Systematic Investment Plans (SIPs) have long been a favoured investment approach among Indian investors, offering a disciplined way to grow wealth over time. In this article, we will delve into the fascinating world of SIPs by pitting two IT giants against each other: Tata Consultancy Services (TCS) and Infosys. Through meticulous calculations and analysis of the past five years, we aim to uncover which company’s stock would have been the better choice for a SIP investor.

Over the past half-decade, we tracked the performance of TCS and Infosys stocks as part of a SIP investment strategy. We considered the scenario where an investor diligently purchased five stocks of each company on a monthly basis. We meticulously crunched the numbers and assessed the total returns from both TCS and Infosys SIPs over this five-year period.

TCS SIP details |

|

| No. of Stocks to buy each month | 5 |

| Average price after 5 years of SIP (Rs) | 2,744.91 |

| Qty. of shares after 5 years of SIP | 310 |

| Amount Invested over time (Rs) | 8,50,921.99 |

| Avg Market price as on October 18, 2023 (Rs) | 3494.625 |

| Investment value as on October 18, 2023 (Rs) | 10,83,333.75 |

| Profit in % | 27.31% |

Infosys SIP details |

|

| No. of Stocks to buy each month | 5 |

| Average price after 5 years of SIP (Rs) | 1,152.10 |

| Qty. of shares after 5 years of SIP | 310 |

| Amount Invested over time (Rs) | 3,57,149.85 |

| Avg Market price as on October 18, 2023 (Rs) | 1441.275 |

| Investment value as on October 18, 2023 (Rs) | 4,46,795.25 |

| Profit in % | 25.10% |

After crunching the numbers and analysing the data, TCS has clearly triumphed over Infosys in the SIP race but with a thin margin. The TCS SIP managed to outperform the Infosys SIP by a notable 2.21% over the five-year period.

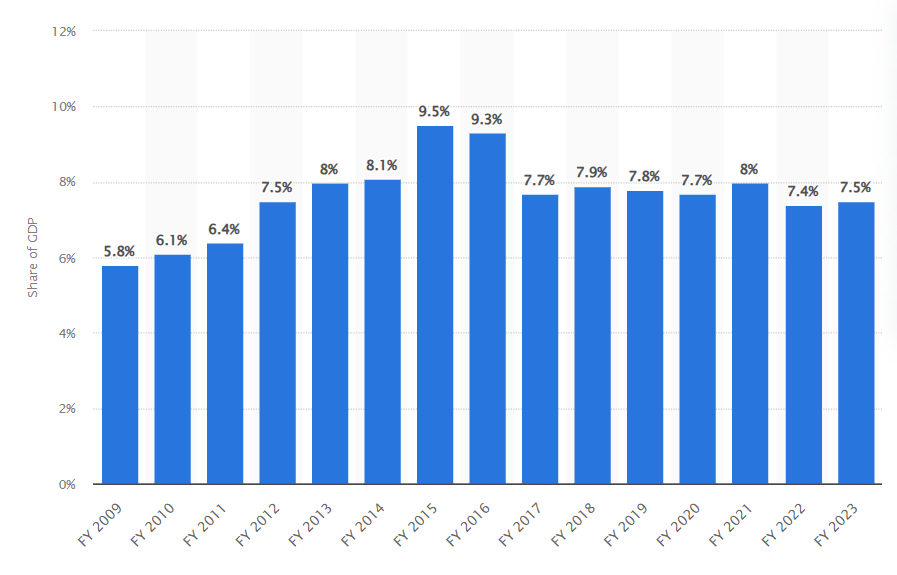

India, renowned as a top global offshoring hub for IT firms, plays a pivotal role in the business process management (BPM) market. The Information Technology/Business Process Management (IT-BPM) sector made a substantial contribution, amounting to approximately 7.5% of India’s GDP in the fiscal year 2023. BPM is more than just a process; it’s a structured approach that integrates methods to enhance, analyse, automate, and optimize business processes.

Source: www.statista.com

As we peer into the future, the fusion of BPM and robotic process automation (RPA) promises a landscape of strengthened collaborations within India’s rapidly expanding IT and BPM industry. This is where the market leaders, Infosys and TCS, are poised to shine. Alongside them, a host of other IT sector companies are also experiencing significant growth. The industry has demonstrated consistent revenue growth over the years, and given the sector’s accelerated pace of expansion, it is highly likely that revenue generation will continue its upward trajectory. In this dynamic landscape, Infosys and TCS are set to lead the way, while their peers in the IT sector also ride the wave of growth and innovation.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

We're Live on WhatsApp! Join our channel for market insights & updates

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers