IPO Details

Bidding Dates

20 Mar '23 - 23 Mar '23

Minimum Investment

₹14,980 / 1 Lots ( 428 Shares )

Price Range

₹33 - ₹35

Maximum Investment

₹194,740 / 13 Lots ( 5564 Shares )

Retail Discount

To be announced

Issue Size

₹66.00 Cr

Investor category and sub category

Qualified Institutional Buyers | Non-Institutional Investors | Retail Individual Investors |ARQ IPO Prediction

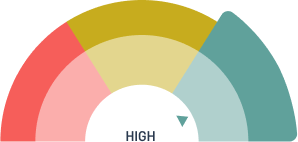

Listing gain & Over subscription prediction

Over-Subscribed 5.15x

Chances of listing gains & oversubscription

high

Updated 45mins ago

DAY 4

IPO Dates

Important dates with respect to IPO allotment and listing

IPO Opening Date

Mar 20, 23

IPO Closing Date

Mar 23, 23

IPO Allotment Date

Mar 28, 23

Initiation Of Refunds

Mar 29, 23

Credit Of Shares To Demat Account

Mar 31, 23

IPO Listing Date

Apr 03, 23

IPO Subscription Details

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

|

Day 1Mar 19, 2023 |

1.03 | 0.78 | 0.48 | 0.62 |

|

Day 2Mar 20, 2023 |

1.10 | 3.71 | 1.91 | 2.37 |

|

Day 3Mar 21, 2023 |

1.28 | 9.01 | 4.44 | 5.50 |

|

Day 4Mar 22, 2023 |

42.92 | 64.08 | 14.95 | 32.49 |

IPO Subscription Status Live

| Investor Category | Subscription (Times) |

|---|---|

| Qualified Institutions Buyers | 42.92 |

| Non-Institutional Buyers | 64.08 |

| Retail Investors | 14.95 |

| Employees | [.] |

| Other | [.] |

| Total | 32.49 |

About Company

They are an infra company engaged in constructing roads, including national highways, state highways, district roads, smart roads under PM’s Smart City Mission projects and others. In 2014 the company was started by M/s Udayshivakumar as a proprietary business and converted to a partnership at a later date. It primarily operates in the state of Karnataka.

Udayshivakumar Infra is an ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 company. The company had worked on 30 projects since 2015 worth ₹68,468 lakh.

Udayshivakumar Kotarki is a JV between the company and Kotarki Constructions Pvt. Ltd. The newly formed JV has been awarded a project by NHAI worth Rs. 17,100 lakh.

The bidding window of Udayshivakumar Infra IPO will remain open from March 20-23, 2023. The company plans to raise Rs. 66 crores from 20,000,000 equity shares with a face value of ₹10. Investors can bid in the price band of Rs 33-35 per share.

Udayshivakumar Infra IPO Objective

- Meeting incremental working capital requirements

- General corporate purposes

Why should you invest in Udayshivakumar Infra Ltd.?

These are the top reasons to consider investing in the IPO.

- The company operates in two business lines of construction and sales (RMC, Jelly and M-sand, Scrap, Iron and steel).

- The company stands to gain from a strong order book to undertake projects of different sizes and complexities.

- They have successfully executed 30 projects since 2015.

- They entered a JV in April 2022, which helped them expand their capacity to undertake bigger projects.

Udayshivakumar Infra Noteworthy highlights

- On December 31, 2022, they had 30 ongoing projects with an order size of Rs. 85,387.75 lakh and projects worth Rs. 43,650.98 lakh in the pipeline.

Udayshivakumar Infra Company Financials

| Particulars | Year ending on March 31, 2022 | Year ending on March 31, 2021 | Year ending on March 31, 2020 |

|---|---|---|---|

| Revenue from Operations | 18,562.92 | 21,039.67 | 19,360.78 |

| Profit After Tax (PAT) | 1,214.81 | 931.92 | 1,048.72 |

| EBITDA | 2,488.91 | 2,363.03 | 2,506.80 |

| EBITDA Margin | 13.41% | 11.23% | 12.95% |

| EPS | 3.33 | 2.55 | 2.87 |

| ROE | 17.78% | 16.59% | 22.38% |

Know before investing

Strengths

3-

They have years of experience building roads under BOQ and EPC business.

-

They have gathered a fleet of equipment and built in-house expertise to support their construction business.

-

The company has set up RMC plants at different construction locations and also sells those to other small constructors.

Risks

3-

Karnataka state government projects are the primary source of revenue for Udayshivakumar Infra Limited.

-

They derive the majority of revenue from a limited number of clients.

-

If the company fails to win projects it can impact its future revenue.

Over-Subscribed5.15x

Login to Angel One App / Website & click on IPO

Select desired IPO & tap on "Apply"

Enter UPI ID, set quantity/price & submit

Accept mandate on the UPI app to complete the process

Over-Subscribed5.15x

Login to Angel One App / Website

Choose IPO section on Home Page

Click IPO Orders

Chose the IPO application you want to view the status for

Udayshivakumar Infra IPO FAQs

Udayshivakumar Infra Ltd. IPO worth ₹66 crore will open for subscription on March 20, 2023. The IPO size containing 20,000,000 will be available in the price band of Rs 33-35 per share.

The basis of the allotment date is March 28, 2023.

One lot of Udayshivakumar Infra IPO has 428 shares.

The IPO will open on March 20, 2023.

Retail investors can apply for a minimum of one lot.

The listing date of Udayshivakumar Infra Ltd. is April 3, 2023.

You can check the allotment status of your IPO application from the Angel One app.

To check the allotment status, enter the application number, DP ID, and PAN number into the app.

Listing gain can’t be ascertained before the IPO is listed on the exchange. You can get this information on the listing date for Udayshivakumar Infra Ltd. which is April 03,2023.

The bank initially blocks the amount you bid for an IPO. It will debit the money when the shares are allotted or unblock the amount after the UPI mandate expiry date.

Login to your UPI handle and approve the payment mandate to complete the IPO application process.

You can submit only one application using one PAN card.

The minimum size of the application will be one lot of 2000 shares.