A lot of investment vehicles are available in the market. Choosing the right investment option needs many things to be considered, from the kind of security or fund, the investor’s risk preference, the tenure of investment, etc. Mutual funds are a kind of investment vehicle that consolidates the investors’ funds and invests them in market securities like bonds, stocks, short-term debts, etcetera. The composition of securities in a mutual fund is called a portfolio and is managed by a registered professional portfolio manager. The portfolio is designed as per the risk tolerance of the investors. Every single share of the fund represents the proportionate ownership and the investor’s proportionate income.

Read More About What is Mutual Fund?

Where can mutual funds invest?

The investment profile of a mutual fund depends on the type of security the fund invests in. Mutual funds invest in stocks or bonds depending on the investor’s risk tolerance. When a mutual fund invests in stocks, it becomes risk-prone as stocks are subjected to market fluctuations, and their potential returns are higher too. On the other hand, mutual funds investing in bonds have fixed income returns and are prone to very low risk. Mostly, in case of a company’s complete failure, the investor does not receive the promised return on the bond security.

Based on this, there are three kinds of funds- equity or growth funds, fixed income or debt funds, and balanced funds.

-

Equity or Growth funds

These mutual funds invest in equity shares and are thus exposed to a higher risk. The expected returns on these funds are usually high. The investors of these funds aim for capital gains over the medium to long term. The risk in equity funds is lesser than stocks as an equity fund entails many stocks, making it diverse.

There are a few types of equity funds.

-

Small-Cap Equity Funds

Small-cap funds are those mutual funds that invest in the schemes offered by companies that rank above 250 in their full market capitalisation as per the Securities and Exchange Board of India (SEBI). The exposure of these funds to stocks is a minimum of 65% of the total assets. These funds are riskier than large or mid-cap funds and provide a higher return.

-

Mid-Cap Equity Funds

In India, the mutual funds that invest in schemes of companies with ranking, as per SEBI guidelines, between 101 and 250 in their full market capitalisation and with exposure to stocks of a minimum 65% of the total assets are called mid-cap funds. These funds are less riskier than small-cap funds.

-

Large-Cap Equity Funds

Mutual funds in India that invest in schemes of companies ranking between 1 and 100 by their full market capitalisation as per SEBI guidelines are called large-cap funds. These are the least risky equity funds, and their exposure to stocks is a minimum of 80% of their total assets.

-

Large and Mid-Cap Equity Funds

The equity mutual funds that entail both large-cap and mid-cap equity funds in an equal ratio, with at least 35% exposure to both kinds of funds of their total assets, are called Large and Mid-Cap Equity funds. This diversification is done to lower the portfolio risks and raise the potential earnings.

-

Multi-Cap Equity Funds

The mutual funds that invest in all small-cap, mid-cap, and large-cap funds with exposure to such stocks at a minimum of 65% are called multi-cap equity funds. Here, the fund manager takes decisions on the predominant investments depending on the market conditions.

2. Debt or Fixed Income Funds

Debt funds or fixed-income funds invest in securities like corporate bonds, treasury bills, debentures, commercial papers, government securities, and money market instruments. These funds provide regular, constant, and risk-free earnings.

Debt funds can be categorised as follows.

-

Liquid Fund –

These funds are the ones that invest in money market instruments with a maturity period of a maximum of 91 days. These are some of the best alternatives for short-term investments.

-

Dynamic Bond Fund –

Mutual funds that invest in debt instruments of different maturity periods based on the interest rate of the time. Investors who have a moderate endurance of risk and have an investment tenure between 3 to 5 years prefer these funds.

-

Corporate Bond Fund –

Investors who want to invest in high-quality corporate bonds and have a lower risk endurance prefer to invest in these funds as these comprise high-rated corporate bonds, which make up a minimum of 80% of their total assets.

-

Money Market Fund –

Mutual funds that invest in money market instruments that have a maturity period of a maximum of 1 year are called money market funds. These are good for people trying to invest in short term debt funds.

-

Income Funds –

These funds invest in securities, mostly with an extended maturity period of five to six years, depending on the interest rates. These are more stable than dynamic bond funds.

-

Gilt Funds-

Funds that invest in high-rated and very low credit risk government securities only are known as Gilt Funds. These are the best choice for fixed-income funds and for risk-averse investors as governments do not usually default on loans that it takes in the form of debt securities.

There are also debt funds like fixed maturity plans, credit opportunity funds, banking and PSU funds, floater funds, etcetera, depending on their maturity periods.

Read more about What are Gilt Funds

3. Balanced or Hybrid Funds

As the name suggests, these funds are composed of both equities and debt securities. The balance is usually skewed towards equity or debt securities depending on the risk tolerance and returns expectations of the investors. These funds provide a regular income along with growth. Investors with a moderate risk tolerance can invest in these funds.

Conservative hybrid fund, Balanced hybrid fund, Aggressive hybrid fund, Dynamic asset allocation fund, Multi-asset allocation, Arbitrage fund, and Equity savings fund are some types of balanced or hybrid funds.

What are the types of investment in a mutual fund?

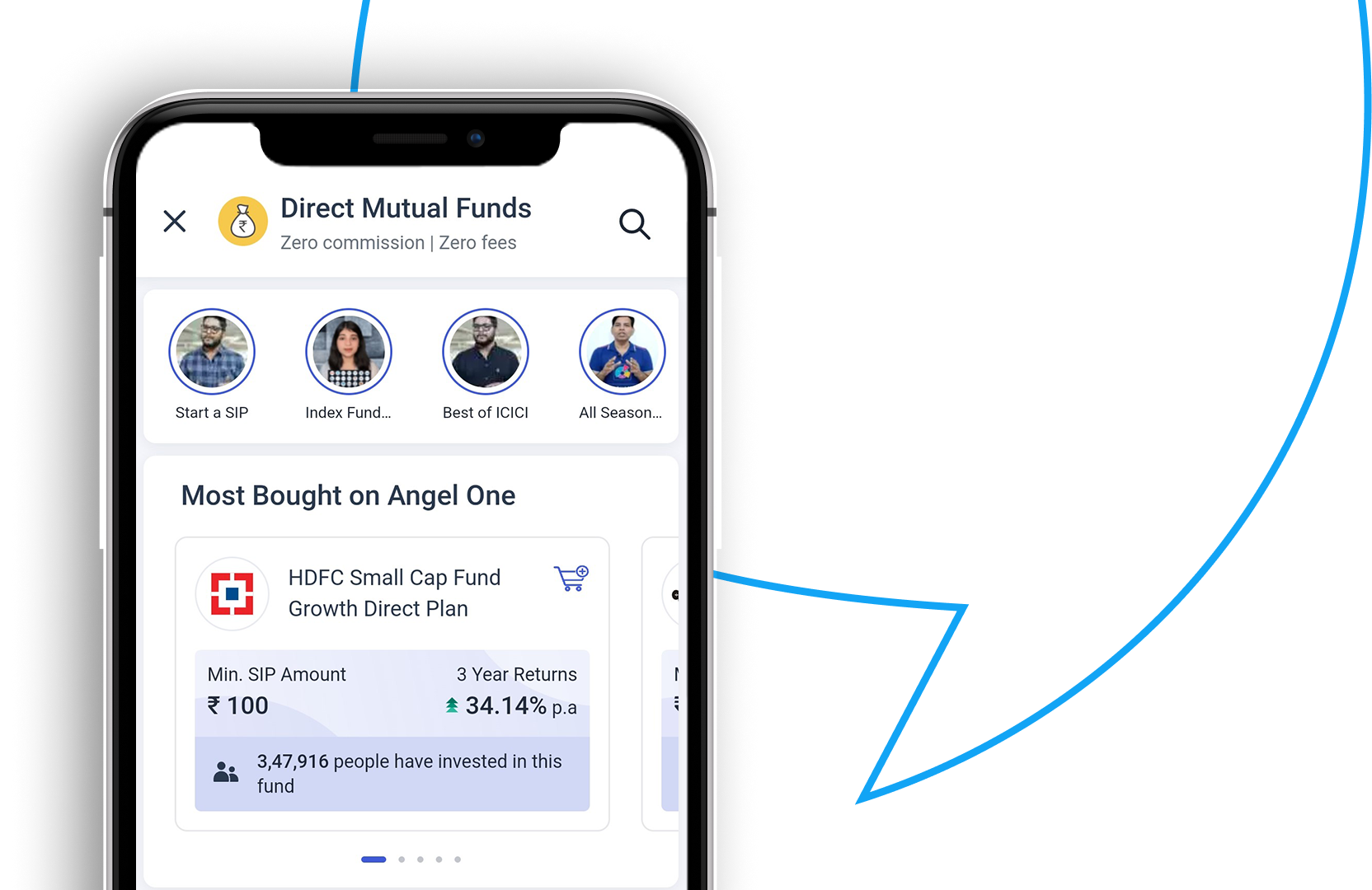

An investor can invest in a mutual fund either all at once by lumpsum investment or can be spread out over a period of time by a systematic investment plan (SIP).

A lump sum mutual fund investment is a bulk one-time investment wherein the investor invests in a particular scheme. There is also a minimum investment value that varies.

A SIP mutual fund is one where periodically investments are made into a mutual fund scheme. The investment can be yearly, monthly, weekly, daily, quarterly, half-yearly, and so on.

Most people prefer a SIP mutual fund over a lump sum mutual fund due to its lower investment requirement and higher interest payments due to the compounding effect.

Mutual funds, therefore, can invest in equity shares, debt securities, and also both together, but the maturity periods and riskiness of the funds determine which investor will invest in which fund.