IPO Details

Bidding Dates

13 Mar '23 - 15 Mar '23

Minimum Investment

₹14,000 / 1 Lots ( 100 Shares )

Price Range

₹133 - ₹140

Maximum Investment

₹196,000 / 14 Lots ( 1400 Shares )

Retail Discount

To be announced

Issue Size

₹154.98 Cr

Investor category and sub category

Qualified Institutional Buyers | Non-Institutional Investors | Retail Individual Investors |ARQ IPO Prediction

Listing gain & Over subscription prediction

Over-Subscribed 12.16x

Angel Subscribed 0.0K

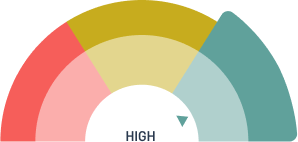

Chances of listing gains & oversubscription

high

Updated 45mins ago

DAY 3

IPO Dates

Important dates with respect to IPO allotment and listing

IPO Open Date

Mar 13, 23

IPO Close Date

Mar 15, 23

IPO Allotment Date

Mar 20, 23

Initiation Of Refunds

Mar 21, 23

Credit Of Shares To Demat Account

Mar 22, 23

IPO Listing Date

Mar 23, 23

IPO Subscription Details

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

|

Day 1Mar 12, 2023 |

0.01 | 0.57 | 0.62 | 0.42 |

|

Day 2Mar 13, 2023 |

0.04 | 1.65 | 1.45 | 1.09 |

|

Day 3Mar 14, 2023 |

8.96 | 33.06 | 5.05 | 12.16 |

IPO Subscription Status Live

| Investor Category | Subscription (Times) |

|---|---|

| Qualified Institutions Buyer | 8.96 |

| Non-Institutional Buyers | 33.06 |

| Retail Investors | 5.05 |

| Employees | [.] |

| Others | [.] |

| Total | 12.16 |

About Company

The company processes natural stores and manufactures engineered quartz. They have two product units located in Jaipur, Rajasthan.

Natural stone harvesting involves a complex geographical process and is desired for uniqueness, aesthetic appeal, texture, colour, and composition. On the other hand, granite is used widely as a kitchen countertop. The products from Global Surface have wide applications in flooring, wall cladding, countertops, cut-to-size, and other items.

The company exports to the United States of America, Canada, Australia and the Middle East, deriving 99% of its revenue from the export business.

Global Surfaces Ltd. IPO Objective

- The fund raised by selling fresh equity shares will be utilised to invest in the wholly owned subsidiary and part financing constructing another manufacturing unit in the Jebel Ali Free Zone, Dubai, United Arab Emirates (UAE).

- General corporate purposes.

Why should you invest in Global Surfaces Ltd. IPO?

Here are your top reasons for investing in the IPO:

- They have transitioned from a single-stone to a multi-stone manufacturing company, offering a diversified product portfolio.

- Exports constitute 99.13% of their operating revenue in FY22. In international markets, they primarily cater to the United States of America, Canada, Australia, and the Middle East.

- They have dedicated in-house R&D teams for developing new products and designs to cater to the diversified customer base.

Global Surfaces Company Financials

| Parameters | Period Ending on September 30, 2022 (₹ lakhs) | Year ending on 31st March, 2022 (₹ lakhs) | Year ending on 31st March, 2021 (₹ lakhs) |

|---|---|---|---|

| Revenue from operation | 1903.13 | 1753.71 | 1632.91 |

| Profit After Tax | 356.34 | 339.32 | 209.64 |

| EBITDA | 418.04 | 474.33 | 403.16 |

| EBITDA Margin | 21.97 | 27.05 | 24.69 |

| EPS (Basic) | 10,52 | 10.02 | 6.59 |

| Period Ended | Year ending on As on 31st March, 2022 | Year ending on As on 31st March, 2021 | Year ending on As on 31st March, 2020 |

| Current Asset | 1,161 | 876.77 | 589.60 |

| Current Liabilities | 491.21 | 528.86 | 499.86 |

Know before investing

Strengths

3-

They have robust financials with revenue from operation and profit recording growth in the past three fiscals.

-

The company is expanding to new international markets.

-

They have robust financials with revenue from operation and profit recording growth in the past three fiscals.

Risks

3-

The top ten customers contribute the majority of revenue.

-

They don’t have long-term agreements with their customers and suppliers, which can impact future profitability.

-

It is an export-driven business. Hence, international market conditions can directly impact the company’s profitability.

Over-Subscribed12.16x

Login to Angel One App / Website & click on IPO

Select desired IPO & tap on "Apply"

Enter UPI ID, set quantity/price & submit

Accept mandate on the UPI app to complete the process

Over-Subscribed12.16x

Login to Angel One App / Website

Choose IPO section on Home Page

Click IPO Orders

Chose the IPO application you want to view the status for

Global Surfaces IPO FAQs

Global Surfaces Ltd. SME IPO will open for subscription on March 13, 2023. The company proposes to raise ₹154.98 crore from the sale of fresh equity shares and OFS of 2,550,000 equities.

The basis of allotment date is March 20, 2023.

One lot of Global Surfaces Ltd. IPO has 100 shares.

The IPO will open on March 13, 2023.

Retail investors can apply for a minimum of one lot and a maximum of fourteen lots.

The listing date of Global Surfaces Limited on BSE & NSE is March 23, 2023.

You can check the allotment status of your IPO application from the Angel One app.

To check the allotment status, enter the application number, DP ID, and PAN number into the app.

Listing gain is the difference between the IPO’s opening and offer prices. The listing gain is influenced by changing investors’ interests, global parameters, and short vs long-term outlooks.

The bank initially blocks the amount you bid for an IPO. It will debit the money when the shares are allotted or unblock the amount after the UPI mandate expiry date.

Login to your UPI handle and approve the payment mandate to complete the IPO application process.

You can submit only one application using one PAN card.

The minimum size of the application will be one lot of 100 shares.