The future value of investment will be

₹ 1,38,042

Invested Amount

₹ 1,00,000

Estimated Return

₹ 38,042

Don't sweat, create your wealth systematically!

Sustainable wealth doesn't grow overnight. Start SIP investment today for long-term wealth growth and financial stability.

What Is the HDFC SIP Calculator?

SIP, or Systematic Investment Plans, are popular investment options that allow you to invest a fixed amount of money regularly in a mutual fund scheme. Unlike lump-sum investments, where a large sum is invested at once, SIP involves investing a smaller predetermined amount at regular intervals. The intervals could be monthly, quarterly or annually.

Through SIP, you can take advantage of the potential returns offered by mutual funds across various asset classes, such as equity funds, debt funds, and hybrid funds. You can select funds based on your risk appetite, investment horizon, and specific financial goals.

If you are planning to invest in mutual funds through the Systematic Investment Plan, it is crucial to make informed decisions. It may often get confusing to choose among the multitude of options available.

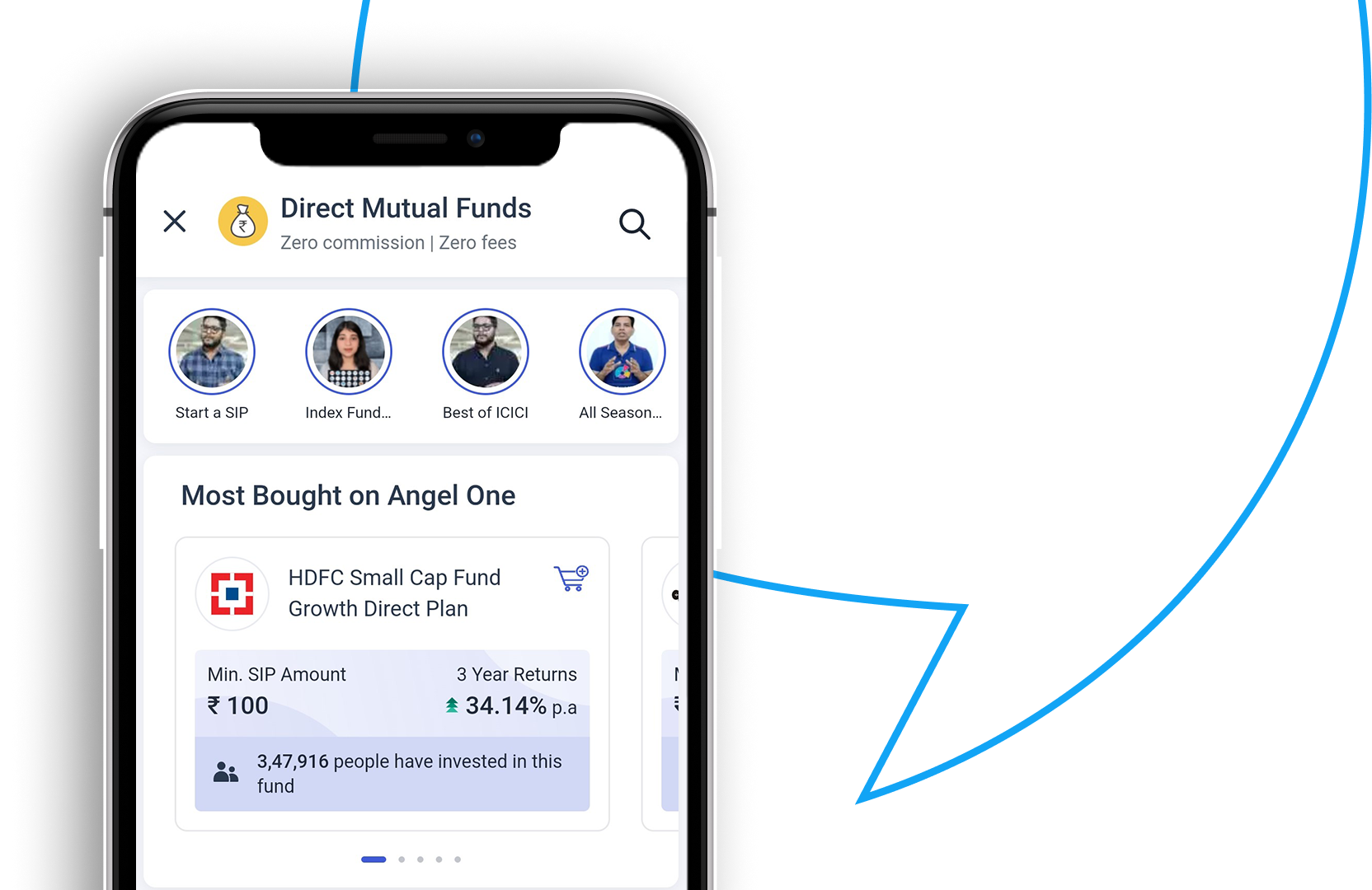

Angel One offers a handy tool to help you calculate potential returns and plan your investments effectively - the HDFC Bank SIP Calculator. This powerful online tool accounts for factors such as the investment amount, investment duration and expected return rate of the mutual fund to compute the expected returns from your SIP investments with HDFC Bank.

You can access the HDFC SIP calculator online on Angel One anytime for free.

How Does an HDFC SIP Calculator Work?

A sip calculator requires inputs such as the investment amount, the duration of the SIP, and the expected rate of return. By entering these variables into the calculator, you can estimate your investments' maturity value.

It’s important to remember that unlike RDs or FDs, where the returns are fixed and guaranteed by the financial institution, SIP returns depend on the performance of the mutual fund scheme and market conditions.

The SIP formula is based on the monthly investment amount, expected return rate, and tenure. Below is the HDFC SIP calculator formula:

S = P × ({([1 + i]^n) – 1} / i) × (1 + i)

Where,

S = SIP Returns

P = Periodic investment amount

i = expected rate of return

n = Number of times SIP is paid

How To Use the HDFC SIP Calculator Online?

Using the online HDFC Bank SIP calculator is convenient and hassle-free. Follow the steps below to get instant estimates:

- Access the SIP calculator on the Angel One website.

