What is an SIP Calculator?

The Systematic Investment Plan Calculator, or a SIP calculator, is a free online financial tool available on the Angel One website that helps you calculate your returns from SIP investments. You can use it to compare the returns from various SIP investment strategies.

A Mutual Fund SIP calculator helps you estimate the future value of your SIP investments. It takes into account various parameters, including the investment amount, i.e., the regular SIP contributions, the expected rate of return, and the investment tenure. By inputting these details, you can get a sense of how your investments may grow over time. While the final maturity amount of your SIP investment may differ due to various external factors, you can get an approximate understanding of the expected returns.

Once you have a clear idea of the expected returns and commitment required, you can then make a more informed decision about which SIP strategy is most viable for you.

How does SIP Calculator Work?

Our SIP calculator online takes three main factors into account:

- Amount of the initial investment (P)

- Frequency of the investment (n)

- Expected rate of return (r)

By inputting these values, the calculator determines the final invested amount and the estimated returns at the end of a specific period of time.

How Can an SIP Return Calculator Help You?

The advantages of using an SIP return calculator are many. Some of them are discussed below:

- Estimate required time and rate of return - Using this tool, you can estimate the rate of return required to reach your desired final amount. Additionally, you can also ascertain the time required for your investment to grow adequately.

- Choose the right SIP – The SIP calculator can swiftly give you multiple variables with which you can assess an SIP scheme. You can use the calculator to compare multiple schemes as per those variables and choose the SIP that is best for you.

How to Use the Angel One Systematic Investment Plan Calculator

The SIP Calculator on Angel One helps in calculating:

- SIP returns on maturity

- Monthly investment amount based on the target

Here are the steps to use the Angel One SIP calculator to calculate the SIP returns on maturity:

- Enter the amount you want to invest.

- Enter the duration for which you want to invest.

- Enter the expected rate of return.

The calculator will instantly give you:

- The total value of your investment after the duration.

- The total invested amount.

- The estimated returns from the investment.

Here are the steps to use the Angel One SIP calculator to estimate the monthly investment amount:

- Enter the expected target amount, i.e., the returns you are expecting.

- Enter the duration for which you want to invest.

- Enter the expected rate of return.

The calculator computes the values and gives how much you need to invest monthly to reach your investment target as per the duration and rate of return.

How Are SIP Investment Returns Calculated?

The SIP returns are calculated by entering the variable numbers mentioned above into the Systematic Investment Plan calculator.

The SIP calculator formula used is,

A = P × ({([1 + r]^n) – 1} / r) × (1 + r)

Where,

A-> Estimated Returns from the SIP

P -> Amount you invest in SIP

r -> Rate of Return you are expecting to get

n -> Number of total SIPs made

Example of Using SIP Calculator

Suppose you are a salaried individual earning a monthly income. Assume that you have decided to put in ₹5,000 per month as SIP, and after due diligence, you have chosen an SIP that gives an average of 12% return per year. Now, if you want to know the final amount this SIP will give you in 5 years:

- Choose the ‘Investment Amount’ tab on the SIP calculator.

- Enter ₹5,000 under ‘ENTER AMOUNT’.

- Enter the expected rate of return as 12%.

- Enter the duration as 5 years.

According to the SIP return on investment calculator, if you pay a monthly SIP amount of ₹5,000 for 5 years at a 12% rate of return, then the final amount you get will be ₹4,12,431.80 from the total invested amount of ₹3,00,000. If you are not satisfied with the end amount, you can decide whether to increase the investment period or find another SIP that gives a higher return.

Alternatively, you can also ascertain your SIP amount based on the target amount. Say that Mr A wants to buy a car worth ₹5,00,000 in 2 years. He has identified an SIP that has given an average of 12% returns in a year. Here’s how he can use the SIP MF calculator to get the estimated SIP amount:

- Choose the ‘Target Amount’ tab on the Angel One SIP calculator.

- Enter ₹5,00,000 in the target amount.

- Enter the duration, i.e. 2 years.

- Enter the expected rate of return from the SIP that you have chosen, e.g. 12% per year.

- The SIP investment calculator will show that Mr A will have to invest ₹18,353 per month in the SIP in order to accumulate ₹5,00,000 at the end of 5 years to buy a car.

