A PAN card is critical for a variety of financial activities. Keeping that in mind, the government of India has simplified the process of PAN verification. You can now do it online from the comfort of your home. PAN verification is a service offered by specific government websites. Users can verify their PAN card online using NSDL’s e-Governance service, provided they have all the necessary information. If you are curious to learn about the online PAN card verification process, this article is for you.

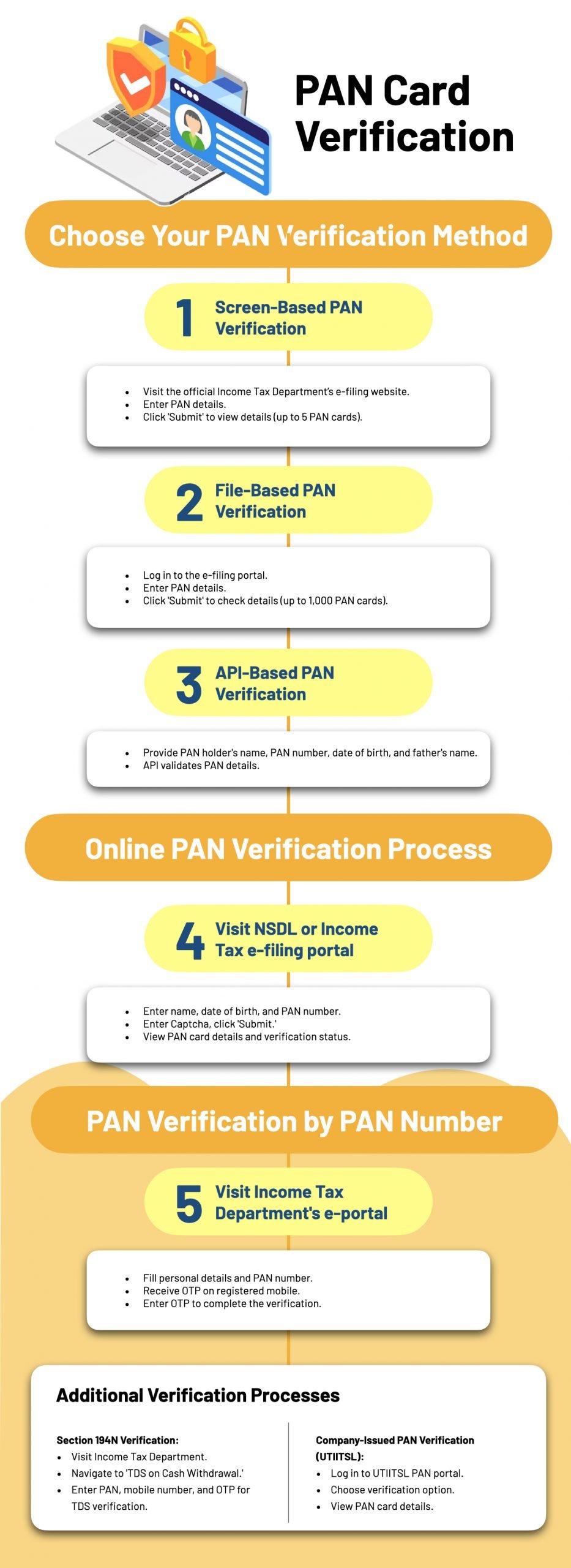

There are 3 ways to verify PAN cards online: screen-based PAN verification, file-based PAN verification, and API-based PAN verification.

Screen-Based PAN Verification

One can verify up to 5 PAN cards at a time using the screen-based verification process. The steps to doing the same are mentioned below.

- Go to the official Income Tax Department’s e-filing website

- Enter the PAN details you want to verify

- Click on ‘Submit’ to view the PAN details

File-based PAN Card Verification

The file-based online PAN verification process allows users to verify up to 1,000 PAN cards at a time. Government agencies and several other entities that need to process PAN verification in bulk generally prefer this method.

Here are the steps for PAN verification using a file-based method.

- Log in to your account in the e-filing portal of the Income Tax Department

- Enter the details of the PAN card you want to verify

- Click on the ‘Submit’ button to check their details

API-based PAN Verification

You can also verify the PAN card using the software. The API uses the following inputs to substantiate the details of the PAN.

