A Permanent Account Number (PAN) card is an essential financial identification issued by the Income Tax Department of India. This crucial document holds immense significance, as a vital tool for tax-related processes, financial activities, and official verifications. However, circumstances may arise where individuals need to cancel their PAN cards due to reasons like duplicate cards, any errors, etc. Understanding the process to cancel a PAN card online or offline is important, as it ensures streamlined financial management and compliance with regulatory norms.

In this article, learn about the steps to cancel a PAN card, how to check the cancellation status, reasons for cancellation and what happens if you don’t cancel a PAN card.

Pan Card Cancellation Form

To cancel a PAN card, you need to fill out the form that says, “Request For New PAN Card Or/ And Changes Or Correction in PAN Data”. Fill your details in the form and ensure that you are the PAN card details you are using on the top. And the duplicate PAN numbers should be mentioned in the section ‘Mention other Permanent Account Numbers (PANs) inadvertently allotted to you’.

How to Cancel a PAN Card?

The steps to cancel a PAN card are similar to the ones you submit for a change in a PAN card. You can cancel a PAN card online or offline at your convenience.

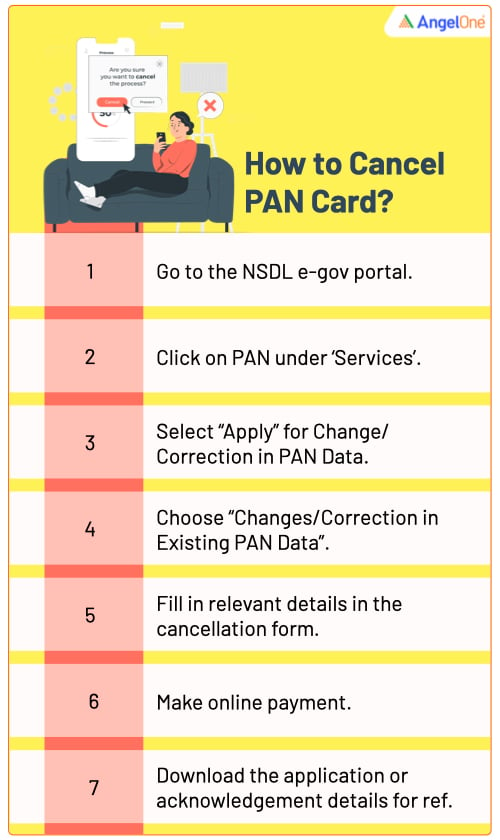

Steps to Cancel a PAN Card Online

- Go to the NSDL e-gov portal.

- Under ‘Services’ click on PAN.

- Select “Apply” under the ‘Change/Correction in PAN Data” section.

- Under the application type, select “Changes/Correction in Existing PAN Data”.

- Fill in your relevant details rightly in the PAN card cancellation form.

- Make an online payment to submit PAN card cancellation online.

- Download the application details or acknowledgement details for further reference.

Steps to Cancel a PAN Card Offline

- Visit the Income Tax Department website.

- Find the “Request For New PAN Card Or/ And Changes Or Correction in PAN Data” form.

- Fill out the form with your relevant details.

- Add the duplicate PAN card details in the section allotted in the form.

- Take necessary documents like your original PAN card and duplicate ones as well.

- Visit the nearby NSDL office to submit the duly filled form.

- The authorities will verify the details and provide an acknowledgement slip for the same.

In this process, you might have to provide a letter as well along with the form explaining about the duplicate PAN card cancellation.

How To Check Pan Cancellation Status

Here are the steps you need to follow to check the status of your PAN card cancellation.

- Go to the NSDL e-gov portal.

- Under ‘Services’ click on PAN.

- On the left side of the page, find the ‘Know Your Application Status’ option.

- Under ‘Application Type’ select ‘New/Change PAN Request’.

- Enter your 15-digit acknowledgement number.

- Enter the code displayed on the screen.

- Click on ‘Submit’.

Reasons for PAN Card Cancellation

- Duplicate PAN: Individuals might have unintentionally obtained multiple PAN cards, which is against the law. Cancelling duplicate PAN cards streamlines financial records and prevents potential misuse.

- Incorrect information: Inaccurate personal details, such as name, date of birth, or address, on a PAN card could lead to cancellation to ensure accurate documentation.

- Death of PAN holder: In the unfortunate event of a PAN holder’s demise, their PAN card may need to be cancelled to avoid potential identity-related issues.

- Migration to another country: If an individual is shifting to another country and there is no possibility for financial transactions in India further then they choose to cancel the existing PAN card.

- Closure of a business: Businesses that cease operations or dissolve may choose to cancel their PAN cards to wrap up financial matters.

- Lost or stolen: Individuals might opt for cancellation to prevent potential misuse in cases of a lost or stolen PAN card.

What Happens if You Don’t Cancel a PAN Card?

Operating with multiple PAN cards or having inaccurate details can disrupt your financial transactions, tax calculations, and overall financial record-keeping. According to the Indian Government, an individual cannot hold more than one PAN card. If a person holds more than one PAN card, under section 272B of the Income Tax Act, 1961, a penalty of ₹10,000 is levied. Furthermore, multiple PAN cards can lead to challenges in Aadhaar linking, affecting your ability to complete KYC processes and avail the Government benefits.

Conclusion

The steps for how to cancel a PAN card online or offline are simple. All you need to do is to fill out the form with the right information and keep track of the application status until the duplicate cards are cancelled.

FAQs

Can NRIs hold PAN cards in India?

Yes, NRIs who have taxable income in India must have a PAN card. Also, NRIs who want to invest in mutual funds or stocks in India also need a PAN card.

Can we cancel an existing PAN card and apply for a new one simultaneously?

No, you can’t cancel your existing PAN card and apply for a new one simultaneously. If there are any changes needed on your existing PAN card, you can choose the right form and request changes.

Should I cancel my PAN card if I move to another city in India?

If you move to another city within India, you do not necessarily need to cancel your PAN card. The PAN card by the Income Tax Department is valid all over the country. However, you should update the address details associated with your PAN card. The Income Tax Department allows you to have the same PAN card while updating your address to reflect your new city of residence.

What to do if the Income Tax department issues two cards to one person at the same time?

Having two PAN cards for the same person is not permitted and can lead to confusion and potential legal issues. In such cases, you should immediately contact the Income Tax Department to rectify the situation. Inform them about the duplicate issuance and follow their guidance to resolve the matter, which may involve cancelling one of the PAN cards.