Advantages of Using the Angel One SIP Calculator

- Enables financial planning: The online SIP calculator by Angel One can assist you in financial planning. You can get an idea of how much you need to invest regularly to reach your target amount. This will help you in planning your monthly budget.

- Compare and assess SIPs: Angel One’s SIP Calculator helps you compare and assess various SIP investment strategies based on the final amount, total invested amount and the expected return.

- Free to access: The online Systematic Investment Plan Calculator is completely free to use, no matter how many times you use it. You can access the Angel One SIP Calculator at any time from anywhere in the world.

- Provides instant results: The investment calculator gives you instantaneous results that are accurate.

- Easy to use: The SIP MF Calculator by Angel One is easy to use. All you need to do is input the basic details of your SIP and get results in less than a minute.

Systematic Investment Plans (SIPs) in India

SIPs have become a popular method for building wealth in India, especially among the salaried middle class. This is especially true for mutual fund SIPs, as here, retail investors can access the benefits of professional management of their investments at a low cost.

What is SIP?

An SIP, or Systematic Investment Plan, is a method of investing money into mutual funds or stocks. It allows you to invest a fixed amount at regular intervals over time rather than making a large, one-time investment.

SIPs offer investors an easy, convenient way to invest without having to worry about timing the market. You can just set up an account and benefit from rupee-cost averaging over time. SIPs are also known for their flexibility, as you can start by investing a small amount and eventually increase your contribution as your financial situation improves.

To calculate the potential returns of your investment via this mode, you can use a SIP calculator online.

Types of SIPs

Read the following types of SIPs to know which one is the best for you:

- Regular SIPs

This is the standard SIP, where investors pay a fixed amount periodically. They enable regular transfer of funds from the bank to the SIP account. It helps average out the cost of the SIP units purchased.

- Flexible SIP

In this case, you can change the SIP amount as per your requirement. For instance, when the market is down and the assets are underpriced, you can buy more. Similarly, you can buy less when the assets are overpriced.

You can also alter the instalment amount according to your financial condition. You can lower the SIP amount when you are short of cash and increase it when you have a cash surplus. This is also called Flexi-SIP or Flex-SIP.

- Step-up SIP

Also known as Top-up SIP, this plan allows you to increase or step up the SIP amount at regular intervals. For example, you can start a monthly SIP with ₹10,000 and arrange to increase it by ₹1,000 every year. This plan is suitable for salaried people who expect annual increments and bonuses.

- Perpetual SIP

You can stay invested in most SIPs for a predetermined period of time. However, for perpetual SIPs, you have to only mention the start date and not the end date. This means that you are going to keep investing in the SIP until you request the fund house or the Asset Management Company (AMC) to stop the SIP.

- Trigger SIP

In this type of SIP, you can set a trigger for an SIP. The trigger could be an event, like a sudden market dip or a favourable market condition, a specific index level, a level of NAV (Net Asset Value), etc. Your trigger can result in starting the SIP, redeeming the fund units, or switching to another scheme. This is highly useful for people who invest based on principles and want to automate their investments.

- Multi SIP

This scheme allows you to invest in multiple funds of a fund house via a single SIP. For example, if you invest ₹30,000 monthly in a multi-SIP, you can split the amount into five schemes, buying units of ₹6,000 each. It makes investing in multiple SIPs a much smoother process and helps add to the diversity of your SIP portfolio.

SIPs can also be categorised as per the kind of instruments that they invest in, e.g. equity funds, debt funds, overnight funds, balanced funds, money market funds, etc.

Benefits of SIPs

An SIP can help you achieve financial independence at an earlier age, provided you start investing at an early age. This is because:

- The money invested in the SIP compounds over the years, generating a high return eventually.

- Unlike investing in stocks yourself, you do not have to worry about investment strategies. The funds will be allotted by capable professionals who understand financial markets well.

- You can garner high returns without having to make a huge investment in one go. It is perfect for salaried people who get a moderate but regular income.

- It encourages financial discipline as your SIP commitment nudges you to be more attentive toward your spending.

- Investing in certain SIPs like ELSS funds can help you save thousands of rupees in taxes.

How to Start SIP Investment?

