In the world of investments, Exchange-Traded Funds (ETFs) have become powerful tools for diversification, risk management, and growth. Two ETFs, Nifty Bees and Gold Bees, have gained prominence not just for their individual strengths but for their unique feature – negative correlation.

The magic happens when you understand the concept of negative correlation between Nifty Bees and Gold Bees. In simple terms, when Nifty Bees rises, Gold Bees often remain steady or even gain value, and vice versa. This unique relationship resembles a financial balancing act, driven by market forces.

One of the primary reasons for this negative correlation is the ‘flight to safety.’ During economic uncertainty, gold shines as a safe-haven asset. It’s considered a store of value, with a price that tends to be less volatile than the stock market. Therefore, when the Nifty 50 index faces a downturn, Gold Bees often emerge as a haven for investors seeking stability.

In a thriving economy, equity markets usually outperform gold. Investors become more willing to embrace risk to chase higher returns. As a result, when the Nifty 50 index is on the rise, Gold Bees may experience a dip in their performance.

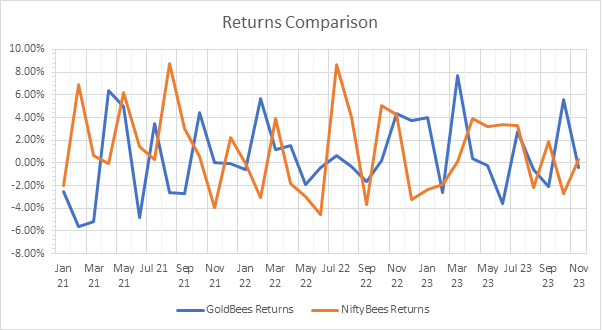

To illustrate this concept, let’s turn to the data. From January 2021 to October 2023, the performance chart of Nifty Bees and Gold Bees vividly demonstrates their inverse relationship. When Nifty Bees shines, Gold Bees often stand strong, and vice versa.

The chart underscores the compelling narrative of Nifty Bees and Gold Bees moving in opposite directions. Here’s a visual representation of this intriguing dynamic.

Beyond these factors, several other elements contribute to the negative correlation between Nifty Bees and Gold Bees. These include:

Understanding this negative correlation is not just theoretical; it’s a practical tool for investors. During economic downturns or bear markets, holding a portion of your investments in Gold Bees can act as a hedge against portfolio losses. Conversely, when the economic outlook is optimistic, and bull markets prevail, Nifty Bees offers opportunities for wealth creation.

Investors can construct a portfolio consisting of both Nifty Bees and Gold Bees to harness their negative correlation and mitigate overall risk. The specific allocation will depend on individual risk tolerance and investment goals.

For instance, a conservative investor may allocate 70% to Nifty Bees and 30% to Gold Bees. On the other hand, a more aggressive investor might consider a 90% allocation to Nifty Bees and 10% to Gold Bees. Investors can adjust their allocation as their risk tolerance and investment goals evolve.

The benefits of holding both Nifty Bees and Gold Bees in your portfolio are:

In conclusion, the negative correlation between Nifty Bees and Gold Bees is a valuable resource for investors navigating the complex world of financial markets. This unique synergy empowers investors to create diversified portfolios that can withstand market volatility and capitalize on opportunities in various market conditions.

Disclaimer: This article is intended solely for educational purposes. The securities mentioned are for illustrative purposes and not indicative of recommendations. It is based on information gathered from various secondary sources and is subject to change. Consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers