Introduction

Investors are always looking for opportunities that not only hold the potential to yield significant returns but also offer the enticing possibility of tax savings. Among the plethora of investment choices, ELSS Funds, or Equity Linked Savings Scheme Funds, emerge as a notable option. These financial instruments promise not only wealth accumulation but also efficient tax management, making them an attractive option for those aiming to enhance their investment portfolio and reduce their tax liabilities.

In this article, we’ll walk you through the details of ELSS mutual funds, explaining what they are, their advantages, and how they work.

What is an ELSS Fund?

ELSS Fund is an investment avenue primarily focused on equities, characterised by a mandatory lock-in duration of three years, during which your invested capital remains inaccessible. Notably, investing in ELSS presents an opportunity to reduce your taxable income by a maximum of Rs. 150,000, potentially resulting in decreased tax obligations. Furthermore, following the conclusion of the three-year lock-in period, any profits accrued from this investment are categorised as Long Term Capital Gain and are subject to a 10% tax if the gains exceed Rs. 1 lakh.

What are the Features of ELSS Mutual Funds?

Now that you understand what ELSS mutual funds are let’s explore the key features that make them an appealing investment choice.

-

Equity Investment Opportunity

ELSS funds primarily invest in equities, aiming to capitalise on the growth potential of the stock market.

-

Diversification Strategy

These tax-saving mutual funds diversify their investments across various sectors and industries, spreading risk while seeking growth opportunities.

-

Lock-In Period

ELSS mutual funds have a lock-in period, encouraging a disciplined approach to investing and fostering a long-term perspective.

-

Tax Savings

ELSS investments offer tax benefits under Section 80C of the Income Tax Act, allowing investors to lower their taxable income.

-

Taxation on Returns

Gains realised from ELSS funds are subject to Long Term Capital Gain (LTCG) tax, offering clarity on the taxation of investment returns.

By understanding these features, you can make informed decisions about incorporating ELSS mutual funds into your investment portfolios.

Tax Benefits of ELSS Mutual Funds

Let’s take a closer look at the tax benefits offered by ELSS Mutual Funds, delving into their potential to enhance your financial planning.

Section 80C Deduction

ELSS schemes fall under Section 80C of the Income Tax Act, providing a means to enjoy tax deductions on the principal amount you invest. This deduction is a cumulative benefit, allowing you to claim up to Rs. 1.5 lakh under Section 80C for investments across various specified instruments such as ELSS, NSC, PPF, and more.

Tax Efficiency on Gains

ELSS Mutual Funds introduced a strategic lock-in period of three years. Upon redeeming the units after this duration, you stand to gain long-term capital gains (LTCG). The noteworthy aspect is that LTCG up to Rs. 1 lakh in a financial year is exempt from taxation. Any LTCG beyond this threshold attracts a tax of 10% on gains exceeding Rs. 1 lakh without considering indexation.

Why opt for investing in ELSS Tax Saving Funds?

Here are the main reasons to consider investing in ELSS Mutual Funds, each enhancing your investment strategy:

Diversification for Balanced Growth

ELSS tax-saving mutual funds stand out for their diversified approach. These funds introduce diversification to your portfolio by Investing across a spectrum of companies, from small-cap to large-cap, and spanning various sectors. This diversification helps manage risk while exploring growth opportunities.

Accessible Entry Point

ELSS schemes offer a low minimum investment threshold, often as low as Rs. 500. This accessibility allows you to initiate your investment journey without the need for substantial initial capital. It paves the way for a broader demographic to enter the investment landscape.

Systematic Investment Advantage

ELSS Funds offer the flexibility of Systematic Investment Plans (SIPs), which enable you to contribute smaller, regular amounts. This approach not only aligns with a steady and consistent investment pattern but also allows you to enjoy tax benefits while creating wealth over time.

Factors to Weigh Before Investing in ELSS Funds

Before investing in ELSS Mutual Funds, you should consider the following factors:

Balancing Investment and Tax Planning

While ELSS Funds provide tax benefits, it’s important to view them as more than a tax-saving tool. Ensure that your investment plan serves your broader financial objectives. While tax planning is crucial, crafting an investment strategy that aligns with your long-term goals should take precedence.

Smart SIP or Lumpsum Decision

The allure of tax benefits can lead to last-minute investments in ELSS mutual funds through lump sum contributions. However, this approach can expose you to market volatility. Opting for a Systematic Investment Plan (SIP) spreads your investments over time, helping you navigate market fluctuations and potentially lowering your average investment cost.

Optimal Investment Horizon

Although ELSS offers a relatively short lock-in period, equities typically need more time to mature. While they might seem appealing for short-term goals due to the 3-year lock-in, consider a longer investment horizon of 5-7 years. This approach aligns better with the inherent volatility of equities and provides room for potential growth.

List of ELSS Funds in India

The following is a list of ELSS mutual funds that are available in India, along with some information on the returns they have generated over the last year and the risks that are associated with those returns.

| ELSS Fund Name | Category | 1-Year Returns | Fund Size (in Crores) | Risk Level |

| Bandhan Tax Advantage (ELSS) Fund | Equity | 22.00% | 4,776 | Very High |

| Bank of India Tax Advantage Fund | Equity | 19.80% | 792 | Very High |

| Canara Robeco Equity Tax Saver Fund | Equity | 13.00% | 5,979 | Very High |

| DSP Tax Saver Fund | Equity | 17.90% | 11,303 | Very High |

| Franklin India Taxshield Fund | Equity | 20.10% | 5,029 | Very High |

| HDFC Taxsaver Fund | Equity | 21.40% | 10,930 | Very High |

| JM Tax Gain Fund | Equity | 21.00% | 87 | Very High |

| Kotak Tax Saver Fund | Equity | 18.40% | 3,855 | Very High |

| Mahindra Manulife ELSS Fund | Equity | 17.10% | 649 | Very High |

| Mirae Asset Tax Saver Fund | Equity | 16.60% | 16,634 | Very High |

| PGIM India ELSS Tax Saver Fund | Equity | 17.90% | 540 | Very High |

| Parag Parikh Tax Saver Fund | Equity | 18.50% | 1,742 | Moderately High |

| Quant Tax Plan Fund | Equity | 16.60% | 4,434 | Very High |

| SBI Long-Term Equity Fund | Equity | 26.20% | 14,430 | Very High |

| Union Tax Saver (ELSS) Fund | Equity | 15.90% | 663 | Very High |

Note that this is not a recommendation but a list of funds that have exhibited strong performance within this timeframe. Before making any investment decisions, it’s crucial to consider your financial goals, risk tolerance, and investment horizon.

Conclusion

ELSS tax-saving mutual funds provide a compelling avenue for individuals seeking a blend of growth potential and tax benefits. With their equity-oriented approach, diverse investment options, and short lock-in period, ELSS funds offer a strategic tool to enhance financial portfolios while optimising tax savings. As you explore these funds, remember to align them with your unique financial goals and consult a financial advisor to make informed investment decisions.

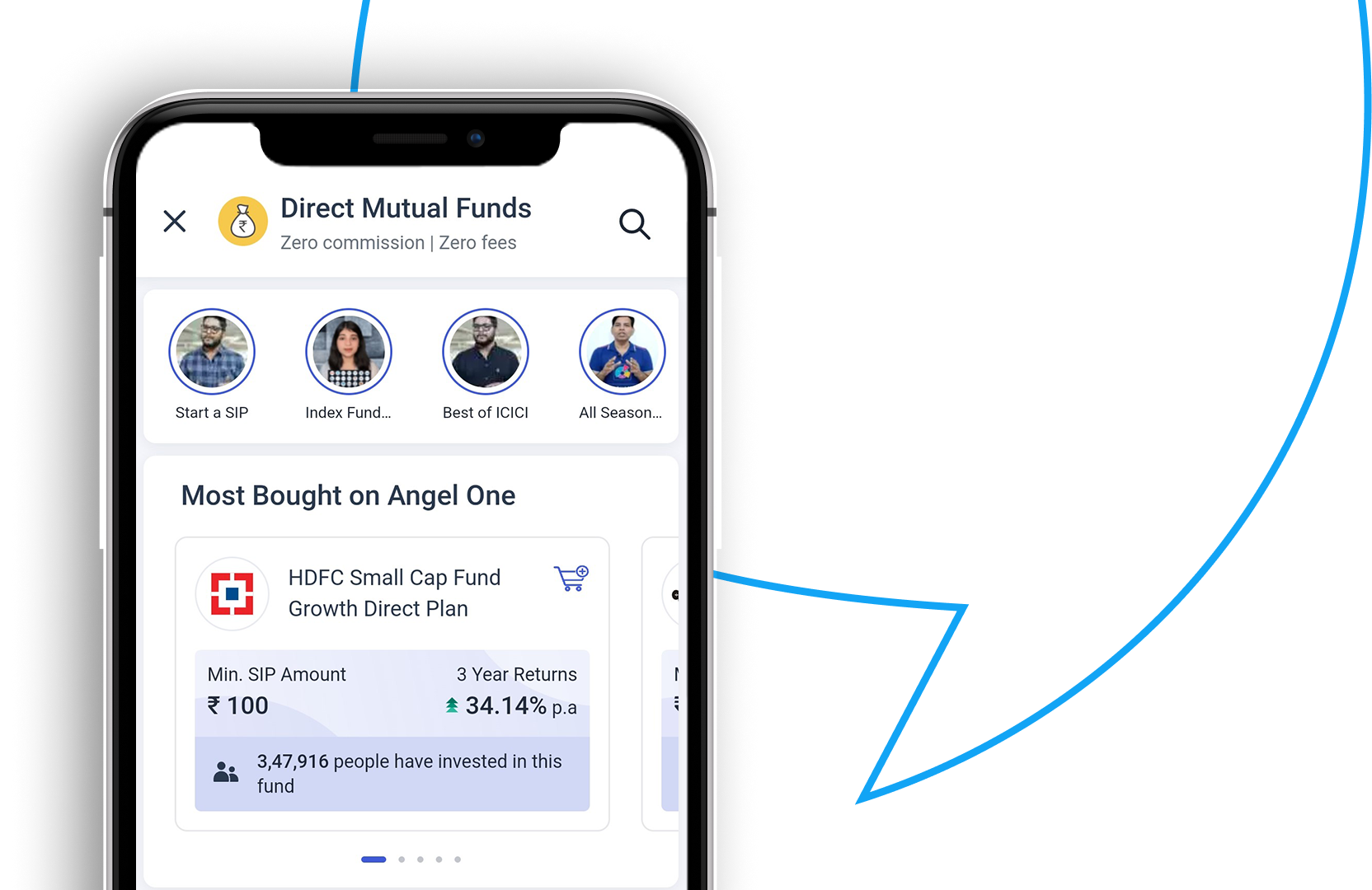

Now that you know all about ELSS mutual funds, take the next step, open a Demat account with Angel One and invest in your favourite ELSS fund, unlocking the potential for both financial growth and tax savings.

Mutual Fund Calculators:

| SIP Calculator | Lumpsum Calculator |

| SWP Calculator | Step Up SIP Calculator |

| Mutual Fund Returns Calculator | ELSS Calculator |

FAQs

What are ELSS Tax Saving Mutual Funds?

ELSS Tax Saving Mutual Funds are equity-oriented investment options that combine potential growth with tax benefits. They offer a diversified portfolio, a short lock-in period, and tax deductions under Section 80C. Ideal for those aiming to save taxes and enhance their financial portfolio.

How do ELSS Funds provide tax benefits?

ELSS Funds offers tax benefits through Section 80C, allowing you to claim deductions on the invested amount. They also offer tax efficiency on long-term capital gains. Gains up to Rs. 1 lakh are tax-free, while you will have to pay 10% tax on gains exceeding this limit.

Why should I invest in ELSS Tax Saving Funds?

ELSS Funds provide diversification, low minimum investment, and the option of Systematic Investment Plans (SIPs). They offer a balance between growth potential and tax-saving advantages. Choose based on your risk tolerance and investment horizon.

How should I choose the right ELSS Fund?

Consider factors like historical performance, investment horizon, and risk tolerance. Evaluate the fund’s alignment with your financial goals. Consult a financial advisor to tailor your investment strategy and choose a fund that suits your needs.