Grow Wealth, Start SIP Now!

Start Your Mutual Fund Investments Journey Today

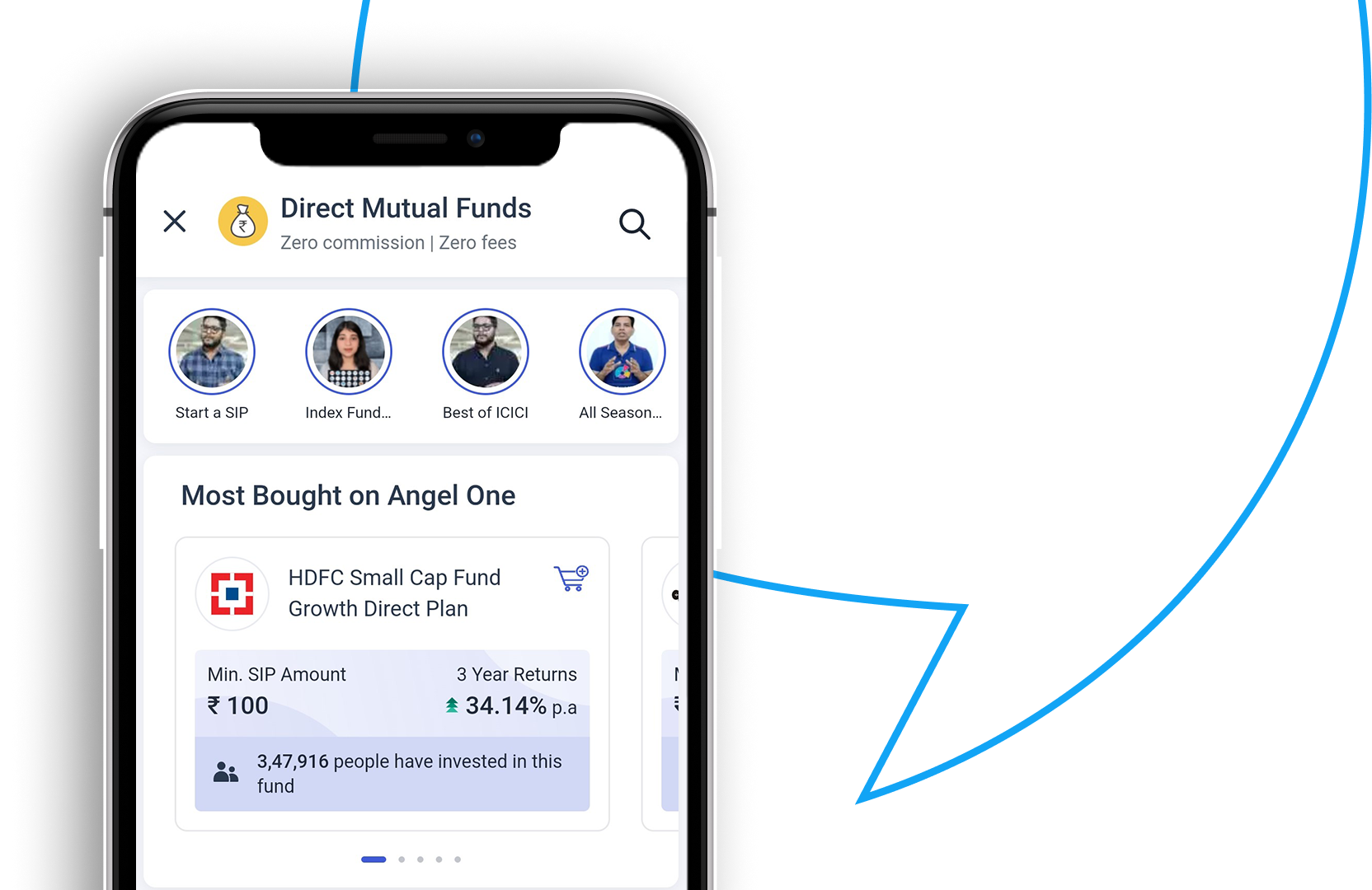

Explore Mutual Funds

Benefits of Investing in Mutual Funds with AngelOne

Angel One offers over 4,000 Mutual Fund schemes without any hidden charges or fees, making

your investment journey safer, easier, and more rewarding. Our advanced tools and

calculators offer a simple yet superior investment journey and aid your decision-making.

Whether through SIP (Systematic Investment Plan) or a lump sum, you can invest in Mutual

Funds seamlessly on Angel One with complete ease. Create your own mutual fund portfolio

based on your risk profile, investment horizon and investment goals. Also, you can enjoy a

flexible withdrawal policy for your portfolio at Angel One.

Download your Angel One Super App from the Play store or App store on your device and start

your investment journey in just a few minutes.

0% Commission

Choose from our vast investment portfolio at 0% commission and enjoy all the benefits!

Trust

We have gained the faith of 1 Cr+ happy customers over the last 25 years.

Seamless Investing

Enjoy hassle-free investment processes. Open your account with Angel One in just a few minutes and start investing!

Research Backed Recommendations

Our advisory is backed by top-grade research & analysis. We are always happy to help you.

How to Invest in Mutual Fund Through AngelOne

Open AngelOne App

Open Angel One App and click on the Mutual Fund icon

Find the fund you want to invest

Now find your preferable Mutual Fund to invest by using search, trending funds or top recommendations. Choose your suitable SIP or One-time-investment-plan

Make your Investment

Now you are all ready to invest

Invest & Track

Track your investments in your mutual fund dashboard to see all the updates

Ways to Invest in Mutual Funds

When investing in mutual funds, there are two avenues or modes of investment - Systematic Investment Plans (SIP) and Lumpsum

- SIP (Systematic Investment Plan):This approach involves making regular, fixed investments in a mutual fund scheme at predefined intervals, typically monthly. SIPs enable you to spread your investments over time, reducing the impact of market volatility. For example, you invest ₹10,000 every month to achieve an investment goal of ₹12,00,000 over 10 years.

- Lumpsum:Lumpsum mode requires a one-time investment in a mutual fund scheme. It's like making a substantial down payment. While this approach may offer quick returns, it's often considered riskier due to market fluctuations. An example of lump-sum investment is investing a significant amount like ₹12,00,000 in one go in a mutual fund.

Both SIP and lumpsum investments have their advantages and disadvantages, so your choice should align with your financial objectives, risk tolerance, and investment horizon.

Types of Mutual Funds Based on Asset Class

Mutual funds offer diverse investment options, classified primarily based on their asset class. Here, we explore three main categories:

-

Equity Mutual Funds

Equity mutual funds primarily invest in stocks or shares of companies. These funds aim for capital appreciation and are well-suited for investors with a higher risk tolerance and a long-term investment horizon. Equity funds can be further categorised into various subtypes, such as large-cap, mid-cap, and small-cap funds, each focusing on companies of the respective market capitalisations. Equity mutual funds have the potential for significant returns but can also be relatively volatile. -

Debt Mutual Funds

Debt mutual funds allocate their assets to fixed-income securities such as bonds, government securities, and corporate debentures. They are known for generating regular income through interest payments and are considered less risky than equity funds. Debt funds are a preferred choice for conservative investors seeking stable returns with lower risk. They offer liquidity and are commonly chosen for short to medium-term financial goals. -

Hybrid Funds

Hybrid mutual funds blend the best of both worlds by investing in a combination of equity and debt instruments. They are designed to balance risk and return, offering diversification across asset classes. Aggressive hybrid funds, conservative hybrid funds, and balanced hybrid funds are subcategories that differ in their equity-debt allocation. Hybrid funds are versatile, catering to investors looking for a blend of safety and growth, making them suitable for various investment horizons.

Grow Wealth, Start SIP Now!

Start Your Mutual Fund Investments Journey Today

FAQs

The investment scheme by which a company pools money from investors and invests the money in securities such as stocks, bonds, and short-term debt, is called a mutual fund. Each mutual fund investment has its own objective and tries to achieve the same.

In Angel One, you can use the Angel One app to invest in mutual funds. You can buy mutual funds at zero fees & charges in the app. One can invest in SIP as well as lump sum.

SIP or systematic planning investment is a facility you can enjoy in mutual funds. This facility is offered to investors so that they can invest in a disciplined manner. SIP helps investors to invest a fixed amount at a pre-settled price in the selected mutual fund scheme.

In a mutual fund investment, a certain amount of money is pooled from different investors all having a common investment objective. Then the money is invested in various assets like equities and bonds which are based on the scheme's objectives. An AMC (asset management company) makes these investments on the behalf of the investors.

Mutual fund is considered one of the safe investments as it lets investors diversify their portfolio with minimum risks.

One can invest in direct mutual funds by visiting the mutual funds' website, through online stock exchange platforms, MFU (Mutual Funds Utility) or other various digital channels. Angel One provides the facility to invest directly.

First make clear financial goals. Now, check how much risks you are willing to take. Then do an asset allocation. Remember that different asset classes have different profiles. So one should understand that the risk and the return are directly related to each other. With a higher risk appetite, one higher allocation to equities and vice versa.

You can easily calculate the return of your mutual funds using the Angel One MF calculator.

Mutual funds can be of various types. However, it is broadly classified on the basis of: Asset Class, Investment Goals & Based on Structure. A few of the types are Equity Funds, Debt Funds, Money Market Funds, Hybrid Funds, Growth Funds, Income Funds, Liquid Funds, etc.

Like any individual securities, for profit, when you sell shares of a mutual fund or ETF (exchange-traded fund), you will have to pay taxes on the realised gain. Moreover, one also needs to pay taxes if the fund realises a gain by selling a security for more than the original price. This is applicable even if you don’t sell any shares.

If it is an open-ended scheme, then it can be withdrawn at any time. However, if you have invested in an Equity Linked Savings Scheme (ELSS), the lock-in period is 3 years from the date of investment.

If you decide to withdraw within a year of making equity investments, your gain will be taxed at a flat tax rate of 15% plus cess plus surcharge. The short-term capital gain rises if you plan to withdraw your units of equity mutual funds within 12 months.

The best time to redeem is when the financial goals are to be achieved.