The future value of investment will be

0Invested Amount

Estimated Return

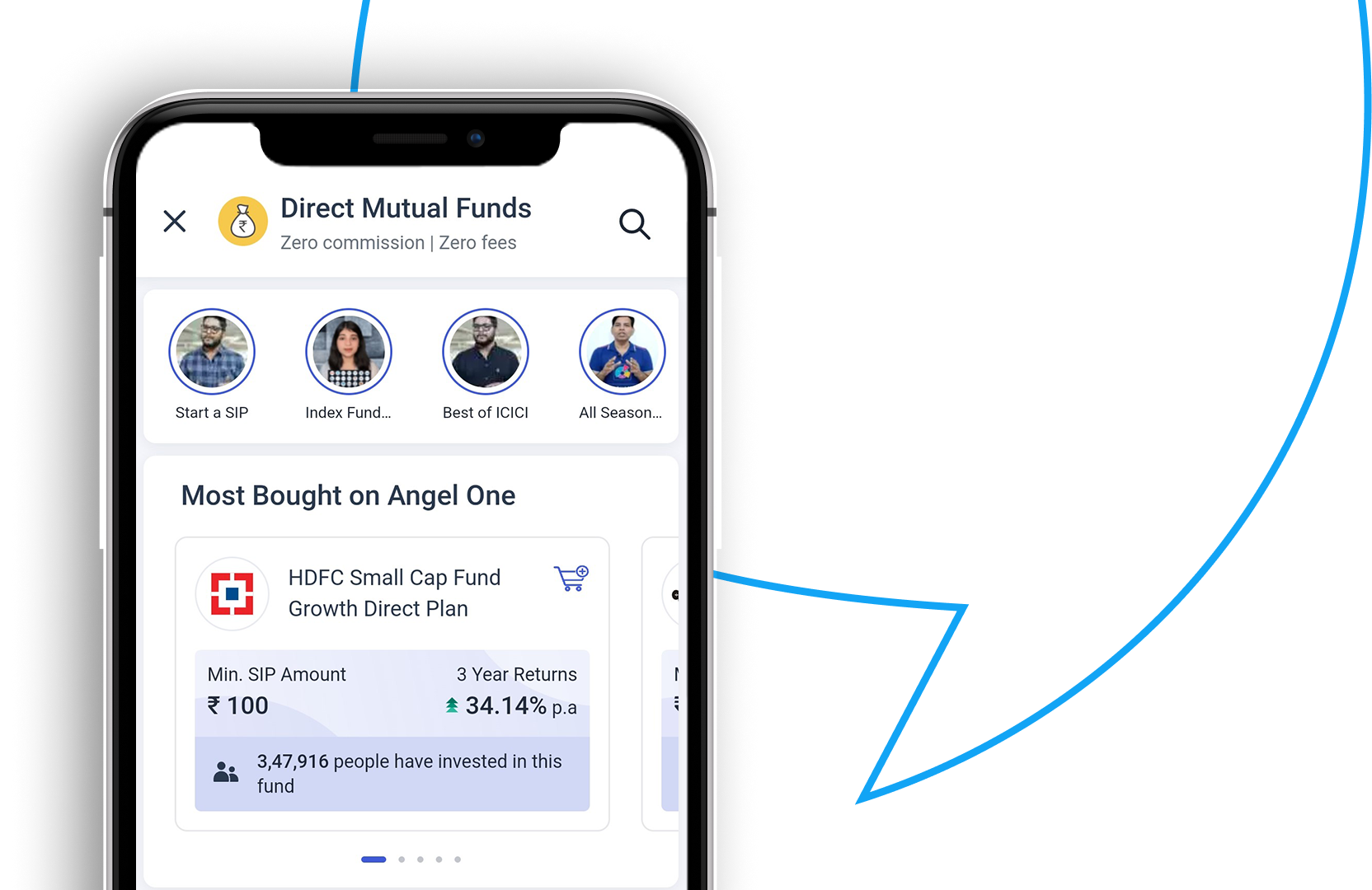

Start investing in Mutual Funds with just ₹100!

Mutual funds in India are investment vehicles that pool money from multiple investors and invest it in a diversified portfolio of securities such as stocks, bonds, and other financial instruments. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual fund returns in India refer to the performance and profitability of mutual funds in the Indian market. It indicates the change in the value of investments made in mutual funds over a specific period. The returns can be positive, indicating gains, or negative, indicating losses.

Investors in India can choose from various types of mutual funds based on their investment objectives, risk tolerance, and time horizon. These funds can include equity funds, debt funds, hybrid funds, index funds, and more. The returns of each mutual fund depend on the performance of the underlying securities in the fund's portfolio. To assess and estimate mutual fund returns, investors can use an online mutual funds returns calculator.

What is a Mutual Fund Returns Calculator?

An online mutual funds returns calculator is a tool that helps investors estimate the potential returns on their mutual fund investments. It allows investors to input parameters such as the investment amount, investment duration, expected rate of return, and any additional contributions. The calculator then provides an estimate of the future value of the investment based on the given inputs.

Financial websites in India, like Angel One, offer mutual funds calculators on their platforms. These calculators can assist investors in planning their investments, setting realistic goals, and making informed investment decisions. It's important to note that the calculations provided by these calculators are based on certain assumptions and past performance, and the actual returns may vary. Therefore, it's always necessary to consult with a financial advisor and understand these calculations well before you make any investment decisions.