- Name of the PAN cardholder

- PAN number

- Date of Birth

- Father’’ Name

Once you provide the inputs, the API validates the PAN card details.

PAN Card Verification Online Process

In the age of digitisation, when most of the necessary services are offered online, it is no wonder that PAN verification services will also be available on the Internet. You can verify the details of your PAN card by logging in to NSDL or the Income Tax Department’s e-filing portal.

The government has authorised Protean e-Gov Technologies Limited to provide PAN card verification services to eligible entities. These are the steps to follow to verify your PAN card.

- Login to the NSDL or the Income Tax e-filing portal

- Add your name, date of birth, and PAN number

- Enter the ‘Captcha’ code in the space provided and click on ‘Submit’

- The screen will show your PAN card details along with your PAN number verification status

Online PAN Verification by PAN Number

Another method to verify your PAN card online is via the PAN number. You can follow the steps below for online PAN card verification using a PAN number.

- Go to the e-portal of the Income Tax Department

- On the screen, fill out your details, such as your full name, date of birth, phone number, and PAN card number

- Click on ‘Continue’

- An OTP will be sent to the registered mobile number

- Enter the OTP to validate

- Follow the steps on the next page to complete the process

How to Verify PAN Online Under Section 194N?

Section 194A of the Income Tax Act deals with TDS deducted on interest paid on investments other than securities. The tax is deducted at the source under Section 914A on the interest before being paid to the resident. To verify PAN under Section 194A, the candidate must follow the steps below.

- Go to the official website of the Income Tax Department

- Navigate to the option ‘TDS on cash Withdrawal’

- Enter the PAN and the mobile number you want to verify

- Check the declaration dialogue box and click on Continue

- You’ll receive an OTP on your registered mobile number

- Enter the OTP and click ‘Continue’

- The screen will display the percentage of deductible TDS

How To Verify PAN Details Issued by the Company?

Users who apply through the website of UTIITSL can verify the status of their PAN card online.

UTIITSL or UTI Infrastructure Technology and Services, is one of the country’s largest financial services companies that issues PAN cards like NSDL. UTIITSL is a government agency that provides financial technology to the financial sector of the government of India. For PAN verification on UTIITSL’s portal, one must follow the steps stated below.

- Go to the UTIITSL PAN portal and log in with your credentials

- Choose an option to validate your PAN card

- The PAN card details will be displayed

Entities Eligible for PAN Verification

Below is a list of entities that are eligible to verify PAN cards.

- Reserve Bank of India (RBI)

- Any scheduled bank

- Central Vigilance Agency

- Insurance companies

- Insurance Web Aggregators

- Central and State Government Agencies

- Non-Banking Financial Companies (NBFCs) approved by RBI

- Digital Signature Certificate Issuing Authorities

- Credit Information comPANies approved by RBI

- Depositories

- Department of Commercial Taxes

- Goods and Services Tax Network

- KYC Registration Agency

- Prepaid Payment Instrument Issuers approved by RBI

- Housing Finance Companies

- Insurance Repository

- Depository Participants

- Payment And Settlement System Operators authorised by RBI

- Educational Institutions established by Regulatory Bodies

- Entities that require to provide Annual Information Return/Statement of Financial Transactions

- Mutual Funds

- Credit card companies and institutions

- Stamp and Registration Department

- Stock Exchanges, Clearing Corporations, and Commodity Exchanges

FAQs

What is online PAN verification?

PAN verification refers to validating the accuracy and authenticity of the information provided on a PAN card. It is a service provided by authorised government websites to eligible entities.

Are there any charges for PAN card verification?

Yes, you would need to pay charges in advance based on your preference. Protean charges ₹12,000 + GST as an annual registration fee.

Is there any software for mass verification of PANs?

Yes, users can verify PANs using an API. It is one of the three methods of online PAN verification.

Why is verification necessary?

PAN verification is necessary to verify PAN card details, track financial transactions, and prevent fraud. Businesses and financial institutions must verify PAN details to comply with regulatory necessities and minimise the risk of illegal activities such as money laundering and tax evasion.