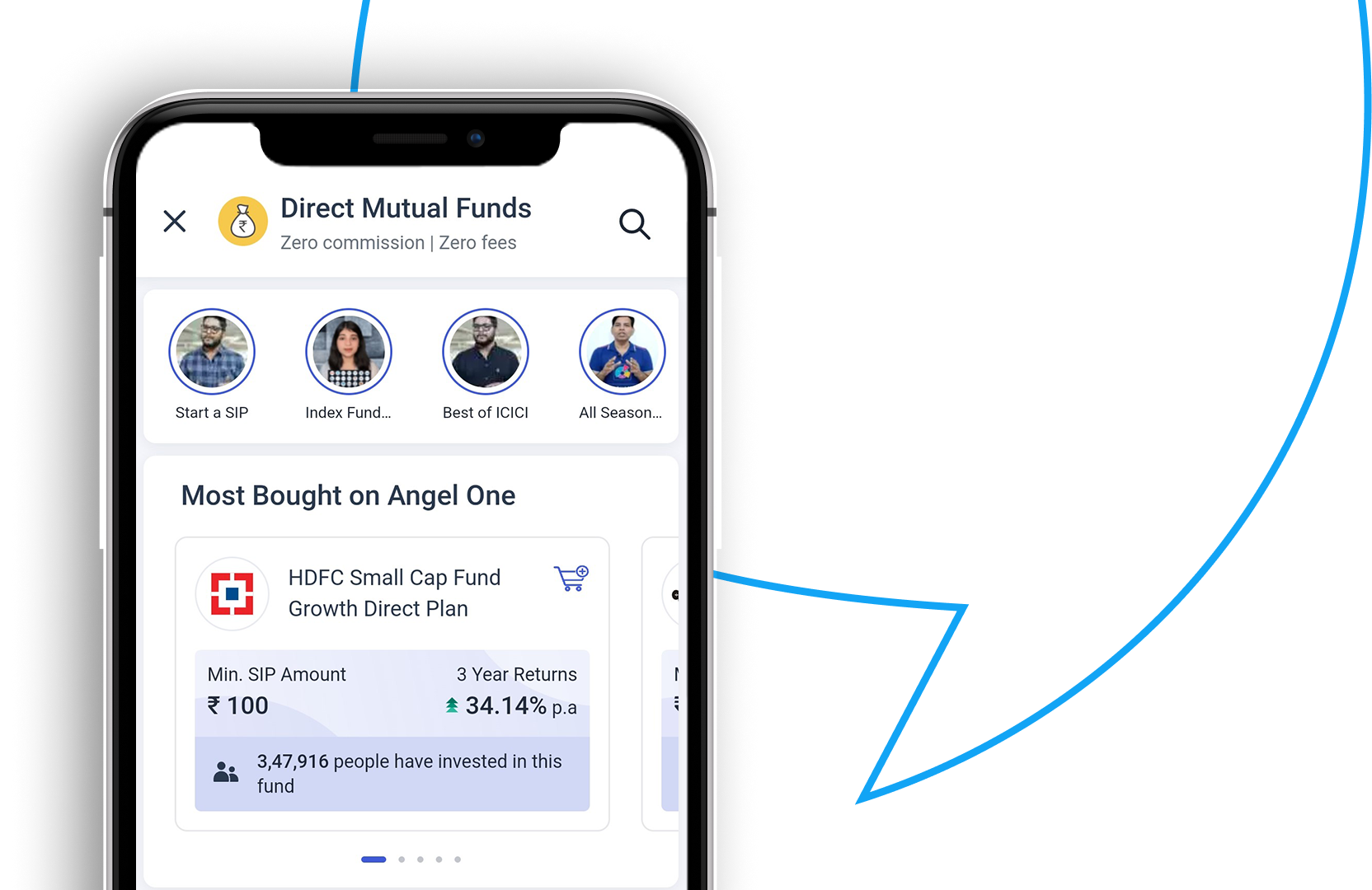

You can easily start a Mutual Fund SIP on the Angel One app by taking the following steps:

- Go to the Home page and click on Mutual Funds.

- Choose the Fund that you want to invest in from the section titled ‘Discover Mutual Funds’. You can start your search by clicking on ‘EXPLORE ALL FUNDS’. You can also narrow down your search by clicking on the categories of funds given.

- Once you have gone through the details of a mutual fund and chosen it, click on ‘INVEST’.

- Choose the SIP option and enter the monthly amount and date i.e. the day of the month when the SIP payments will be made from your account.