How To Use An Online Mutual Fund Returns Calculator?

Using an online mutual fund returns calculator on Angel One is a straightforward process. Here's a general guide on how to use an online mutual funds calculator:

- Choose a reliable calculator: Start by selecting a reliable online mutual funds calculator. You can find the calculator on the official website of Angel One. The calculator will suit your specific needs and is user-friendly.

-

Input investment details: Once you've chosen a

calculator, you'll need to input the necessary investment details.

The specific inputs required may vary between calculators, but they

generally include:

- Investment amount: Enter the initial amount you plan to invest in the mutual fund

- Investment duration: Specify the investment duration, such as 1 year, 3 years, 5 years, or a custom period.

- Expected rate of return: Provide an estimate of the average annual return you expect from the mutual fund. This can be based on historical performance or your own projections.

- Run the calculation: After inputting all the necessary details, click on the "Calculate" or "Calculate Returns" button to run the calculation. The calculator will process the information and provide you with an estimate of the future value of your investment based on the inputs provided.

- Review the results: Once the calculation is complete, the calculator will display the estimated returns for the specified investment period. The results include the projected total value of your investment, the gains or returns earned, and any additional contributions made.

- Analyse and plan: Review the results provided by the calculator and analyse the projected returns. Evaluate how the estimated returns align with your investment objectives and financial plans. Utilise this information to make well-informed decisions regarding your investment strategy and assess if any modifications are necessary.

It's important to note that while online mutual funds calculators can provide helpful estimates, they are based on assumptions and historical data. The actual returns on your investments may vary due to market fluctuations and other factors. Therefore, it's important to consult with a financial advisor as well as conduct thorough research before you make any investment decisions.

Mutual Fund Returns Calculator Formula

The mutual fund returns calculator formulas for finding out the future value of a lump sum investment and a Systematic Investment Plan (SIP) are as follows:

Lump Sum Investment:

Lumpsum Returns = Present Value × (1 + r/100)^n

Where,

- Lumpsum returns are the estimated value of the investment at the end of the investment period.

- Present Value is the initial investment amount.

- r is the expected rate of return per period (expressed as a percentage).

- n is the number of periods (usually in years) for which the investment is held.

For Systematic Investment Plan (SIP):

Future Value = P × [(1 + i)^n - 1] × (1 + i)/i

Where

- Future Value is the estimated value of the investment at the end of the investment period.

- P is the periodic investment amount (e.g., monthly or quarterly).

- i is the periodic rate of return (expressed as a percentage) per investment period (e.g., monthly or quarterly).

- n is the total number of investment periods.

Benefits of Using Online Mutual Funds Return Calculator

Using an online mutual funds return calculator like that of Angel One offers several benefits for investors. Here are some advantages of using these calculators:

- Quick and convenient: Online mutual funds return calculators provide a fast and convenient way to estimate potential returns on your investments. They are easily accessible from any device with an internet connection, allowing you to perform calculations at your convenience.

- Accuracy and efficiency: Calculating mutual fund returns manually can be time-consuming and prone to errors. Angel One’s online calculator helps eliminate the risk of miscalculations and provides accurate results based on the inputs provided. This saves time and ensures efficient analysis of investment scenarios.

- Financial planning: Mutual funds return calculators help you plan your finances by providing estimates of the potential growth of your investments. You can experiment with different investment amounts, durations, and expected rates of return to see how they impact your investment goals.

- Goal setting and realistic expectations: By using the mutual fund return calculator by Angel One, you can set realistic investment goals based on the estimated returns. It helps you understand the time horizon required to achieve your financial objectives and make adjustments as necessary.

- Comparison of investment options: If you're considering multiple mutual funds or investment strategies, these online calculators allow you to compare the potential returns of different options. This helps you make informed investment decisions by evaluating the potential outcomes of each choice.

- User-Friendly interface: Angel One’s online calculators have user-friendly interfaces that make them accessible to individuals with varying levels of financial knowledge. They are designed to be intuitive and easy to navigate, enabling even novice investors to use them effectively.

Factors Influencing Mutual Fund Returns

The performance of mutual funds can be influenced by various factors. Here are five key factors that can affect mutual funds' performance:

- Performance of the securities in the fund portfolio: The performance of the individual securities held within the mutual fund's portfolio has a significant impact on its overall performance. If the securities in the portfolio, such as stocks or bonds, perform well, they can positively contribute to the fund's returns.

- Fund management team: The expertise and skill of the fund management team play a crucial role in a mutual fund's performance. Experienced and knowledgeable fund managers can make informed investment decisions, conduct research, and actively manage the portfolio to generate positive returns.

- Economic changes: Economic conditions, such as changes in interest rates, inflation, or market volatility, can affect mutual fund performance. Different types of funds may respond differently to economic changes. For example, equity funds may perform well during periods of economic growth, while bond funds may be influenced by interest rate movements.

- Expense ratio: The expense ratio represents the cost of managing the mutual fund. It includes management fees, administrative expenses, and other operational costs. A higher expense ratio can eat into the fund's returns, potentially impacting overall performance. Investors should consider the expense ratio when evaluating the fund's potential for long-term returns.

- Fund cash flows: The inflows and outflows of money into the mutual fund can impact its performance. If investors pour more money into the fund, it may have a positive effect on the fund's returns and the ability to generate higher returns. Conversely, large outflows may require the fund manager to sell securities, potentially affecting the fund's performance.