Thematic funds have gained considerable traction among investors in recent times, reflecting a heightened preference for sectoral investment strategies. Amidst market upswings, investors often gravitate towards thematic investing, seeking to capitalize on specific sectors or themes to outperform the broader market indices.

The surge in thematic fund interest is evident from the Association of Mutual Funds in India (AMFI) data, which indicates a notable inclination towards sectoral/thematic funds. Notably, sectors such as banking, capital goods, and infrastructure have garnered significant attention and are expected to continue performing well in 2024.

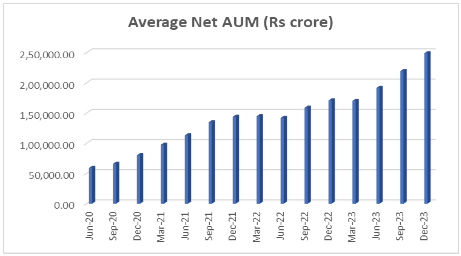

The net assets under management (AUM) of sectoral/thematic funds witnessed a remarkable surge, increasing by 206.76% between December 2020 and December 2023, reaching a staggering Rs 2.59 lakh crore.

This surge can be attributed to various factors, with attractive returns being a key driver behind the growing interest in thematic funds. Investors have shown a preference for thematic funds targeting specific sectors, such as PSU companies, over diversified funds encompassing various sectors. This trend is particularly pronounced during bullish market phases, as investors seek to capitalise on sector-specific growth opportunities.

Check: Best Sectoral / Thematic Mutual Funds

In 2023, thematic funds witnessed varied performances across different sectors. The PSU sector emerged as a top performer, delivering returns of almost 54%, followed by infrastructure funds with returns of about 40%. Technology funds also showcased resilience, posting returns exceeding 27%.

However, the banking sector underperformed relative to other sectors, with returns of around 18%, albeit lower than that of PSU or infrastructure funds. Consumption funds delivered returns of approximately 24%.

Market dynamics often witness sectoral rotations, with different sectors and themes gaining prominence at different times. In 2023, sectors such as PSU, manufacturing, and infrastructure outperformed, while consumption, FMCG, and financials relatively lagged. The government’s focus on public sector undertakings (PSUs) and infrastructure contributed significantly to the attention garnered by sectoral mutual funds.

Thematic mutual fund schemes till now have experienced an inflow of Rs 26,957.43 crore for FY2024 as compared to Rs 9,801.36 crore in FY2021. This demonstrates a 175% increase in the fund inflows in three years. Notably, sectoral funds have experienced a notable increase in fund inflows, reflecting investor confidence in specific sectors such as infrastructure, banking, housing, pharmaceuticals, and manufacturing.

| Quarter | No. of Schemes | Net Inflow (+ve)/

Outflow (-ve) during the period (Rs crore) |

Net AUM

(Rs crore) |

Average Net AUM

(Rs crore) |

| Jun-20 | 95 | 726.51 | 60,109.58 | 59,165.13 |

| Sep-20 | 95 | 205.45 | 65,757.02 | 65,928.59 |

| Dec-20 | 103 | 4,639.09 | 84,352.72 | 80,120.23 |

| Mar-21 | 106 | 4,230.31 | 98,079.64 | 97,551.24 |

| Jun-21 | 108 | 4,049.35 | 1,14,683.65 | 1,13,050.90 |

| Sep-21 | 112 | 10,232.06 | 1,36,722.55 | 1,34,902.43 |

| Dec-21 | 117 | 7,026.04 | 1,46,657.68 | 1,43,842.91 |

| Mar-22 | 117 | 5,821.03 | 1,48,830.47 | 1,44,894.14 |

| Jun-22 | 118 | 7,813.13 | 1,41,636.05 | 1,41,953.06 |

| Sep-22 | 121 | 3,367.41 | 1,59,075.50 | 1,58,772.10 |

| Dec-22 | 123 | 3,862.42 | 1,68,659.80 | 1,70,862.13 |

| Mar-23 | 126 | 8,688.05 | 1,72,819.48 | 1,70,195.33 |

| Jun-23 | 130 | 904.86 | 1,96,178.07 | 1,91,586.55 |

| Sep-23 | 140 | 9,382.00 | 2,20,141.61 | 2,19,524.05 |

| Dec-23 | 149 | 11,865.88 | 2,58,760.81 | 2,49,007.38 |

The stellar performance of thematic funds in 2023 was propelled by government initiatives in infrastructure and PSU sectors. However, as the market enters 2024, global economic headwinds may pose challenges for international themes.

Nevertheless, selective investors focusing on government-backed initiatives and long-term growth trends may still uncover alpha-generating opportunities. Analysts anticipate continued strong performance in sectors such as banking, capital goods, and infrastructure, with growth-oriented strategies likely to outperform value investing.

Conclusion

Thematic funds have emerged as an attractive investment option for investors seeking exposure to specific sectors or themes. The surge in thematic fund interest, coupled with robust sectoral performances, underscores the evolving investment landscape in India. While challenges may arise amidst global economic uncertainties, the resilience of thematic funds and their potential for alpha generation make them a compelling investment avenue for discerning investors.

As the market continues to evolve, investors are advised to remain vigilant and align their investment strategies with prevailing market dynamics and long-term growth prospects.

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers