Best High Risk Funds

|

Fund Name

|

AUM

|

3Y Returns

|

Ratings

|

|---|

About High Risk Mutual Funds

Mutual funds are exposed to various risks depending on their category and the selected underlying asset. Equity mutual funds are considered riskier than other fund types because of their notably higher market risk.

While market risk is common for all equity funds, some are slightly riskier than others. These are high risk mutual funds.

Mutual fund investors can choose funds according to their risk appetite. Large-cap funds are the least risky because they invest in the stocks of large companies with sound financials and track records compared to small and mid-cap companies. The high risk funds choose high-volatility securities for higher capital appreciation.

High risk funds promise higher returns against higher risks. They invest in volatile assets but also pay higher dividends. If you are adept at taking higher risks, these funds might fit your investment style.

How do High Risk Funds Work?

High-risk funds, often referred to as high-yield or speculative funds, are investment vehicles that focus on assets with the potential for significant returns but also come with a higher level of risk. These funds typically invest in assets like stocks, bonds, or other securities of companies or entities with uncertain financial stability or prospects.

The key principle behind high-risk funds is the pursuit of higher returns. Investors in these funds accept the increased risk of losing their investment capital in exchange for the potential for substantial gains. These funds are managed by professional portfolio managers who make strategic decisions to maximise returns within the fund’s risk parameters.

Features of High Risk Funds

Schemes that primarily invest in high-risk securities or volatile equities belong to the group of high risk MFs. Therefore, equity hybrid funds, diversified or multi-cap funds, sector funds, credit risk schemes, small and mid-cap MFs, etc. fall under the high risk mutual fund category.

These funds predominantly invest in stocks and bonds of growing companies, which typically makes them high risk. Growing companies are highly volatile but earn higher returns in the right economic conditions.

Since these stocks invest in highly volatile stocks (as per categorisation), the risk-reward ratio is significantly high. To limit the adverse effects of investing in highly-risky mutual funds, investors bet on the best high risk mutual funds.

Advantages of Investing in High Risk Funds

Despite being critically high-risk, these funds are suitable for specific investors. These are some of the top benefits of investing in high risk funds.

- Higher returns: One of the primary benefits of these funds is their high returns. These funds enjoy high growth potential when the underlying securities perform well, maximising your returns.

- Capital appreciation in the long term: These funds are suitable for your long-term financial goals. The average investment duration for high risk funds is 5–7 years to generate significant inflation-adjusted returns.

- Market beating returns: High risk funds are excellent investments for earning long-term capital gains. These funds can generate market-beating returns in a positive market cycle.

- Tax benefits: These funds are tax-efficient investments for individuals in the high-income tax category and offer more benefits compared to bank FDs over the long term.

Returns on these funds are highly impacted by market cycles. Hence, investors must track portfolio performance to minimise the adverse impacts of market risks. Finally, most high-risk funds allow investors to invest through systematic investment plans (SIP) or in lumpsum. Investors can opt for a SIP or lumpsum depending on their financial standing.

Risk Involved in High Risk Mutual Funds

Although mutual fund investing is considered reliable, there are high-risk funds that allow you to invest in growing companies. It means these companies are not steady like the large-cap funds and are susceptible to market fluctuations, which can seriously impact the returns on your investments.

Factors To Consider Before Investing in High Risk Funds

Before investing in high-risk mutual funds, consider these six crucial factors:

- Risk Tolerance: Assess your risk tolerance carefully. High-risk funds can be volatile, so ensure you’re comfortable with potential losses.

- Investment Goals: Clearly define your investment objectives, whether it’s long-term growth, retirement, or a short-term goal.

- Time Horizon: Determine how long you can commit your money to the investment. High-risk funds may require a longer time horizon to ride out fluctuations.

- Diversification: Review the fund’s holdings and ensure it aligns with your overall portfolio diversification strategy.

- Track Record: Research the fund manager’s performance and the fund’s historical returns. Look for consistency and expertise.

- Fees and Expenses: Understand the fund’s expense ratio and any additional costs. High fees can erode returns over time.

Remember, high-risk mutual funds can offer potential rewards, but they also come with increased uncertainty.

Who Should Invest in High Risk Funds?

High-risk funds are more suitable for investors with deep knowledge of the stock market and a fair understanding of macroeconomic trends. Since these funds primarily invest in companies in their growth phase, they offer more significant returns when invested for 10 years or more. Hence, investors ready to expose their portfolios to market risk for a longer period should invest in these funds.

Nonetheless, investors should consider the following factors before parking their money in these funds:

- Investment goal: These funds are best suited for long-term investment.

- Risks: One must assess their ability to accept losses and select the investment amount before investing in these funds since they have significant risk-reward dynamics.

- Fund’s performance: Checking the fund’s past performance and peer comparison will help with decision-making.

Taxability of High Risk Mutual Funds

The tax incidence of high risk funds depends on the type of fund’s asset allocation.

Short term capital gain: Capital gain generated by investing in equity-oriented, high-risk mutual funds held for less than one year will attract a tax of 15% plus a penalty. Conversely, if it is a debt fund, gains realised within 36 months will be taxed as per the income tax slab rate.

Long-term capital gain: A 10% tax will be applied on a capital gain of more than Rs 1 lakh in a year. It is the case with equity-oriented high-risk funds. In the case of debt funds, capital gains after 36 months will be taxed at 20%, with the benefit of indexation.

Dividend taxation: The dividend income is added to the investor’s taxable income and taxed as per their slab. There is also a 10% TDS charged by the mutual fund house on dividend amount exceeding ₹5000 in a financial year.

How to Invest in High Risk Funds?

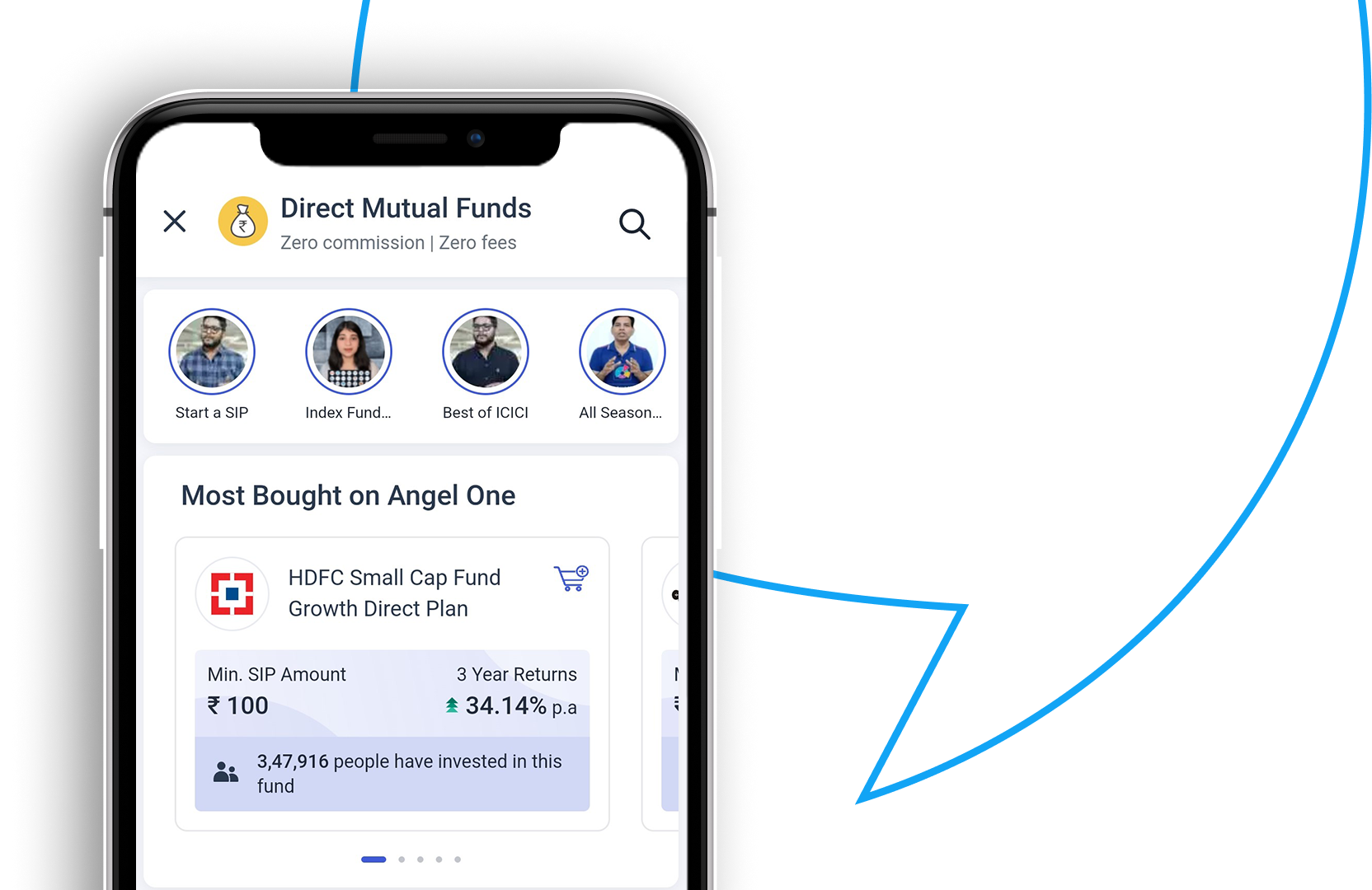

Investing in equity mutual funds is simplified through your Angel One account. Here’s a straightforward guide:

Step 1: Access your Angel One account using your registered mobile number. Verify with an OTP and input your MPIN.

Note: If you don’t have a Demat account with Angel One, it’s quick to open one by completing KYC requirements and submitting the necessary documents.

Step 2: Identify the ideal fund based on your financial goals and risk tolerance. In the Angel One app’s mutual fund section, evaluate these factors:

- Search for your preferred fund or consider Angel One’s recommended options.

- Assess the fund’s historical performance, tax implications, portfolio sectors, and holdings.

- Use the calculator to estimate potential returns.

- Gauge the fund’s risk level and align it with your risk appetite.

- Check reputable rating agencies’ ratings, typically on a scale of 1 to 5.

- Consider the fund’s expense ratio to understand the cost of investment.

Step 3: Once you’ve chosen the fund(s) you wish to invest in, log in to your Angel One account, navigate to the Mutual Funds section, and locate your chosen fund. Since this may be a long-term investment, exercise caution in your selection:

- Decide between a lump sum investment or a monthly SIP.

- Specify the investment amount and payment method, with UPI being the recommended option. Alternatively, you can opt for net banking.

- For SIP investments, create a mandate for future instalments, streamlining the process.

Top 5 High Risk Mutual Funds to Invest in

The following are some of the best high risk mutual funds available in India –

| Name | AUM (₹ in crore) | Minimum investment (₹) | CAGR 3Y (%) | CAGR 5Y (%) |

| HDFC Balanced Advantage Fund | 52,079.29 | 100 | 29.10 | 12.93 |

| SBI Equity Hybrid Fund | 54,563.90 | 1000 | 18.07 | 10.55 |

| ICICI Pru Balanced Advantage Fund | 44,515.74 | 500 | 18.17 | 10.26 |

| SBI Liquid Fund | 52,892.20 | 500 | 4.29 | 5.28 |

| HDFC Liquid Fund | 49,008.59 | 100 | 4.27 | 5.26 |

The above-mentioned top funds are for informational purposes only and are not recommendations. The funds are based on a 5-year CAGR, which is subject to change frequently. Check out real-time data on Angel One.

HDFC Balanced Advantage Fund

A balanced advantage fund invests 30 to 80% of the corpus in equities, depending on the PE ratio and market valuation. These belong to the very high-risk mutual funds category . The composition of the particular scheme suggests 66.94% investment in equities, and the rest is spread across government securities, corporate debt, and cash and cash equivalent instruments. It is benchmarked against the NIFTY 50 Hybrid Composite Debt 50:50 Index.

SBI Equity Hybrid Fund

As the name suggests, the SBI Equity Hybrid Fund invests both in equities and debt instruments. SBI Equity Hybrid Fund is a large-size fund, with 77.79% of its assets allotted to equity investments. Side by side, the fund also invests in government securities, corporate debt, and cash and cash equivalents. This follows the CRISIL Hybrid 35+65 – Aggressive Index.

ICICI Pru Balanced Advantage Fund

A balanced advantage fund invests in both equity and debt securities. The fund has an exit load of 1.00%. The ICICI Pru Balanced Advantage Fund has an AUM of ₹44,515 crore. CRISIL Hybrid 50+50 – Moderate Index is the benchmark followed by the fund. It has an expense ratio of 0.91% against a category average of 1.34%. The PE ratio is 29.16, against the category PE ratio of 30.17.

SBI Liquid Fund

It is a debt fund that invests primarily in debt instruments with a maturity of 91 days. The fund manager invests in commercial papers, certificates of deposit, Treasury bills, and government securities. It is a moderate-risk fund. The expense ratio is 0.18%, and the yield-to-maturity is 7.09%, against a category expense ratio of 0.22% and a YTM of 7.15%.

HDFC Liquid Fund

It is another liquid fund that invests primarily in fixed-income instruments with a maturity period of 91 days or less. The fund is moderately risky, meaning the chances of losing your principal amount are low. The exit load is low at 0.007%. Investors can invest through a SIP or lumpsum, and the fund has no lock-in period.