- Choose the mode of payment e.g. UPI.

- Click on ‘START SIP’ to start the SIP process.

- You can choose to make your first SIP payment right away as well by checking the box next to ‘Make first SIP payment now’.

SIP Vs Lumpsum

Whether to go for SIP or lump sum investment depends on your cash flow position. If you receive your income at indefinite intervals, then you should go for a lump sum investment. This is because the lump sum investment would earn a higher return compared to an SIP with the same total investment amount.

Tax Implications on SIP Investment

Taxation of SIPs in India is based on the following:

- The holding period of the investment. For instance, gains from an equity fund held for more than 12 months are considered long-term capital gains and taxed accordingly. However, gains from equity funds held for less than 12 months are considered short-term capital gains and taxed accordingly.

- Tax-saving mutual funds (ELSS) are eligible for a tax deduction of up to ₹1.5 lakh in a financial year.

Mistakes to Avoid in Systematic Investment Plan

The following are some of the mistakes that should be avoided in SIP investments:

- Procrastination - Delaying the start of SIP can reduce the potential benefits of compounding over time.

- Stopping SIP - You should not stop your SIP midway because SIPs give their highest returns towards the end of their holding period. Therefore, the short-term opportunity cost of leaving your SIP midway is quite high.

- Ill-informed selection of funds - Choosing a fund without adequate research may lead you to invest in an SIP that is not in line with your goals. It's essential to research and choose SIPs based on investment goals, risk tolerance, and historical performance.

- Excessive investing - Investing beyond one's means can lead to financial strain. Setting a realistic and affordable SIP amount ensures consistency in contributions.

Invest in Mutual Funds Using SIP Calculator

You can use the SIP calculator to calculate the expected returns from various mutual fund SIP schemes. Once you have adequate data, analyse it to choose the one that works best for you.

Mutual Fund Calculators

SIP Calculator FAQs

What benefits does an SIP return calculator offer to investors?

It helps you calculate the return on your investment based on the inputs given. It let you calculate return under different investment scenarios and compare them so that you can adjust your financial goals accordingly.

How do I use a SIP calculator for investment planning?

SIP calculator is simple and straightforward enough for anyone to use it. To use the calculator, the user has to follow the steps mentioned below:

- Select an investment amount

- Select the frequency of investment

- Select total investment tenure

- Set expected return rate

The SIP investment calculator will return the result in a few seconds.

Are SIPs similar to mutual funds?

SIP isn't an investment tool. Instead, it is one of the two ways to invest in mutual funds.

Can I modify my SIP amount?

Yes, you can adjust your SIP amount at your convenience.

How much can I invest in a SIP?

You can start with as little as Rs 500 and invest up to any amount you want. But your investment must align with the rest of your financial commitments – your income minus existing expenses, liabilities, and loan payment.

How much should you invest? Use the SIP calculator to compare return values in different investment situations to select the best one.

What is the maximum tenure of a SIP?

There is no maximum limit. However, the minimum tenure is fixed at three years.

What are the benefits of SIP?

The benefits are as following:

- Instil regular investment habit

- No need to time market

- Benefits of starting early even with a small amount

- Benefits from rupee cost averaging

- Simple way of investing through ECS.

Can I start SIP at any time or when the market is high?

The advantage with SIP is that you don't have to time the market. It is a safe method to invest in mutual funds. SIP works on the principles of rupee cost averaging, which means more units get allocated when the market is down and fewer units when it is rallying.

Are there any upper limits in SIP investments?

No, SIP doesn't limit you to any investment amount. However, the installment amount should depend on your monthly income, existing liabilities, and future financial goals. After taking these factors into account, choose an investment amount.

Can I miss a SIP?

Your SIP will not get terminated for missing one SIP. If you don't have enough money in a month, you can skip SIP payment. You'll not get penalized for that.

Can an SIP calculator guarantee accurate future returns?

An SIP calculator can give you an accurate answer as to what will be the final return from an investment of a given amount, rate of growth and time period. The amount, the time period and the compounding rate must be entered by the user based on their own assumptions and preferences.

In which mutual fund should I start SIP?

It should be based on your financial goals.

How to shorten SIP duration?

SIP doesn't have a lock-in period, meaning that you can withdraw/stop any time. There is no penalty imposed.