- Enter the periodic (usually monthly) investment amount you plan to invest in SIP.

- Select the expected rate of return.

- Enter the tenure of your investment.

The calculator will provide you with a detailed breakdown of the potential returns, including the total investment amount, the maturity amount, and the overall growth of your investment.

Let’s understand the above steps with an example. Suppose you want to invest Rs. 4,000 monthly in a mutual fund SIP for 5 years, and the expected rate of return is 12% p.a. Here’s how to determine the final maturity amount and total returns using the online SIP calculator:

- Enter Rs. 4,000 in the monthly amount field.

- Adjust the slider to input the rate of return as 12% p.a.

- Enter 5 years as the tenure.

The SIP calculator will show you the total investment amount and expected returns immediately. In this case, the expected returns will be Rs. 89,945. The maturity amount will be Rs. 3,29,945.

You can also use the calculator to determine how much you should be investing as monthly SIP to reach a certain monetary goal by switching to the target amount calculator. This requires you to enter the targeted value along with the tenure and estimated return rate. Once done, it displays how much you need to invest in SIP monthly.

So, if you target Rs. 7,50,000 after 4 years and the mutual fund is expected to return 11%, the calculator will yield your monthly SIP investment of Rs. 12,396.

Benefits Of Using the HDFC SIP Calculator

- Eliminates calculation errors: An online SIP calculator eliminates the chances of errors or miscalculations, ensuring accurate and reliable results every time.

- Saves time: With an SIP calculator, you need not spend hours calculating manually.

- Allows comparison of options: You can add varying values for monthly installments, tenure, and expected rate of return to see how they affect the maturity amount and returns. This flexibility empowers you to find the optimal combination that aligns with your financial goals.

- Free to use: The online FD calculator is a freely accessible online tool.

Which Factors Influence SIP Earnings?

- Monthly Instalment: The amount you invest as SIP each month directly impacts the maturity amount. Higher installments lead to greater returns.

- Tenure: The investment tenure plays a significant role in determining the returns on your investment. Longer tenures help to take advantage of market highs and balance the decrease in value during market turbulences.

- Market conditions: Mutual funds are directly linked to the market, and thus SIP earnings depend on the market conditions and the performance of underlying investments.