. Although these patterns are subject to change with time in response to market dynamics, it is evident that different forms of mutual funds attract specific investor categories.

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers