The concept of risk-return trade-off is based on the expectation that with an increase in the potential return, the risk also increases. In other words, earning profits in the stock market comes with a set of risks which every investor has to factor into their investment strategy.

In the following article we will comprehensively go over what is a risk-return trade-off.

What Is Risk-return Trade-off?

Risk-return trade-off meaning is the dilemma that investors of balancing risk and returns that investors often face. The higher the returns, higher the risk. For example, stocks offer the highest potential returns for investors but they aslo come with the highest level of risk.

An ideal risk-return trade-off depends on several factors such as the investment goals, level of risk tolerance, investment duration and the additional capital available. If investors want to make high profits quickly, they are likely to follow the risk-return trade-off mindset and thereby invest in volatile assets that display the highest fluctuations in price.

Example of Risk-Return Trade-off

Consider Sachin, a 30-year-old investor saving for retirement in 30 years. Here’s a risk-return trade-off he faces:

1. Option 1 (Low Risk, Low Return): Invest in a savings account with a guaranteed 1% annual interest rate.

This is very safe, but over 30 years, inflation might erode the purchasing power of her savings.

Estimated Return after 30 years: Assuming a constant 2% inflation rate, the real (inflation-adjusted) return would be -1% (1% interest rate – 2% inflation).

2. Option 2 (Higher Risk, Higher Potential Return): Invest in a diversified stock mutual fund with an average historical return of 8% per year. Stocks are riskier, but offer the potential for higher growth.

Estimated Return after 30 years: Assuming a constant 8% annual return and 2% inflation, the real return would be 6% (8% return – 2% inflation). This could significantly grow her retirement savings.

Therefore, Sachin needs to decide between the guaranteed but low return of the savings account (safer) or the potentially higher return with more risk associated with the stock mutual fund. The choice depends on his risk tolerance and how comfortable he is with potential losses in the stock market.

Understanding Risk-return Trade-off

The following are some of the key factors that drive the level of risk and return trade-off in mutual funds:

- Market capitalisation: Mutual funds investing in smaller companies, i.e. with lower market cap, offer potentially higher returns due to the companies starting from a lower base. But because they are small companies, they are also susceptible to wider array of negative events, and face greater challenges against bigger competitors. This also leads to their stock prices being both positively and negatively affected by many small events, resulting in higher volatility.

- Investment horizon: Short-term investors usually face higher risk from short term market fluctuations compared to long-term investors who can expect the market to grow over the long term.

Importance of Risk-return Trade-off

Mutual funds are investment instruments that pool money from investors and invest it in various stocks and debt instruments to create a diversified portfolio. They provide investors with different levels of risk and return based on their market view, objectives, risk tolerance, and timeline. In that context, here is the importance of the risk-return trade-off in mutual funds.

- Risk management: The trade-off provides a useful framework to investors to assess the potential risks and rewards for different investment opportunities.

- Return optimisation: Investors can now find the right portfolio for themselves with an expected return that truly captures the reality of the market. It allows them to optimise their portfolio based on their own investment objectives, such as capital preservation, growth, or income.

- Diversification: The risk-return trade-off formula helps investors to manage their portfolios and reduce risk by investing in low-risk investment instruments. It allows them to understand how both risk and return of their portfolio can be improved via diversification into a wider variety of instruments.

How Is Risk-return Trade-off Calculated in Mutual Funds?

The risk-return trade-off in mutual funds is calculated using various formulas that help investors assess their portfolio’s potential risks and returns. Below are some of the key metrics used to evaluate the risk-return trade-off in mutual funds:

- Outperformance Evaluation (i.e. Alpha Ratio): Investors in mutual funds can utilise the alpha ratio to assess how their investments perform compared to a chosen benchmark. This benchmark, often a market index, is a reference point for the fund’s performance within a specific asset class. The alpha reveals the returns exceeding (positive alpha) or falling short of (negative alpha) the benchmark’s performance. A zero alpha indicates the fund’s returns mirrored the benchmark. A 1% alpha means the portfolio has outperformed the benchmark by 1%.

- Market Sensitivity (i.e. Beta Ratio): The beta ratio gauges a mutual fund’s susceptibility to market movements, typically measured against a benchmark index. In essence, it reflects how volatile the investment is relative to the overall market. Investors leverage beta to understand the inherent risk associated with their investment. Beta is calculated by dividing the asset price variance by the asset price’s covariance and the market benchmark. A beta of 1 signifies the fund’s movement aligns closely with the benchmark, a beta of zero suggests a minimal correlation, while a negative beta shows an inverse correlation. A negative beta indicates an inverse relationship, where the fund moves opposite the benchmark.

- Risk-Adjusted Return (i.e. Sharpe Ratio): This ratio helps investors evaluate the investment’s return while considering the level of risk involved. It essentially calculates the “extra return” earned for each unit of risk taken. The calculation involves subtracting the risk-free rate (a guaranteed return with minimal risk) from the investment’s average return and then dividing the result by the standard deviation of returns (a measure of volatility). A higher Sharpe ratio indicates a more favourable risk-adjusted return, meaning the investment generates superior returns for the level of risk assumed.

Also Read More About Sharpe Ratio in Mutual Fund

What Is Better: Alpha, Beta, or Sharpe Ratio?

Investors navigating the risk-return trade-off have three key tools at their disposal: alpha, beta, and Sharpe ratio. Each metric provides valuable insights to inform investment decisions.

The alpha ratio helps investors assess outperformance relative to a chosen benchmark. This benchmark, often a market index, serves as a reference point for a fund’s performance within a specific asset class. A positive alpha indicates the fund’s returns exceeded the benchmark, while a negative alpha suggests it fell short.

The beta ratio, on the other hand, gauges a mutual fund’s sensitivity to market movements. In essence, it reflects how volatile the investment is relative to the overall market. Investors leverage beta to understand the inherent risk profile associated with their investment.

Finally, the Sharpe ratio goes beyond simply looking at returns. It’s a measure of risk-adjusted return, helping investors evaluate if the potential reward justifies the level of risk involved. A higher Sharpe ratio indicates a more favourable balance, meaning the investment generates superior returns for the level of risk assumed.

How Is the Risk-reward Ratio Calculated?

The risk-reward ratio is calculated by dividing the expected return from a trade by the amount of capital that is put at risk, i.e. the maximum amount that you stand to lose if the market moves in an unfavourable direction. Traders often aim for a risk-reward ratio of roughly 2:1 or higher to ensure that the expected profit is worth the risk.

Conclusion

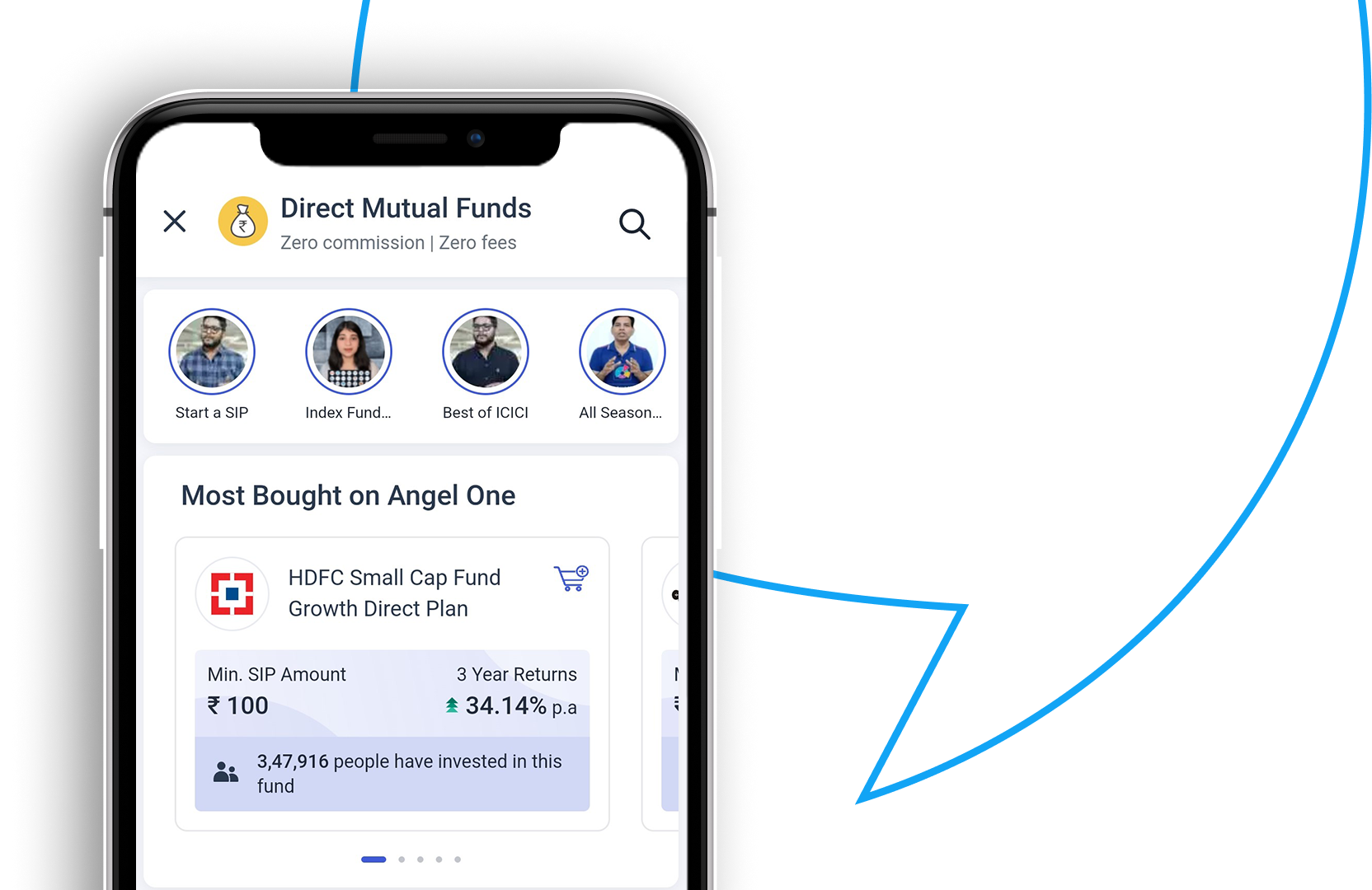

Now that you have understood risk-return trade-off, you are better prepared to start investing in mutual funds. If you are new to investing, open a free demat account with Angel One!